In today’s issue:

- Will the Supreme Court decision in West Virginia vs. EPA finally implicate FERC’s plans to use climate assessments in regulation?

- It’s a critical time for FERC Chairman Glick, who has been called Biden ‘most effective climate warrior.’

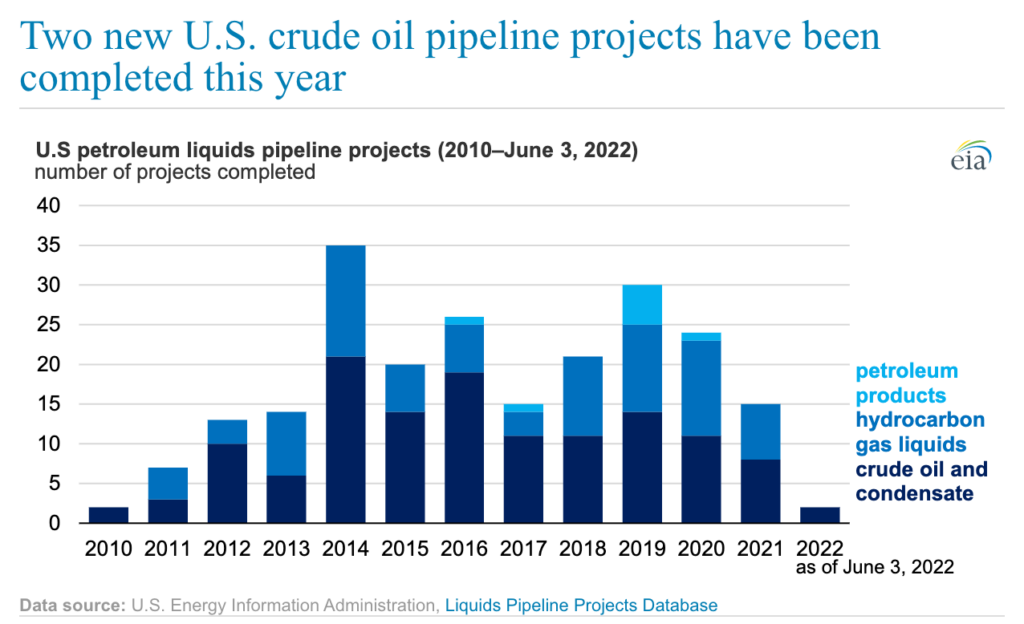

- The Energy Information Administration reports that just two crude oil pipeline projects and no liquid hydrocarbon pipeline projects have been completed in 2022.

- Florida Gov. Ron DeSantis vetoes a bill that would allow Florida’s monopoly utilities to raise rates if they lose revenues from families that generate solar energy.

- Power from New Jersey offshore wind project can offer the state low carbon solutions and balanced sources, but fuel diversification is needed to ensure reliability.

- BP’s review of global energy finds a post-COVID surge in 2021, with coal dominating but renewables jumping 15 percent and natural gas hitting a new record.

- The Biden Administration’s decision July 1 on offshore leasing only added to uncertainty over energy exploration.

FERC’s Desire to Apply Climate Considerations to Its Decisions Faces Supreme Court Headwinds

he decision by the U.S. Supreme Court in West Virginia, et al., vs. the Environmental Protection Agency, et al., could have an impact on plans by the Federal Energy Regulatory Commission (FERC) to extend its jurisdiction over climate objectives.

The High Court ruled June 30 that the EPA’s efforts to curb emissions from power plants fell under the “major question” doctrine, which requires a “clear statement” from Congress that it intended to delegate “authority of this breadth to regulate a fundamental sector of the economy.”

Specifically, the Court held that “Congress did not grant the Environmental Protection Agency in Section 111(d) of the Clean Air Act the authority to devise emissions caps based on the generation shifting approach the agency took in the Clean Power Plan.”

Said J.B. Ruhl, the co-director of Vanderbilt University Law School’s Energy, Environment and Land Use program: “Anything now that agencies do to respond to climate change with regulatory authority, I would fully expect the interests that feel they are on the losing end of the proposal, will launch a ‘major questions’ challenge. It’s opened up a whole new world of speculation.”

