Beginning this month, we are broadening our coverage from the electricity market to all relevant energy sectors. The change is necessary, we felt, as global dynamics are deeply affecting the interactions of both the input from all types of energy and the output of electricity.

The Energy Reality Report (or simply “ERR”) provides readers like you with news and timely analysis on policies, markets, and technology trends that affect our nation’s ability to power American homes and businesses and maintain national security.

In today’s issue:

- An Energy Information Administration study looks at the dire consequences of a lack of new natural gas pipelines.

- Sen. Manchin is playing a critical role in keeping natural gas flowing and electricity reliable, both in the U.S. and abroad.

- A controversial tax on methane emissions would hurt natural gas production. Who’s on which side of the issue?

- Two pipeline companies are engaged in a lawsuit that reveals the importance of assuring gas flows.

- A new DOE program intends to hand $6 billion to utility companies with nuclear plants, but critics raise objections.

- In Illinois, consumers get a $1 billion rebate that shows that government subsidies may not be needed for profitable nuclear reactors.

- Natural gas is displacing coal rapidly, causing utilities to set a record for usage in January.

- Pennsylvania, the second-largest gas-producing state, is enjoying a renaissance thanks to extraction and transport.

What Happens If No New Gas Pipelines Are Built? A New EIA Report Examines the Consequences

We have reported in recent months on the controversy surrounding attempts by the Federal Energy Regulation Commission (FERC) to slow down or stop the development of new gas pipelines by asserting a mandate on carbon emissions that goes far beyond its mission to maintain reliability and keep consumer costs low.

On Feb. 18, FERC issued two policy statements, which as Politico put it, instituted “sweeping new policies for large natural gas pipeline projects, including a framework for assessing how pipelines and other facilities contribute to climate change.”

According to a March 8 article in the National Law Review:

Most notably, this marks the first time FERC has formally incorporated environmental justice considerations into one of its policies…. FERC has fundamentally reshaped the legal landscape for approval of natural gas pipelines.

The Commission on March 24 then backtracked on the February actions after coming under intense criticism in a Senate Energy and Natural Resources Committee hearing on March 3. Another reason for the about-face is likely the war in Ukraine, which has raised domestic energy costs and catalyzed efforts to move oil and especially natural gas to Europe as a substitute for Russian supplies.

At any rate, there is growing appreciation of the importance of improving the flow of natural gas within the U.S. and on to other markets.

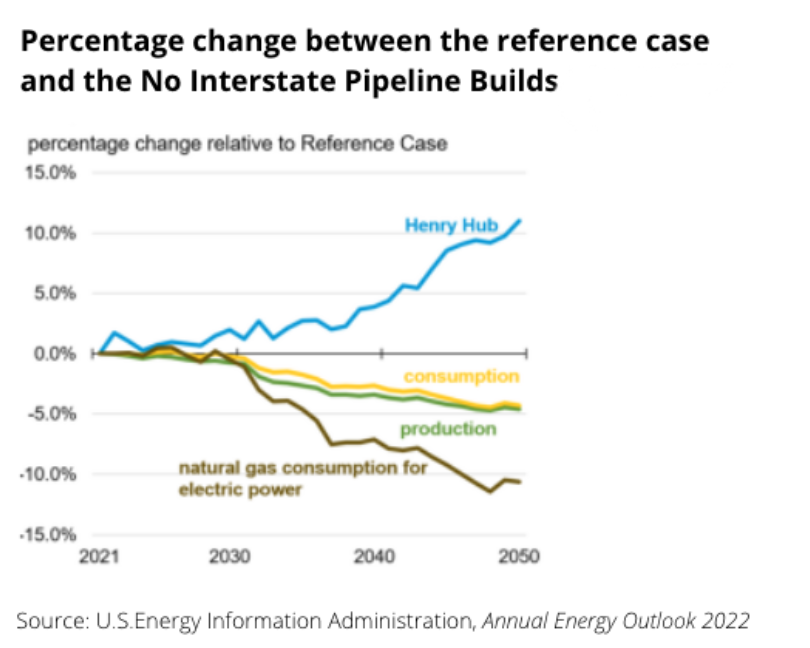

If you have any doubts, take a look at a recent report with the awkward title, “Exploration of the No Interstate Natural Gas Pipeline Builds Case,” by the U.S. Energy Information Agency (EIA). The report outlines severe consequences if the U.S. fails to build additional interstate natural gas pipelines between 2024 and 2050.

