In today’s issue:

- Rep. Cathy McMorris Rodgers is set to take over the House Energy & Commerce Committee, and Sen. Joe Manchin is expected to retain Senate Energy and Natural Resources as chances for permitting reform increase in a new Congress.

- Richard Glick is now almost certain to lose his chairmanship of FERC as Sen. Manchin declines to hold a confirmation hearing.

- As the U.S. undergoes a ‘haphazard’ energy transition, large regions of the country risk energy shortages this winter, a new NERC Winter Reliability Assessment finds.

- NY approves a transmission line for offshore wind, but other East Coast projects face challenges.

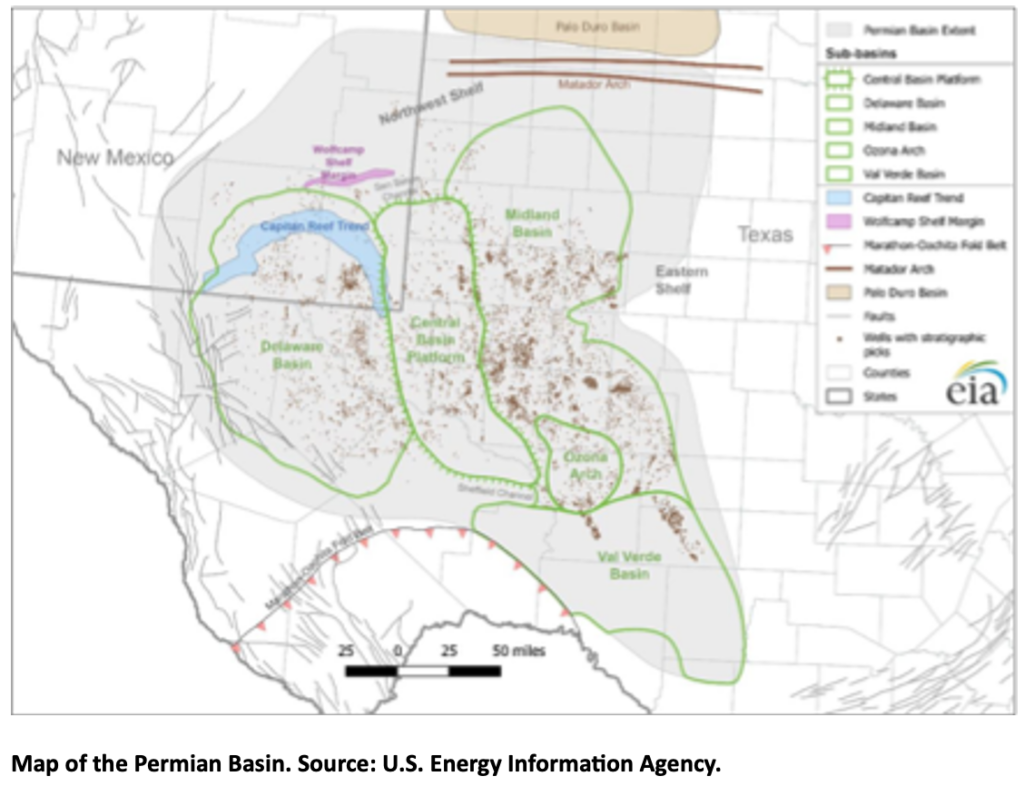

- Natural gas flaring will increase in the Permian Basin because of a lack of pipeline capacity.

As Republicans Take the House, Prospects for Permitting Reform Brightens

Republicans recaptured the U.S. House by a narrow margin in the mid-term elections, and Democrats continue to control the Senate, either through a 50-50 broken by the Vice President or, if they win the Georgia Senate runoff election on Dec. 6, by two votes. Rep. Cathy McMorris Rodgers (R-WA) is widely expected to become chair of the powerful House Energy & Commerce Committee when the new Congress convenes in January. She is currently the ranking member. Rep. McMorris Rodgers has been highly critical of President Biden’s policies, which she sees as restricting domestic energy development. She is also an advocate for renewable sources of energy, especially hydroelectric generation, for which Washington is the leading state.

“The best way to reverse the damage of Biden’s energy crisis and drive down energy prices is by flipping the switch and unleashing American energy at home,” she said in October. “America can and must lead the world in reducing emissions – without trading our energy security [and] affordability.”

Rep. McMorris Rodgers said on Fox News that Republicans will “say ‘yes’ to more pipelines and implement permitting reforms.” She wants more federal lands leased for oil and gas drilling. She also backs building “more hydropower plants and nuclear plants” and favors increased exports of liquefied natural gas (LNG).

