In today’s issue:

- EPA’s new rules would require 78% of new sedan sales to be electric in less than 10 years. Is that realistic?

- More EV sales would put an enormous strain on an electricity grid that is already unreliable.

- The jury is out in Chicago on another trial involving a monopoly utility scandal with alleged political corruption.

- It’s time to come to terms with the huge cost of moving to a “net zero” emissions future.

- Is permitting reform an idea whose time has finally come?

- In a Louisiana shipyard, a manifestation of the importance of offshore wind to an all-of-the-above energy policy.

- Billionaire environmentalists love their private jets.

- Here’s why even anti-China Republicans are reluctant to ban liquefied natural gas exports.

New EV Standards from the EPA Would Cause a ‘Revolution,’ But America Appears Far from Ready

The U.S. Environmental Protection Agency (EPA) on April 12 announced new proposed emissions standards for cars and trucks to “accelerate the ongoing transition to a clean vehicles future and tackle the climate crisis.” The standards are meant to “avoid nearly 10 billion tons of CO2 emissions” by 2055 (“equivalent to more than twice the total U.S. CO2 emissions in 2022”) and to “reduce America’s reliance on approximately 20 billion barrels of oil imports.”

The new standards, if adopted, would force automakers to produce and sell far more electric vehicles (EVs). The EPA noted that since President Biden took office, “the number of EV sales has tripled while the number of available models has doubled.”

Compliance with the rules will require 78% of new sedans, 68% of pick-ups, and 62% of crossovers and SUVs to be all-electric by 2032.

“The new rules would require nothing short of a revolution in the U.S. auto industry, a moment in some ways as significant as the June morning in 1896 when Henry Ford took his ‘horseless carriage’ for a test run and changed American life and industry,” wrote Coral Davenport in the New York Times.

In 2022, only 5.8% of cars sold in the U.S. were EVs. But sales have been rising rapidly. In 2021, the figure was 3.1%.

Without the proposed regulatory changes – but with the subsidies prescribed by last year’s Inflation Reduction Act – the Energy Information Administration last month forecast that EVs will make up only 15% of sales in 2030 and 19% by 2050. While EVs are becoming more popular in the luxury class, they “remain less competitive against conventional gasoline-powered cars and light trucks serving the mass market,” the EIA report noted.

Said a Wall Street Journal editorial on April 13: Reasons that uptake hasn’t been faster “include higher prices and insurance costs, a battery range that typically tops off at 250 miles and long charging time. Even rapid chargers take 20 to 30 minutes, which most people don’t want to spend while driving children to soccer or baseball games.”

Other critics raised concerns about the EPA proposal. One is the affordability gap that both the EIA and the Journal mentioned. EVs are far more expensive than conventional vehicles: $54,000 on average compared to $44,000 for gas-powered cars, according to Summer 2022 data from J.D. Power. Other costs will rise as well. Heavy electric trucks used to haul goods and raw materials cost two to three times as much as diesel trucks, so Americans can expect a dramatic increase in direct and indirect costs for many goods and services.

In addition, critical materials for EVs are in short supply, increasing U.S. dependence on China, a major source. The charging infrastructure, despite recent enhancements, is also likely to be inadequate. The EPA says that “there are over 130,000 public chargers across the country – a 40% increase over 2020,” but, according to a January report from S&P Global, the country will need over 2 million public chargers installed by 2030 if EVs represent 40% of new sales by that date – and perhaps an additional 1 million or more based on the Biden Administration goals for EV sales.

Another criticism is simply that this massive intervention in the marketplace denies consumers the freedom to make their own choices. As the Wall Street Journal put it:

The U.S. auto industry is nominally still privately owned, but it is slowly becoming a de facto state-directed utility. That’s the meaning of the Environmental Protection Agency’s proposed new vehicle-emissions standards Wednesday that will force-feed the production of electric vehicles, whether or not consumers want them…. This isn’t about clean air. This is about forcing auto makers to produce more EVs that consumers will have no choice but to buy since there will be few gas-powered vehicles left.