Without new pipeline construction, the U.S. will produce 4.6 percent less natural gas than was previously expected (Reference case) and the “projected 2050 spot price at the Henry Hub [will be] 11.0 percent higher than in the Reference case.” Natural gas consumption will drop 4.3 percent below Reference.

This analysis predated the war in Ukraine, but even then it was clear that building more pipelines was absolutely critical. “We found the East North Central, Middle Atlantic, and South Atlantic regions were the most sensitive to changes in pipeline capacity because of limitations to growth in production in the Appalachia Basin,” said the report.

Jeffrey Kupfer, former Acting Deputy Secretary of Energy in the George W. Bush Administration, cited the EIA report in an opinion piece in the May 5 Washington Examiner. He concluded from the study that, to “stabilize and lower energy prices for the long haul, policymakers must take lessons from this latest global crisis and focus on the long term, especially when it comes to energy infrastructure.”

Unfortunately, writes Kupfer, we’ve been moving in the wrong direction, “with large interstate natural gas pipeline projects such as the Atlantic Coast Pipeline, the Penn East Pipeline, and the Constitution Pipeline being shelved because of heightened legal and public pressure.”

Kupfer also notes that “higher natural gas prices will result in higher carbon emissions. Although they may provide an opportunity in some instances for carbon-free power sources such as solar and wind, they are also likely to resurrect coal-fired power.” In its analysis, the EIA forecasts “increased coal-fired power generation, which would be more carbon intensive than the natural gas-fired generation it displaces.”

Finally, as we can see from events unfolding in Ukraine, without major investments in domestic pipelines and liquefied natural gas (LNG) terminals for export, U.S. national security will suffer, and we “won’t be able to meet the call to provide additional volumes of natural gas to Europe” to end the continent’s dependence on Russia.

Senator Manchin and the Need to Keep Natural Gas Flowing

In the effort to bring FERC back to reality, Sen. Joe Manchin (D-WV), the chair of the Senate Energy and Natural Resources Committee, has played an important role.

In a May 9 op-ed in the Huntington Herald-Dispatch, Steve White, the former chairman of the West Virginia Democratic Party, noted Manchin’s recent contributions:

As gas prices and energy costs continue to skyrocket, now is not the time to block clean American energy projects – but that’s exactly what American energy regulators tried to do. Thank goodness Sen. Joe Manchin stood up to stop them.

White wrote that FERC commissioners argued that natural gas production harms the environment, but, in fact, “nothing could be further from the truth.” He noted that from 2009 to 2019 the U.S. led the world in reducing emissions, and “the biggest reason…was the increased use of clean-burning natural gas. America needs more natural gas, not less.”

With West Virginia, the fifth-largest U.S. gas producer, “standing to lose so much, Sen. Joe Manchin stepped up to the plate…. Manchin’s strong words and strong opposition to FERC’s rule did the trick,” wrote White.

To be sure, FERC still has more work to do if it intends to return to its fuel neutrality mandate. During a recent CLEANPOWER conference on May 17 in Austin, TX, FERC Chairman Richard Glick openly advocated for “energy storage participation in wholesale markets via hybrid projects with wind and solar,” per a recent Utility Dive report.

Chairman Glick further stated, for “some of these market rules that were created years ago, no one envisioned solar-storage [developments], or wind and storage for that matter. So we need to figure out what the barriers are and how we can knock those down,” Glick said, calling it “one of FERC’s most important roles.” No doubt storage has an important role to play, but picking winners and losers for the electric grid defies FERC’s mission to be a neutral arbiter in power markets. And ensuring reliable power could suffer if FERC prioritizes some sources over others.

Back to Sen. Manchin, he is pushing for federal funds to help Europeans build new LNG terminals for U.S.-produced natural gas. According to the Journal, which added, “Another move his team has considered would give the energy secretary authority to fast-track the equivalent of free-trade status for North Atlantic Treaty Organization members and other U.S. allies who want to buy American natural gas but don’t have free-trade agreements.”

The Wall Street Journal reported Sen. Manchin wants “Biden to use the Defense Production Act to force through the completion of the Mountain Valley Pipeline, planned to transport natural gas from shale formations in northwestern West Virginia to southern Virginia.” Sen. Manchin says, “There’s so much that we can be doing right now. We can’t get a 42-inch pipeline out of the Marcellus Shale. It’s ridiculous. So I talk to the White House, [which asks,] ‘What can we do to help you?’ I said, ‘Build the damn line.’”