In their “Commitment to America,” issued by Minority Leader Kevin McCarthy (R-CA) on Sept. 23, Republicans listed 12 broad policy goals. Second on the list was: “Make America Energy Independent and Reduce Gas Prices.”

To implement that policy, Rep. McMorris Rodgers and the prospective new chairman of the House Committee on Natural Resources, Rep. Bruce Westerman (R-AR), who has a forestry degree from Yale, will probably rely on the “American Energy Independence From Russia Act,” H.R. 6858, which, according to a Nov. 18 E&E Daily report, “would offer a host of policies that would undercut Biden administration energy decisions, including a restoration of the approval of the Keystone XL pipeline, directions to offer public lands for fossil fuel production and efforts to streamline liquefied natural gas exports, among other areas.” The bill was blocked by Democrats during the current Congress.

Other Republicans who will be ascending to chairs of committees that affect energy policy include Rep. Sam Graves (R-MO), who is expected to head the Transportation and Infrastructure Committee, and Rep. Frank Lucas (R-OK), now the ranking member of the Science, Space and Technology Committee. Both are opponents of the Biden approach.

But even in the 118th Congress, if Republicans want to change energy policy, they face a Democratic Senate and a President with different views. Still, in one area – permitting reform that will prevent long delays for energy infrastructure projects – there is a good deal of common ground.

In a preview of the new Congress, the law firm Squire Patton Boggs wrote that House Republicans will introduce their own legislation to “address permitting in order to increase fossil fuel production and other low- to no-carbon sources.” Democrats “equally want permitting reform,” said the firm, so “this is an area where bipartisan cooperation may be possible.” Republicans in the House are also likely to apply oversight scrutiny to clean-energy projects under last year’s Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA).

On the Senate side, authority over energy is more concentrated. Influential Sen. Joe Manchin (D-WV) is expected to retain his position as chairman of the Energy and Natural Resources Committee. Permitting reform is his top priority. He was promised a vote on his measure by the President and Majority Leader Chuck Schumer in return for his backing of the IRA, but because of opposition from both the left and the right, Manchin agreed on Sept. 27 to remove his legislation from the Continuing Resolution to keep the government operating.

Manchin has not given up, and he still wants to drive his measure through during the Lame Duck session of Congress in December by attaching it to one of two must-pass pieces of legislation, the National Defense Authorization Act or the omnibus fiscal 2023 appropriations bill. That may be impossible with opposition from the left wing of the Democratic party.

This year or next, there seems to be sufficient appetite in Congress for permitting reform legislation, which President Biden will almost certainly sign, as well as for other policies that stress reliable and affordable electricity generation in a time when the grid’s effectiveness is in question and inflation is high.

Sen. Manchin Declines to Hold a Hearing to Confirm FERC Chairman

The long-running drama over the possible reconfirmation of Richard Glick as chairman of the Federal Energy Regulatory Commission (FERC) seems headed for resolution at last. Unless Energy and Natural Resources Chairman Manchin changes his mind, Glick won’t get another term.

On Nov. 10, Manchin said he was “not comfortable” moving ahead with Glick’s renomination, said a spokesperson. According to EnergyWire, “Glick has advanced a slew of regulatory changes seen as key for adding more solar, wind and batteries to the nation’s power grid.” Sen. Manchin, by contrast, rightfully wants FERC to focus on energy reliability and an all-of-the-above energy strategy, not climate change causes appropriate for jurisdiction under other agencies.

Sen. Manchin’s decision came on the heels of comments made six days before by President Biden, who said coal plants are too expensive to operate, and “we’re going to be shutting these plants down all across America” in order to shift to wind power. West Virginia is the number-two coal producer in the U.S. after Wyoming, and in 2020 “coal-fired power plants accounted for 88% of West Virginia’s electricity net generation,” according to the U.S. Energy Information Administration.

Sen. Manchin called the President’s remarks “outrageous and divorced from reality.” He added:

Comments like these are the reason the American people are losing trust in President Biden and instead believe he does not understand the need to have an all-in energy policy that would keep our nation totally energy independent and secure.

Glick, who has been called “Biden’s most effective climate warrior” by Politico, was nominated for a new term back in May, but Sen. Manchin and others on the committee raised doubts. Politico reported on Oct. 13 that Glick is saying “he’s optimistic he’ll get a confirmation hearing by the end of the year,” in part because of reassurances from Schumer and the White House. “I’m being told that there’s a lot of folks — the White House, Sen. Schumer, others — that are working hard towards the confirmation,” Glick said at the time.