That speculation could extend to “FERC’s proposal for how to assess the emissions of individual interstate natural gas projects before they are approved for construction,” according to Climatewire. That proposal constitutes what Energywire in March called “sweeping new policies for large natural gas pipeline projects.”

Such policies were already in doubt even before the Supreme Court decision. In February, FERC Chairman Richard Glick and other members of the Commission’s Democratic majority attempted to expand the scope of FERC by establishing a framework for determining how pipelines and other facilities contribute to climate change.

But new rules ran afoul of Chairman Joe Manchin (D-WV) and other members of the Senate Energy and Natural Resources Committee in a March 3 hearing. Manchin blasted FERC for its “shortsighted attack on fossil fuel resources.” The new policy was especially ill-timed, he said, with an “energy war” underway, a reference to the Russian invasion of Ukraine. Manchin told reporters that Glick “went way out of his wheelhouse” with the policy statement and should “just do your damn job.”

Following this pushback, FERC made what Manchin called a “course correction,” delaying but not definitively ending implementation of the new rules. Glick, who in May was nominated for a new term as chairman by President Biden and needs to face confirmation hearings by Manchin’s committee, “said he hopes to revisit the proposals soon and potentially finalize them with changes supported by one or more of his Republican colleagues,” according to an Energywire report.

In that same news report, Neil Chatterjee, a former FERC chair, said the Supreme Court ruling could make the policies even more politically untenable. “What [the ruling] will do is give those challenging FERC infrastructure policies a huge weapon,” said Chatterjee, a Republican appointee who left FERC last August.

Ari Peskoe, director of the Electricity Law Initiative at Harvard Law School, differed with Chatterjee, arguing that “Congress chose to grant FERC wide discretion in permitting decisions…. Given the flexible nature of FERC’s authority, it’s plausible that Courts would not apply the MQD [major questions doctrine] at all. That said, one of the problems with the MQD is that it’s a moving target.”

FERC Commissioner Mark Christie, a Republican appointee, said in his dissent to the Commission’s February decisions that considering climate pollutants is indeed a “major question” that lies outside the scope of Congressionally granted FERC authority under Section 7 of the Natural Gas Act.

“Whether this Commission can reject a certificate based on a GHG [greenhouse gas] analysis — a certificate that otherwise would be approved under the NGA — is undeniably a major question of public policy,” Christie said. “It will have enormous implications for the lives of everyone in this country, given the inseparability of energy security from economic security.”

On the other hand, Climatewire quoted Romany Webb, a senior fellow at Columbia University’s Sabin Center for Climate Change Law, as saying,

I would argue that there’s probably more examples of FERC considering environmental factors — including downstream environmental factors — in its pipeline certification decisions, than EPA interpreting the best system of emission reductions in the way it did in the Clean Power Plan.

Time of Reckoning for ‘Biden’s Most Effective Climate Warrior’

Still, the Supreme Court decision is clearly a blow to the ambitions of Glick and some of his FERC colleagues to establish the Commission as a major climate regulator – especially at a time when the Chairman is seeking confirmation.

As we noted in Newsletter No. 13, a Politico piece in March carried the headline, “Biden’s most effective climate warrior faces potential doom in the Senate.”

Catherine Morehouse wrote that “Glick has launched perhaps the most far-reaching agenda of any leader ever at the commission…. His efforts to reshape the agency’s mission include conducting closer examinations of the climate impacts of new energy infrastructure, as well as the effects of existing natural gas pipelines and fossil fuel facilities on low-income areas and minority communities where they are often located.”

These ambitions seem a far cry from FERC’s official mission to “assist consumers in obtaining economically efficient, safe, reliable, and secure energy services at a reasonable cost through appropriate regulatory and market means, and collaborative efforts.”

This may be the real “major question”: Should FERC stick to its already enormous role of keeping energy reliable and inexpensive, or should it expand into a significant climate regulator? At a time of breakdowns and outages, as well as increased energy costs and high inflation, expansion seems, at the very least, inopportune.

Few Pipeline Projects Completed So Far This Year

Even without FERC’s proposed assessment rules in effect, pipeline projects in the U.S. have progressed at a snail’s pace.

Not a single pipeline project for petroleum products or hydrocarbon gas liquids has been completed this year. At the same time, only two crude oil pipeline projects have become operational, according to the Energy Information Administration. That figure is far short compared to prior years with 30 completed projects in 2019, 24 in 2020, and 15 in 2021.