Sen. Manchin should continue to make reliable electricity and energy security a priority. And as Chairman of the Senate Energy and Natural Resources Committee, he should make sure the committee does not shirk its oversight responsibility to prioritize these issues.

Controversy Over a Tax on Methane Emissions

Sen. Manchin seems to be reaching for a compromise on another thorny energy issue: whether a fee – that is, a tax – on methane emissions should be included in bipartisan energy legislation.

Sen. Manchin has been negotiating with the chair of the Environment and Public Works Committee, Sen. Tom Carper (D-Del), and the ranking member, Sen. Shelley Moore Capito (R-WV). The latter is against any kind of fee, but, according to a May 6 Politico article, Sen. Manchin’s position is that a fee is acceptable if “certain conditions” are met “namely, that pipelines would not be penalized if they are not able to build infrastructure to trap the potent greenhouse gas.”

Sen. Manchin said at a recent hearing, “We are working on negotiations that they will not be able to [apply] a methane fee if a pipeline is prohibited from being able to take the methane off.”

Sen. Manchin seems to have possibly shifted his position from last year. On Dec. 12, “Manchin told reporters that he continues to have concerns about a fee on emissions of methane, a potent greenhouse gas that can leak from oil and gas wells,” according to the Washington Post.

At the time, Sen. Manchin said that he thinks the methane fee would be duplicative of new methane regulations from the Environmental Protection Agency. ‘If they’re basically complying with the regulations, then they shouldn’t be subject to the fee,’ he said of oil and natural gas producers.

As part of the original “Build Back Better” package, the tax on methane emissions would start at $900 per ton and rise to a lofty $1,500 by 2025. Such a fee would amount to a tax not simply on methane but more importantly on natural gas, which means that it would raise electricity prices at a time when inflation is the worst in 40 years.

The American Gas Association estimates that the methane tax could add another 17% to an average customer’s bill, and a Wall Street Journal editorial noted that this is the kind of “regressive tax that hurts low-income families without a financial cushion. The Department of Energy notes the average energy burden for low-income families is three times higher than for more affluent households.” The editorial continues:

The methane tax exposes the contradiction at the heart of Democratic climate policy: The party wants to make fossil fuels more expensive to reduce their production and use, but it doesn’t want consumers to notice who is raising their energy bills. The methane tax is their latest stealth enforcement hammer. Once the tax is in place, it will be easy to raise over time, further squeezing producers.

The Journal points out that Sen. Manchin, who is up for re-election in 2024, says he wants legislation to be “fuel neutral” and not specifically penalize fossil fuels. But the methane fee, says the editorial, “is targeted, punitive and can be linked to higher consumer energy bills. The Republican campaign ads almost write themselves.” It is surprising that Sen. Manchin has not been tougher in opposition.

A Lawsuit Exposes Potential Impacts of Oil Pipelines on Gasoline Prices

Converge Midstream, LLC, on May 3, filed a lawsuit in State District Court in Harris County, Texas, charging publicly traded Magellan Midstream with “ongoing anti-competitive practices” that Converge alleges are contributing to higher energy costs for U.S. consumers.

According to a press release from the company, its CEO, Dana Grams stated Magellan’s action allegedly, “stifles competition, increases costs to crude oil shippers and markets, and raises the cost of gasoline and other refined products for…businesses and families are already struggling with higher energy prices and surging inflation.”

Converge’s press release noted under Texas law, “pipeline companies like Magellan are common carriers, a status which provides them the power of eminent domain to gain right-of-way on private property. Along with this privilege, Texas law requires common carriers like Magellan to make their pipelines broadly available to market participants for the public good.”

The suit alleges that, nevertheless, “Magellan has systematically shut out or impeded Converge’s operations, as well as the operations of other competitors and companies in the Houston area,” blocking these firms and their customers from gaining access to markets.

A Magellan company spokesperson told InsideSources the lawsuit had no merit.

“We plan to aggressively defend against the allegations and pursue all available remedies of our own, including counterclaims,” said Bruce Heine, Magellan’s Vice President of Government and Media Affairs.

Converge Midstream is an independent crude oil storage and transportation company that operates salt dome storage caverns and “two common carrier pipelines to receive shippers’ crude oil into its facilities and redeliver that crude oil to refiners, exporters, traders and other parties throughout the Houston market.”

Magellan Midstream, based in Tulsa, is much larger. It operates a 9,800-mile refined products pipeline system with 54 terminals with storage capacity for approximately 39 million barrels and two marine terminals.