More Pressure on the Electric Grid at a Time When It Is ‘Wheezing’

But perhaps the most serious issue is the strain that vastly increased use of EVs will put on the grid. “The initiative is being launched at the same time the nation’s electricity grid — which would fuel all these new EVs — is wheezing,” reported the Washington Post, “with destabilizing power outages and developers of wind and solar projects often stuck waiting years to connect to transmission lines.”

In a special section on electric grids, which it terms “the ultimate supply chains,” The Economist pointed out that reaching net zero by 2050 would require global electricity to rise from the current 20% of total energy consumption to 52%. “Adding capacity to the electricity grid is not a simple task,” they reported. “The grids used by developed countries are not accustomed to rapid change.”

Post reporters Evan Halper and Timothy Puko minced no words in their article on April 16:

Engineering is a challenge, but the bigger hurdle involves addressing financing and regulations if the grid is to evolve into one that can reliably charge tens of millions of electric vehicles. Before the administration even unveiled its latest plan to push automakers to step up EV production, the Department of Energy had already concluded that transmission systems need to be expanded by 60 percent by 2030 to meet Biden’s broader emissions goals. And they may need to triple in capacity by 2050.

The reporters write: “That expansion is not on track. Fights over where utility lines should be located, who should build them and who should pay for them continue to create major bottlenecks.” The average time it takes a developer to add a wind or solar project to a regional power grid is now four years – twice as long as it took in 2017. The reporters concluded:

The Biden administration is promising to ease congestion and shore up the grid through billions of dollars in spending on transmission lines and other improvements authorized in the infrastructure package that Congress passed. But it could be years before the upgrades and expansions are operational.

In a Forbes column on April 14, the Pacific Research Institute’s Dr. Wayne Winegarden looks to the experience of California, where currently 18% of car sales are EVs.

“California has long been the epicenter of government-imposed green mandates,” wrote Winegarden, “but the state’s experience is not encouraging. For example, as a Pacific Research Institute [PRI] report documents, state energy mandates impose a more than $2,000 burden on every Californian through higher gas and electricity costs and reduced economic output.” Winegarden is a senior fellow in business and economics at PRI, which publishes this newsletter.

“A recent report by the North American Electric Reliability Corporation,” Dr. Winegarden writes, “has ranked California as being at ‘high risk’ for energy shortfalls due to the push for more unreliable renewable power, and by 2024, ‘demand could fall below supply for 10 hours during peak summer months.’”

A NERC official told CNBC:

Renewables also don’t necessarily map to where demand is, unlike fossil fuels . . . which means more transmission lines are needed and building them can take from seven to 15 years. Thus, the entire electricity grid will require massive and expensive infrastructure upgrades to try to keep up with the increased demand from the Biden mandates.

In addition, a 2021 study by the National Renewable Energy Laboratory found that electrifying the economy could increase electric demand by as much as 81% in 2050 from 2018 levels. Such a massive increase would raise serious implications for reliability. Blackouts in California, Winter Storm Uri in Texas and Winter Storm Elliott all tested the grid with major power outages. Just imagine what forced EV adoption will look like. Dr. Winegarden writes:

The better way to reduce emissions and address global climate change is not through unrealistic government mandates that will impose huge new costs primarily on the working class. It’s by promoting innovation. By incentivizing innovators, we can develop cutting edge technology that can improve the environment in an affordable and less disruptive way. This should be the top priority for federal, state, and local policymakers seeking to address global climate change, not costly and unworkable new mandates like the Biden plan.

Prudent electrification policy requires facing reality and an avoidance of the unplanned effects of rapid electrification, which would be the result of the proposed EPA rules.