Completed so far in 2022 is the 275,000-barrel per day (b/d) Ted Collins pipeline, which transports crude along the Gulf Coast in Texas, and the expansion of the 55,000 b/d expansion of the Cushing South project, which brings crude from terminals in Colorado and Oklahoma to another in Texas.

Combined, these pipelines, projects of Energy Transfer, LP, of Dallas, will transport 330,000 b/d. To put that figure in perspective, consider that the U.S. uses about 20 million b/d.

Why are so few new pipelines being built or older ones expanded? Last year, a few days before President Biden was inaugurated, Hiroko Tabuchi and Brad Plumer of the New York Times wrote:

Pipeline projects like these are being challenged as never before as protests spread, economics shift, environmentalists mount increasingly sophisticated legal attacks and more states seek to reduce their use of fossil fuels to address climate change.

The Atlantic Coast Pipeline was cancelled in July 2020 because of an “unacceptable layer of uncertainty and anticipation of delays,” according to a press release from Dominion Energy and Duke Energy. The Biden Administration revoked the presidential permit to build the Keystone XL pipeline in January 2021, and TC Energy terminated that large project. The hostility to increased pipeline facilities by the Administration, state governments, and interest groups has discouraged further construction of other pipelines.

In Senate testimony last November, the Acting Administrator of the EIA, Stephen Nalley, stated:

Appalachia is the largest natural gas-producing region in the United States, providing 36% of U.S. production in 2021, but we do not expect natural gas production to grow further in Appalachia unless additional pipeline capacity is built that can move natural gas outside of the region.

Nalley, now Deputy Administrator, warned that “pipeline constraints” have led to higher natural gas prices in New England and have reduced flexibility for meeting needs in the West.

Guy Caruso, who served as EIA Administrator from 2002 to 2008 and is now an advisor to the Grow America’s Infrastructure Now Coalition, said:

As supply becomes more an issue, these projects expand the U.S.’ energy transportation capacity, allowing for more oil to flow to terminals. In order to combat the surging energy crisis, more support for energy infrastructure projects is essential. Long-term solutions that increase our domestic capacity will ensure our country’s energy security.

DeSantis Says ‘No’ to a Florida Solar Scheme That Benefits Monopoly Utilities

Gov. Ron DeSantis of Florida vetoed a bill that would have allowed Florida’s monopoly utilities to impose additional charges to recover lost revenues from families that are generating electricity through solar power.

In an April 27 letter to Florida’s Secretary of State, DeSantis wrote that, “given that the United States is experiencing its worst inflation in 40 years and that consumers have seen steep increases in the price of gas and groceries,” Floridians should not have to face further increases from their utility companies.

The action by DeSantis strikes a blow against monopolies by refusing to discourage the production of competitive power (in this case, distributed solar).

In response to the veto, William J. (John) Berger, CEO of Sunnova, a residential solar company, wrote in Utility Dive, that the decision by DeSantis “signals to the state of Florida – and utilities everywhere – that there can be, and should be, a limit on anti-competitive rent-seeking behavior from monopolies.”

Berger noted that utilities are operating on an infrastructure “invented at the turn of the last century.” He continued:

Times have changed. Solar, batteries, smart generator sets, artificial intelligence, and software have become increasingly available to provide power service directly to homes and businesses. Yet our current power system’s monopolistic ecosystem continues to thwart price signaling, technological improvements, consumer choices and technological advancements.

He added, “The end is near for monopolies. We must liberate the power consumer.”

Writing in the Gainesville (Fla.) Sun in May, David Jenkins, president of Conservatives for Responsible Stewardship, called the original solar bill “a massive assault on individual liberty and the free market that sailed through the Florida Legislature at the behest of the state’s largest monopoly utility, Florida Power & Light (FPL).”

The bill, he wrote, “included a huge subsidy that would guarantee FPL profits by letting it and other utilities raise customer electric bills to make up for any revenue lost to competition from rooftop solar.” Jenkins continued:

By contrast, solar energy paired with storage for nighttime generation is — along with wind and nuclear —not only cheaper, it is largely immune from price spikes due to conflicts overseas. That price stability of solar, along with its cheaper price and low carbon footprint, is a big draw for businesses looking to expand or relocate and a strong driver of economic activity.