A New DOE Program to Hand $6 Billion to Utility Companies With Nuclear Plants

The Energy Department on April 19 launched the Civil Nuclear Credit Program – part of the Bipartisan Infrastructure Bill – that will provide up to $6 billion in grants to keep financially strapped nuclear power plants operating. But critics are questioning whether the program is needed or if it will end up being a windfall to monopoly utilities.

“U.S. nuclear power plants contribute more than half of our carbon-free electricity, and President Biden is committed to keeping these plants active to reach our clean energy goals,” Energy Secretary Jennifer Granholm said in a statement. The question is whether competitive forces, as opposed to government subsidies, will cause such plants to operate more efficiently and their ratepayers to be better served.

In the first phase of the program, grants will be restricted to the three plants that announced they would close down prior to Sept. 30, 2026, but according to a Politico report, at least two of those plants have definite plans to decommission their reactors despite the new federal money.

“Future awards,” said Politico, “will not be limited to reactors with scheduled shutdowns.” DOE can’t estimate how many plants will qualify for funds in the second round.

Nuclear advocates want even more. Matt Crozat, Nuclear Energy Institute executive director of policy development, said in a statement that his members will work to ensure that the $6 billion subsidy program is effective, but will also “continue to advocate for a production tax credit, which will offer greater certainty for owners to make long-term investments in their carbon-free nuclear plants.” In other words, the nuclear industry wants subsidies even for profitable reactors. That action means taxpayers would foot the bill for even more boondoggles.

There’s no doubt that some nuclear plants have suffered from cost overruns and competitive pressures. “The fracking revolution…unlocked vast new natural gas production,” said the Politico report, “and a surge in wind and utility-scale solar plants caught nuclear plant owners in a vise of cheaper competition.”

Since 2013, a dozen reactors have closed down before their operating permits expired, but 93 reactors are still operating, and some observers are questioning their safety.

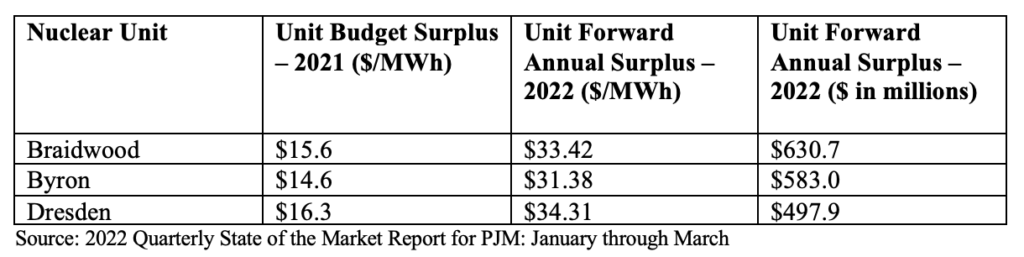

But are nuclear plants truly in financial danger? The latest quarterly Independent Market Monitor Report from PJM, the large regional transmission organization, casts doubt. All 16 of the nuclear units in the region were showing a significant surplus for the period January to March. Three units were receiving state subsidies even though they were in surplus, and four others can receive a subsidy if they need it. All PJM regional nuclear units scored a surplus for the year 2021, and all plants are projected to have budget surpluses in 2022.

A blog by the Electric Power Supply Association expressed skepticism that the program fits the expressed economic strategy of the Administration. It began by quoting President Biden as saying that “capitalism without competition is exploitation” and then noted that, “in lieu of an inclusive, market-based approach to combating climate change, resource-specific policies have prevailed as the politically appealing, but less optimal alternatives.”

The Civil Nuclear Credit Program is one such policy. Its federal subsidies harm, rather than encourage, competition by singling out a specific fuel resource. The blog pointed out:

It’s worth remembering that many of the nation’s nuclear resources may not truly be in need of additional taxpayer support to stay in operation, with some expected to yield a profits exceeding $279 million last year. But this is not another musing about the continued profitability of the existing nuclear fleet; we’ve seen and written enough of those, and the financial position of these resources is captured succinctly here.

The piece adds, “When determining need, DOE should only consider nuclear reactors truly exposed to market risk. For example, if a nuclear reactor is in a ‘vertically integrated’ state, which allows generation owners to seek and receive cost-recovery from captive ratepayers, it should not qualify for support, as it is exposed to little or no market risk.”