Glick ran afoul earlier this year of Sen. Manchin, who believed that the FERC under Glick was going beyond the commission’s stated mission by introducing analysis of emissions in its decisions. In a March 3 hearing of his committee, Sen. Manchin criticized FERC for its “shortsighted attack on fossil fuel resources.” He told reporters that Glick “went way out of his wheelhouse” with proposed policy changes and told him to “just do your damn job.” In response, FERC made what Sen. Manchin called a “course correction,” delaying but not definitively ending implementation of the new rules.

If Glick is not confirmed for a five-year term, FERC will be operating with a 2-2 split between Democrats and Republicans starting Jan. 1. That means almost certain gridlock for the commission on contentious issues. The White House could resubmit Glick’s nomination in early 2023, but with Sen. Manchin still leading the committee, he is likely to suffer the same fate. Before joining FERC in 2017, Glick served as general counsel to the Senate committee that Manchin now heads.

Large Portions of the U.S. Risk Energy Shortages This Winter

The 2022-23 Winter Reliability Assessment of the North American Energy Reliability Council (NERC) has concluded that large portions of the U.S. and Canada are at risk of insufficient energy supply during peak periods this winter – specifically, in Texas, the Midwest, the Southeast and the Northeast.

“Our emerging renewable fleet is fully dependent on how sunny or how windy it is,” said John Moura, NERC’s director of reliability assessment and performance analysis, in a media conference on Nov. 17. That doesn’t sound like a reassuring strategy. Moura added:

We don’t have large-scale storage solutions [yet] — so as we transition our system from predominantly coal, nuclear, and gas generation to more renewable and weather-dependent resources, we need to ensure reliability, even on the days when the weather isn’t quite cooperating.

“It’s a bit unprecedented,” said Moura.

A Politico article quoted Jim Matheson, CEO of the National Rural Electric Cooperative Association, saying that the report is a sign the U.S. is undergoing a “haphazard” energy transition. Matheson stated:

As the demand for electricity risks outpacing the available supply during peak winter conditions, consumers face an inconceivable but real threat of rolling blackouts,” he said. “It doesn’t have to be this way. But absent a shift in state and federal energy policy, this is a reality we will face for years to come.

According to the NERC report, in Texas, peak power demand has risen 7% since last winter, but the state’s grid – the Electric Reliability Council of Texas, or ERCOT – remains sensitive to extreme temperatures because it is not interconnected with other grids. As a result, it has minimal ability to import power from other regions – a condition that led to catastrophe during the winter of 2021, with 246 deaths.

The problem in Texas is compounded, said NERC, because two coal plants in the state are not currently in compliance with EPA coal ash rules, “potentially limiting further the amount of generation available in an emergency if EPA decides not to let it operate conditionally.”

In the Midwest, said the NERC report, concerns are running high, with reserve margins for the Midcontinent Independent System Operator, or MISO, down by 5% from last year “due largely retirements of thermal, nuclear, and coal-fired generators and insufficient replacement capacity to meet increasing demand,” said a Washington Examiner article. If weather conditions become extreme, “energy emergencies are likely,” according to Mark Olson of NERC.

New England has its own problem – a shortage of home heating oil, plus a lack of pipeline infrastructure for natural gas. The challenge is amplified by a lack of LNG because of competition with Europe, which is suffering limited supply as a result of the war in Ukraine.

Again, New England will be at the mercy of the weather. The Financial Times reported that the region is “importing European prices” in a looming gas supply crunch. New England officials, according to the FT, “have called for emergency assistance from Washington to pre-empt a crisis, while lashing out at a century-old law that has cut New England off from some of America’s prolific shale output and left it more dependent on expensive imports.”

That law is the Jones Act, a protectionist law that limits which ships can travel between U.S. ports. The law makes maritime delivery of petroleum supplies nearly impossible, so New England has to rely on gas produced abroad.

A July letter signed by the six New England governors asked Energy Secretary Jennifer Granholm “to suspend the Jones Act for the delivery of LNG for all or part of the winter of 2022-23.” But no action has been taken so far.

As we reported last month, ISO New England, the regional independent system operator, warned of possible rolling blackouts as the region competes with Europe for scarce resources. Power producers in New England know about the threat, but there is not much they can do about it. But as the Wall Street Journal reported:

Power producers in New England are limited in their ability to store fuel on site and face challenges in contracting for gas supplies, as most pipeline capacity is reserved by gas utilities serving homes and businesses. Most generators tend to procure only a portion of imports with fixed-price agreements and instead rely on the spot market, where gas prices have been volatile, to fill shortfalls.