Why is Florida so far behind other sunny states? Jenkins asked. “Because years ago, Florida’s big three monopoly utilities chose to go all in on natural gas generation and are intent on squeezing every last penny of profit out of those gas-fired generating plants — even when doing so takes a big bite out of their customers’ wallets…. Making matters worse is the political power these monopolies wield in Tallahassee.” No wonder competitive power suppliers were so pleased with the DeSantis veto.

NJ’s First Wind Project Offshore Will Boost Energy Capacity and Can Help Provide Reliability Through Diverse Fuel Sources

New Jersey’s long awaited offshore wind project, Ocean Wind 1, has reached a critical stage in its federal review. In mid-June the U.S. Bureau of Ocean Energy Management (BOEM) called for public comment on the Draft Environmental Impact Statement (DEIS) for the proposed Ocean Wind 1 wind energy project about 15 miles off the coast of Southern New Jersey.

According to the federal government’s permitting dashboard of infrastructure projects, the estimated completion date of environmental reviews and permitting for Ocean Wind 1 is just over a year away in July 2023.

Ocean Wind 1 is part of the Biden Administration’s plan to build 30 gigawatts of offshore wind energy capacity by 2030. If approved, the project will be the first wind farm off the coast of New Jersey, generating 1.2 to 1.4 gigawatts, enough to power more than 500,000 homes. The Interior Department has announced plans to hold up to seven new offshore lease sales by 2025.

As we noted in Newsletter No. 12, many notable policymakers, including Sen. Manchin, are pushing hard for an “all-of-the-above” strategy. Such a strategy should certainly include wind energy generated by turbines offshore, but it was not until last month that the U.S. Department of the Interior announced its first-ever lease sale along the West Coast. More activity has occurred on the Atlantic Coast, but the U.S. still lags far behind Europe in offshore wind.

Ocean Wind 1 is expected to generate $1.2 billion in economic benefits for New Jersey and create thousands of jobs. The project will provide a greater supply of energy to the state to help balance supply and demand and put downward pressure on prices. As part of a larger, diverse energy mix, it can help ensure reliability.

According to Offshore Magazine, Ocean Wind 1 will include “up to 98 wind turbine generators (WTGs) and up to three offshore substations within the lease area,” which is 15 miles southeast of Atlantic City. Cables from the generators make landfall in Ocean and Cape May Counties.

BOEM’s 45-day public comment period closes Aug. 8.

BP’s New Review of Global Energy Finds Big Increase in Coal Use, But Renewables Rise 15%

Global electricity generation grew by a record 1,577 terawatt-hours, an increase of 6.2 percent over 2020, according to BP’s annual Statistical Review of World Energy. Nearly half that surge occurred in China, and the increase reflects the jump in demand for power as the world recovers from the COVID-19 pandemic.

An opinion piece on the Review in The Hill by Robert Bryce, host of the Power Hungry Podcast and six books on energy, pointed out that “the numbers also show that, despite all the hype about renewable energy and the ‘energy transition,’ when it comes to producing power, countries are still heavily dependent on King Coal.” He added:

Indeed, coal-fired generation continued its dominance of the electricity sector in 2021, accounting for 51 percent of the increase in global electricity generation. Furthermore, coal’s share in the global generation mix increased slightly to 36 percent, while natural gas’s share of the generation mix fell to just under 23 percent.

Renewable use rose 15 percent in 2021, the highest proportion of any fuel, according to the BP Review, but the increase in coal-fired generation “was greater than the jump in wind and solar production combined.” Coal use can be expected to increase further in 2022 as a substitute for Russian natural gas in Europe.

Big increases in coal use were attributed to China, but, writes Bryce, coal-fired generated power also increased in the U.S. and India. He added, “The surge in coal consumption shows that what I call the “Iron Law of Electricity” remains in effect — that countries, businesses and individuals will do what they have to do to get the electricity they need.”

It’s no wonder, then, that global CO2 emissions rose 5.9 percent last year and those in the U.S. were up 6.6 percent. “The pronounced dip in carbon emissions in 2020 was only temporary,” wrote Spencer Dale, BP’s chief economist.