Another Midwest Trial in a Utility Scandal

In Issue No. 22 of this newsletter, we reported that on March 9, a federal jury convicted Larry Householder, the former Speaker of the Ohio House, and Matthew Borges, the former chair of the Republican Party in the state, of participating in a racketeering conspiracy. It involved what the U.S. Attorney’s Office for the Southern District of Ohio called “nearly $61 million in bribes paid to a 501(c)(4) entity to pass and uphold a billion-dollar nuclear plant bailout.”

Last year, Akron-based FirstEnergy Corp. agreed to pay a massive fine related to the same activity. The legislation provided a subsidiary, FirstEnergy Solutions – now bankrupt – but re-emerged as Energy Harbor in 2020, with “more than $1 billion from Ohio ratepayers to bail out its Davis-Besse and Perry nuclear plants in Northern Ohio,” reported The Cleveland Plain Dealer. HB 6 was described by Vox as “the worst energy bill of the 21st century.” It not only bailed out the nuclear plants but also created a surcharge that would raise electricity costs for all residents and businesses in Ohio.

Now, a scandal involving another monopoly utility is reaching a crescendo in federal court with the trial of the “ComEdFour.”

In February 2021, Michael Madigan resigned after serving 36 years as the Speaker of the Illinois House. Seven months before, “Commonwealth Edison agreed to pay a $200 million fine and cooperate with federal prosecutors in acknowledging its part in a near-decadelong bribery scheme, seeking to win Madigan’s favor on legislation by giving jobs and contracts to his allies,” according to the Chicago Tribune. The deal included a three-year deferred prosecution agreement.

At the time, “Madigan’s foremost political confidant, former lawmaker and lobbyist Michael McClain of Quincy, was indicted along with former ComEd CEO Anne Pramaggiore and two other utility players. All four pleaded not guilty,” said the Tribune. Madigan was indicted separately in March 2022 by a federal grand jury “on racketeering and bribery charges for allegedly using his official position to corruptly solicit and receive personal financial rewards for himself and his associates,” according to the U.S. Attorney’s Office. He has pleaded not guilty, and his trial will be separate.

Meanwhile, the prosecution rested its case on April 12 in a Chicago courtroom for the “ComEd Four,” as they are called, and attorneys for the defendants unsuccessfully asked Judge Harry Leinenweber for a directed verdict – which he rejected. “The evidence is clear that this was on the minds of the defendants…They were concerned enough, that they would go to great extremes to keep Madigan happy,” the judge said.

The next day, former ComEd CEO Anne Pramaggiore denied on the witness stand that she was involved in a scheme to bribe Madigan. A local Fox affiliate reported: “Taped calls and testimony from insiders [have] formed the bulk of the case against the four, whom prosecutors say steered more than $1 million to Madigan allies who did little or no work while Madigan helped shepherd legislation critical to the utility’s bottom line.” The case went to the jury shortly after Pramaggiore’s testimony.

The alleged scheme involved an attempt to arrange bailouts for two nuclear power plants – Byron and Dresden. Byron Generating Station is among the ten largest nuclear facilities in the country. The irony of this story is that the plants in question were never in need of a bailout at all, as we pointed out in our newsletter No. 4. They were profitable, according to an analysis by the Independent Market Monitor (IMM), included in testimony June 24, 2021, by the Electric Power Supply Association before the U.S. Senate Energy and Natural Resources Committee.

In fact, the latest 2022 State of the Market Report for PJM (see page 425), released in March, found that for 2023, Byron has an expected an annual surplus of $694.0 million and Dresden, $636.3 million.

There’s a broader lesson here. How many scandals are necessary for public officials to wake up to the shenanigans of politically powerful monopoly utilities?