Meanwhile, others were raising the issue of nuclear safety. Politico quoted Edwin Lyman, director of nuclear power safety at the Union of Concerned Scientists as saying that safety criteria established by Congress are too weak: “We think that Congress missed an opportunity to provide an incentive for reactors to improve their safety performance to well above the minimum. Taxpayers should not be subsidizing borderline-unsafe reactors.”

It’s clear this whole DOE program deserves re-examination.

In Illinois, Ratepayers Will Get a $1 Billion Rebate as Nuclear Subsidies Were Shown to Be Unnecessary

The latest piece of evidence that nuclear plants may not need federal subsidies comes from Illinois, where ratepayers will be getting rebates totaling $1 billion after massive state nuclear plant subsidies were paid out.

It’s a complicated story, but instructive. The rebate began with the signing of the Climate and Equitable Jobs Act by Illinois Gov. J. B. Pritzker last year. Its aim is for the state to achieve 100% renewable energy by 2050. Constellation Energy, formerly Exelon Generation, was threatening to close nuclear plants, so the law required “consumers to pay a subsidy to keep them running,” according to a report by station WTTW, the local PBS outlet.

State officials wisely constructed the deal with a hedge. If prices rose sharply, consumers would be protected. And that is what happened. The result was that families will see $200 returned to them in energy credits.

In a statement, Constellation said the rebate “demonstrates the critical role nuclear power plays in providing clean, resilient and reliable energy, while keeping electricity costs affordable for customers.”

WTTW put it differently:

Nuclear plants lobbied lawmakers for the customer-paid subsidy because they said they needed guaranteed minimums to be profitable; with high wholesale energy prices, they’re making more,…[so] a provision of the law has kicked in that nulls the subsidies and reduces consumers’ bills. If wholesale electricity prices dip, consumers would again be on the hook for paying the subsidy.

“We proposed initially to support the nuclear plants because prices were low,” said Ann Williams, a Democratic state Representative. “But now that prices have spiked, we are going to be seeing this refund. And the bill was designed to provide just that.”

Moreover, since Illinois ratepayers will be getting $1 billion back from the state’s nuclear subsidy program, that fact certainly suggests the plants in question in the state are not in need of any subsidies from either federal or state sources. Again, the PJM’s latest quarterly Independent Market Monitor report reveals the plants’ profitability:

Keep in mind these three nuclear plants are the ones Exelon deceptively said the company would close unless the company got financial help from the Illinois government; their clear profitability demonstrates why Exelon’s case was meritless.

Illinois provides an important lesson: Nuclear plants are subject to the same forces of supply and demand as electricity generators using other fuels. For the sake of consumers, government should not make monopoly utilities immune to those forces except perhaps in the most extreme cases.

Natural Gas Use by Electric Utilities Sets a Record

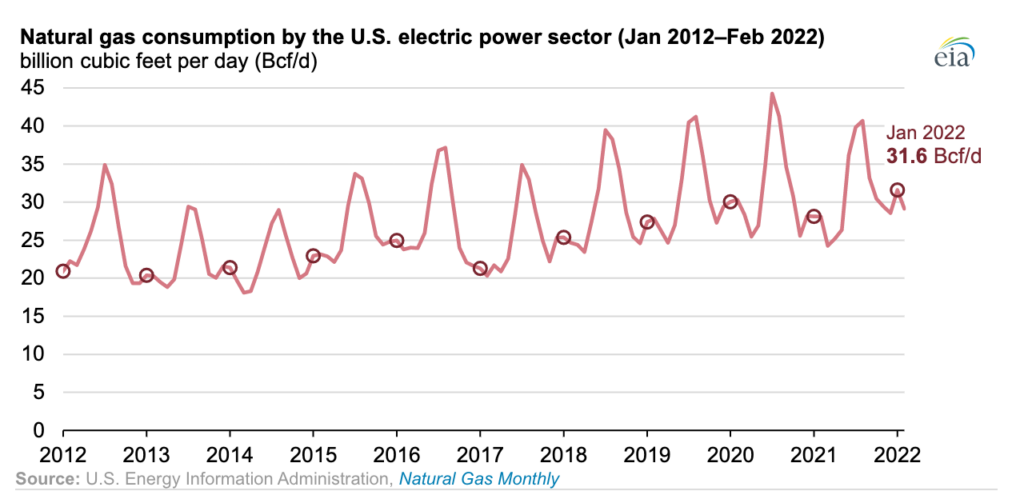

Despite the constraints, natural gas consumption by the U.S. electric power sector set a January record this year, according to the EIA. Consumption hit 31.6 billion cubic feet of gas, compared with about 28 billion in 2021 and 30 billion in pre-COVID January 2020.