Still, Liam Denning, writing in Bloomberg about the BP Review, pointed out that renewables “accounted for the vast majority of any positive demand growth” and, “although global oil demand rebounded by 5.5 million barrels a day, it remained below its pre-pandemic level.” Denning added:

Coal consumption, for its part, jumped past 2019’s total, though didn’t quite reach its all-time peak of 2014. Only natural gas comfortably hit a new record. Still, fossil fuels rule the world, supplying 82 percent of primary energy demand.

That’s down from 85 percent in 2017, but, Denning wrote, “it would be madness for renewables advocates to crow over a 3-percentage-point decline over five years for their chief competition. Such is not the stuff of meeting climate goals.”

Denning also noted that the BP Review showed that use of wind and solar has increased 80-fold since the start of the 21st Century and has outstripped nuclear power for the first time. He added:

Look past the disruptions of pestilence and war, and the underlying trend remains in place: Manufactured energy technologies such as wind and solar are continuing to gain scale efficiencies at the expense of fossil fuels.

Biden Administration Tries to Have It Both Ways on Offshore Leasing, And Few Are Happy

A decision on offshore leasing just before the July Fourth holiday by the Biden Administration added more uncertainty to America’s energy security. The Interior Department said it plans to prohibit new drilling in the Atlantic and Pacific while permitting limited expansion in the Gulf of Mexico and along Alaska’s coast. The proposal allows no drilling in the eastern Gulf near Florida, which is already off limits by law, and calls for only one lease sale in Alaska’s Cook Inlet.

The five-year plan satisfied neither proponents nor opponents of offshore leasing and did little to settle the issue. The Wall Street Journal reported on July 1:

The plan is still being developed, and gives the administration several options—including one that would forgo new lease sales entirely, according to the Interior Department. Ultimately a final decision is months away.

The Journal quoted Brady Bradshaw, senior oceans campaigner at the Center for Biological Diversity, as saying, “President Biden campaigned on climate leadership, but he seems poised to let us down at the worst possible moment. The reckless approval of yet more offshore drilling would mean more oil spills, more dead wildlife and more polluted communities.”

As a candidate, Biden had pledged to block new drilling on federal territory. But with the war in Ukraine restricting Russian energy flows to Europe and with oil and gas prices at high levels, the Administration’s decision – or lack of one – did not please those in Congress and industry who want to see supply increase to meet demand.

“Our allies across the free world are in desperate need of American oil and gas,” said Manchin in a statement. “I am disappointed to see that ‘zero’ lease sales is even an option on the table.”

The Washington Post reported on July 13 that including some drilling in the plan was an effort by the Administration to court Manchin, a critical vote in securing passage of a broad climate plan. “Complicating their calculus is that White House aides do not even know if approving them — or Manchin’s other preferred energy projects, such as a pipeline in West Virginia — would bring the elusive senator on board,” the Post reporters wrote. If one judges from Manchin’s earlier statement, the strategy does not seem to be working.

Under even the quickest scenarios, the Journal noted, previous delays mean that new oil and gas leasing won’t happen “until 2024 or 2025 and new development potentially years after that.”

Meanwhile, a separate editorial in the Washington Post, also on July 13, argued that “environmental groups claiming the proposal undermines Mr. Biden’s climate commitments overstate the degree to which this poses a threat to U.S. and global climate goals. It scales back the Trump administration’s draft plan to open 47 lease sales across every coastal area in the country.”

But it would be unwise, said the Post editorial, to hold no lease sales at all: “The world must urgently transition away from fossil fuels, or it risks the increasingly catastrophic impacts of climate change. But as that transition is underway, people will still need to consume some oil and gas.”

Ending new leases sales would transfer the risk of producing fossil fuels “to other countries, including those that have fewer regulations in place to protect oceans, wildlife and people. A better approach would be to target the demand for energy by placing a price on higher emitting fuels that reflects their social and environmental costs.” One way to do that, the Washington Post editorial argues, is by “increasing royalty rates…. We have long advocated for a carbon tax, which offers the most efficient way to drastically cut emissions.”

Of course, while a carbon tax has an appeal to economists and editorialists, it is yet to be fully tested as a legislative solution in front of Congress.

Meanwhile, with the war in Ukraine causing massive dislocations in energy markets and with inflation at record levels, it would seem foolish to restrict opportunities to add to supply by deploying America’s own abundant offshore natural gas and oil resources.