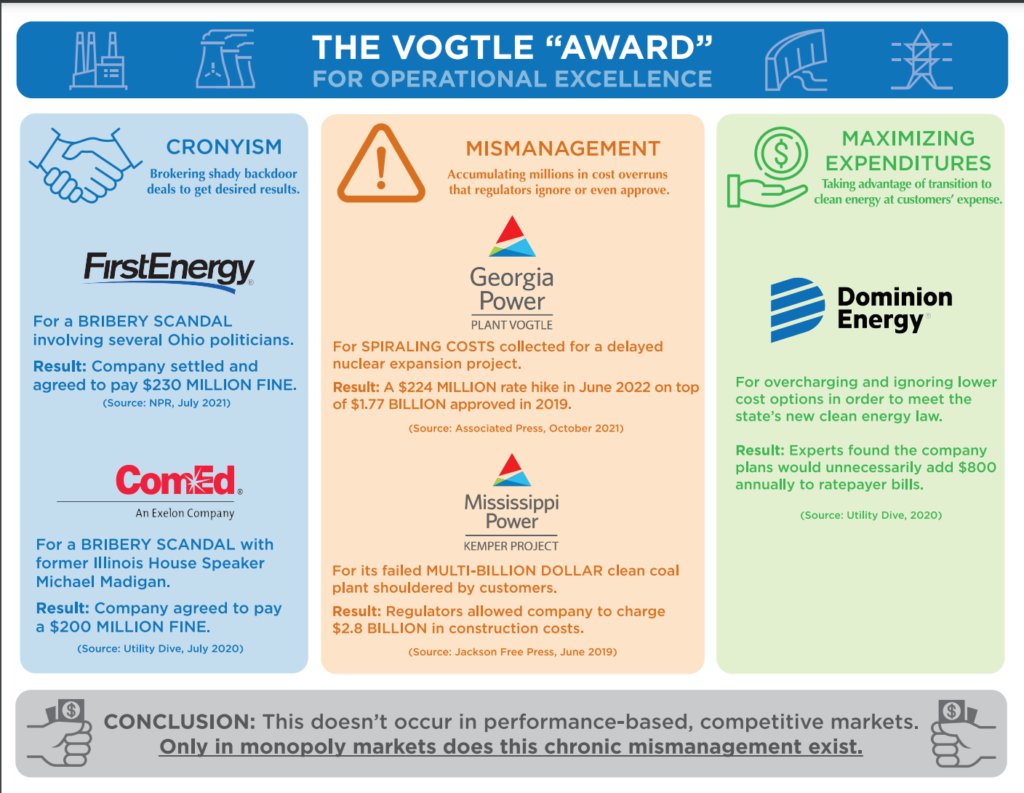

Tom Shepstone of the Natural Gas Now blog in 2021 invented the tongue-in-cheek “Vogtle Award” for “corruption and incompetence.” The award is named for the disastrous Project Vogtle, the Georgia Power nuclear venture that has been plagued with massive cost overruns. Shepstone gave FirstEnergy and ComEd the Vogtle prize for “cronyism,” that is, “brokering shady backdoor deals to get desired results.” He also cited Georgia Power, Mississippi Power, and Dominion Energy in Virginia for separate awards and pointed out that this kind of activity “does not occur in performance-based competitive markets. Only in monopoly markets does this chronic mismanagement exist.”

Injecting Realism into Discussions of Clean Energy Goals

In our last newsletter, we cited the Annual Energy Outlook, released March 16 by the U.S. Energy Information Administration (EIA) as calling into question the Biden Administration’s goals of decreasing greenhouse gas emissions by 50% in 2030 (compared to the 2005 base year) and then reaching net zero in 2050. The EIA estimated that total energy-related CO2 emissions would fall 20% to 45% by 2050– in a far cry from “net zero.”

The report found that relative to 2022, “natural gas generating capacity ranges from an increase of between 20% to 87% through 2050.”

That doesn’t sound like an elimination of fossil fuels. It is clear that they will play a prominent role even as the use of renewables increases.

A McKinsey report in 2020, “The net-zero transition: What it would cost, what it could bring,” concluded:

Capital spending on physical assets for energy and land-use systems in the net-zero transition between 2021 and 2050 would amount to about $275 trillion, or $9.2 trillion per year on average, an annual increase of as much as $3.5 trillion from today. To put this increase in comparative terms, the $3.5 trillion is approximately equivalent, in 2020, to half of global corporate profits, one-quarter of total tax revenue, and 7 percent of household spending. An additional $1 trillion of today’s annual spend would, moreover, need to be reallocated from high-emissions to low-emissions assets.