One reason is that coal stocks have been falling at power plants, dropping in September to 80 million tons, a level 37% lower than the five-year average. Coal was responsible for only 23% of electricity generated in the U.S. in January, compared with a 36% share for natural gas. As recently as four years ago, coal use in electricity generation was greater than gas use.

Renewables and nuclear power each account for about one-fifth of electricity generation. Roughly one-third of renewable generation comes from hydroelectric power and two-thirds from such non-hydro sources as wind and solar.

Gas Is Powering Pennsylvania’s Economic Renaissance

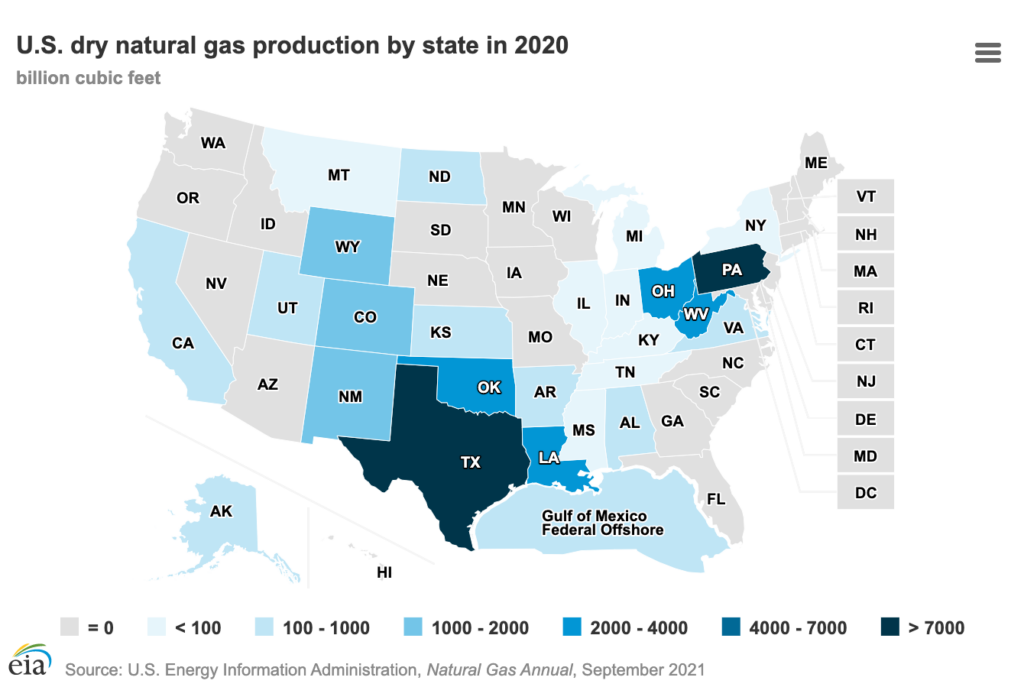

Investments into natural gas production and transportation has been the main driver behind the energy renaissance in the U.S. over the 21st Century, and Pennsylvania, where the first American oil well was drilled in 1859, has been critical to recent success. The U.S. now produces about 10% more natural gas than it uses; in 1995, the U.S. used more than 20% more than it produced.

Pennsylvania is now the second-largest producer of natural gas in the country, responsible for 21.1 percent of U.S. production. The Keystone state is just behind Texas and far ahead of third-place Louisiana.

Natural gas has been good for Pennsylvania, especially the southwestern part of the state. A newspaper that serves the region, the Observer-Reporter, ran an op-ed on May 3 by Jeff Kotula headlined, “Keep Pennsylvania’s foot on the (natural) gas,” extolling the revitalization that natural gas extraction and transportation has brought to local communities. Kotula has witnessed this economic boom first-hand. He is president of the Chamber of Commerce and Tourism Promotion Agency in Washington County, the second-largest oil and gas producing county in the state.

“Actions taken by the Biden Administration threaten to upend the progress made over the past decade,” Kotula wrote. “Decisions like canceling the Keystone XL pipeline and raising fees on energy producers are misguided energy policies that negatively impact jobs, the economy and our energy security.” He added:

Recently there have been signs that the Biden Administration is recognizing the importance of the natural gas industry to our national and international security…. However, the Administration is still restricting the number of acres offered for leasing and increasing the costs that energy producers must incur to produce it. With all the energy that exists right under our feet, there is no excuse to hinder its use or restrict its benefits.