NY Approves an Offshore Wind Energy Transmission Line, But Other States Face Challenges

In a major step to deliver offshore wind energy to the electric grid, the New York Public Service Commission has approved a 25-mile transmission line for the Sunrise Wind Farm off the coast of Long Island. When operational in 2025, it will have the capacity to generate 924 megawatts (MW) of clean electricity, enough to provide power to 600,000 homes. Offshore wind, as we have noted in the past, is an essential element in the fuel diversification necessary to ensure reliability of electricity as demand increases. The U.S. is hoping to add nearly 30 gigawatts of offshore wind generation capacity by 2030, enough to power about 21 million homes.

Macroeconomic changes, however, are raising costs for offshore wind production, and backers of a major project in Massachusetts recently declared it was “no longer viable” under contracts filed in May. There’s a need to implement the offshore wind provisions in the IRA, including a 30% tax credit for offshore wind projects that begin construction before January 1, 2026. But, again, our regressive permitting laws are standing in the way.

As Sen. Chris Murphy (D-CT) and Brad Campbell, president of the Conservation Law Foundation, wrote in the Boston Globe on Nov. 21, “It can take a decade to permit and build offshore wind, clean transportation, and major electric transmission. This is as unacceptable as it is unnecessary.” They added:

It is impossible to realize this potential without addressing the nation’s failing regulatory infrastructure. Outdated and unwieldy review and permitting processes hinder our ability to meet the urgency of the climate crisis and bog down much-needed projects in delays and litigation that fail to safeguard the communities and the natural resources they’re designed to protect.

States on the East Coast are counting on offshore wind to meet their power needs, but challenges abound. In addition to the financial woes in Massachusetts, Ocean City, NJ, is fighting a transmission line that will bring power from an offshore wind project. Dominion Energy is objecting to performance standards that the Virginia State Corporation Counsel wants to apply to its proposed 176-turbine wind farm off Virginia Beach. Offshore wind is still a nascent industry, and obstacles are to be expected, but costs and permitting obstacles (which are related) need mitigation for the technology to meet its promise.

Pipeline Capacity Shortages in the Permian Basin Mean More Natural Gas Flaring

In the Permian Basin, located in Texas and New Mexico, the biggest single supply of shale oil in the U.S., “pipelines [are] effectively maxed out,” and there’s no capacity to ship more natural gas until the latter half of next year, reports Kevin Crowley of Bloomberg. As a result, in this time when gas shortages are afflicting Europe and, as we noted above, are threatening much of North America, operators in the Permian “are set to significantly increase the amount of natural gas they burn into the atmosphere.”

The choice they face is whether to cut back on oil production and thus have less gas as a byproduct or keep pumping oil but flare off the gas. Crowley writes:

Going for the latter would threaten to undo much of the progress achieved in the last few years to address the industry’s flaring problem, which hasn’t just attracted the ire of climate-change activists but also that of ESG-minded investors.

The article quotes Alexandre Ramos-Peon, head of shale research at Rystad Energy, as saying, “It’s inevitable that some produced gas will just be flared. Volumes of flared gas could triple to 3% of total production, driven by private operators with less stringent emissions targets, he said.

A blog post on Nov. 15 by the Grow America’s Infrastructure Now (GAIN) Coalition criticized the Biden Administration for “its lack of support for domestic energy infrastructure projects, particularly for pipelines.” As demand has rebounded from COVID’s setbacks, supply hasn’t kept pace, “largely due to transportation and export constraints.”

GAIN, an organization of businesses, trade associations and labor, points to what is happening in the Permian Basin: “In the resource rich areas of Central and West Texas gas production has accelerated but the boom in production has not been correlated with an increase in pipeline capacity to transport natural gas to processing facilities.”

Flaring in the Permian Basin has been a concern among some interest groups for years. The Environmental Defense Fund issued a report in 2020 that praised several Permian producers for developing strategies for minimizing flaring. Now, however, Permian operators are facing a crisis, largely because of government policy. As the GAIN blog states:

It is ironic that, in the name of environmentalism, the Biden administration has weaponized regulatory hurdles and permitting to impede energy infrastructure projects from receiving the necessary support, now leading to increased emissions due to burning off gas. There is no clearer example of this than in New England, where the lack of pipelines is causing states to import natural gas, resulting in inflated energy prices this winter.