Writing in National Review, Denmark’s Bjorn Lomborg, a fellow at the Hoover Institution and president of the Copenhagen Consensus Center, estimated, “Just the additional cost of low-emission assets and infrastructure would be $5.6 trillion annually. That is more than one-third of the global annual tax intake.”

Reducing emissions is a legitimate and important goal, but realism is necessary, and it’s hard to take grandiose estimates involving net zero seriously.

More Interest in Permitting Reform in Congress but Still No Action

Even the progress estimated by the EIA will be difficult to achieve if the U.S. continues to make it difficult to build the necessary infrastructure. The Economist magazine made this point emphatically in its April 8 issue, quoting Sen. Lisa Murkowski (R-Alaska) as saying, “We can be the superpower of all energy sources,” but for that to happen, “we’ve got to have permitting that makes sense.”

BloombergNEF estimates that over 1,000 gigawatts of power projects “are awaiting access to the grid, with renewables making up the lion’s share of capacity waiting in interconnection queues.”

On March 27, the U.S. Chamber of Commerce issued a letter to members of Congress, calling the current permitting mess “the single biggest obstacle” to building new energy infrastructure. The letter called for “meaningful and durable legislation…before the end of the summer.” The letter was signed by dozens of organizations, ranging from the Business Roundtable to the Billings (Mont.) Chamber of Commerce.

On March 30, House Republicans passed a sweeping energy bill, deemed H.R. 1 for its importance. With a Democratic Senate and White House, it has no chance to become law, but, as we noted in Issue No. 22 of this newsletter, “parts may pass in a compromise,” including the sensible permitting reform that Sen. Joe Manchin (D-WVa), chairman of the Senate Energy and Natural Resources Committee, tried to get approved last year in a deal for his vote on the Inflation Reduction Act.

Among other changes, it would have set targets on the length of environmental reviews under the National Environmental Policy Act (NEPA) and granted the Federal Energy Regulatory Commission (FERC) more authority to site the transmission lines that are needed to connect wind and solar generation to areas where demand is high.

The Economist noted that permitting reform looks like a bipartisan idea whose time has finally come:

The bigger obstacles to reform have typically come from the left, which has armies of lawyers skilled in delaying projects until they become unviable. Yet change may be coming. Congressman Scott Peters, a Democrat from deep-green California, has been pushing his colleagues to accept that “climate action involves building a lot of things…this is a break-the-glass moment.”

Rep. Peters even says that NEPA needs to be updated: “You can’t sit on this old law as Biblical.”

More recently, Energy Secretary Jennifer Granholm lent her weight to the recommendation for boosting energy infrastructure, and specifically the Mountain Valley Pipeline (MVP) covering Sen. Manchin’s home state of West Virginia. In an April 21st letter to the Federal Energy Regulatory Commission (FERC), Secretary Granholm wrote,

Energy infrastructure, like the MVP project, can help ensure the reliable delivery of energy that heats homes and businesses, and powers electric generators that support the reliability of the electric system. Natural gas—and the infrastructure, such as MVP, that supports its delivery and use—can play an important role as part of the clean energy transition, particularly with broad advances in and deployment of carbon capture technology facilitated by the Bipartisan Infrastructure Law and Inflation Reduction Act. Similarly, new pipeline infrastructure is needed to support the rapid growth of hydrogen as an emissions-free fuel, and to transport carbon dioxide from its point of capture to the location of its use or sequestration.

Members of Congress from both parties should heed this advice in their deliberations over the next steps on permitting reform.

A First-of-Its-Kind Ship for Offshore Wind

A sign of the times, as the New Orleans Times-Picayune reported on April 5:

A first-of-its-kind ship for the offshore wind industry wasn’t halfway built when an order for a second one came in to Edison Chouest, a Houma [La.] shipbuilder that has for decades specialized in vessels that service the offshore oil and gas industry. And things are just getting started.

Standing under the towering unfinished frame of the 262-foot-long Eco Chouest, company vice president Robert Clemons predicted even more ship-building contracts as wind turbines begin sprouting in U.S. waters. “They’re going to need 15 or 20 of these things over the next 25 years,” he said. “And they’re going to need whole flotillas of other assets to supply the industry.”

“Many workers and its crew of 23 will likely spend two weeks aboard the ship during maintenance rounds,” said the Times-Picayune. “Most of the bedrooms are for a single occupant. Shared spaces include a gym, cinema, video game room and even a ‘fire pit lounge.’”

According to an Associated Press report on the vessel, The “unveiling of the work in progress comes almost a week after the Biden Administration announced a wind power strategy aimed at 30 gigawatts of offshore wind by 2030.”

At the International Offshore Wind Partnering Forum in Baltimore on March 29, White House National Climate Advisor Ali Zaidi “outlined ten ways the Administration is making progress toward the 2030 goal, and is on a path to 110 gigawatts by 2050…. Last year alone, American offshore wind investments tripled.”

Once completed, the first service operation vessel for offshore wind turbines will be dispatched for use by Orsted, a Danish offshore wind developer, and Eversource, a Connecticut-based energy company. Orsted and Eversource are teaming up on the Revolution, South Fork and Sunrise wind farms off the coasts of New York, Connecticut and Rhode Island.

The House Majority Leader, Rep. Steve Scalise (R-La) joined David Hardy, the CEO of Orsted Americas, and members of Edison Clouet offshore for a tour of the vessel. Rep. Scalise voiced his support for an all-of-the-above energy policy at the event, saying, “It’s not a question of which source of energy do we need and do we get rid of this source of energy to go to that source of energy. The world is going to need more energy, and we’re going to need all forms of energy.”

Rep. Scalise added, “We can be exporters of this innovation,” he said. “We can build the vessels but also the turbines and the foundations…..This is about greater energy independence from adversarial countries like China and Russia.”

Rep. Scalise also cited H.R. 1, the “Lower Energy Costs Act,” which, as we noted above, passed the House on March 30 with 221 Republican and 4 Democratic votes. Included in the bill is support for further development of wind farms by providing revenue from lease sales to states with active offshore wind development.

Craig Stevens, spokesperson for Grow America’s Infrastructure Now (GAIN), responded to the building of new offshore wind vessels this way: “While it is certain that oil and natural gas is an important American industry and will remain in demand for decades to come, it is also important to acknowledge the role of renewable energy – especially offshore wind. America must develop all of its energy resources – and Orsted, Eversource, and the great folks at Chouest Edison are doing their parts.”

GAIN describes itself as a “diverse coalition of businesses, trade associations, and labor groups that share an interest in creating jobs and strengthening our nation’s economy through infrastructure development.” Members include such organizations as the Ohio Chamber of Commerce and the Texas Pipeline Association.

Environmentalist Billionaires and Their Jets

Another piece of news related to GAIN is its release of a new video highlighting the hypocritical actions of the billionaires who fund expensive climate change campaigns.

The video, for example, notes that Michael Bloomberg’s private jets took more than 1,700 trips over the past four years, emitting at least 10,000 metric tons of CO2. Some 118 private jets transported leaders from across the globe to the UN’s 2021 climate change conference, COP26, emitting over 1,000 tons of CO2 en-route.

Elon Musk responded to GAIN’s video, referring to Bill Gates, tweeting, “Not having a massive short position against Tesla would be a step in the right direction!” Last year, it was revealed that Gates, the founder of Microsoft and an ardent environmentalist, had taken a multi-billion-dollar short position on Tesla – that is, a bet that the stock price will decline.

The Business Telegraph in the UK covered the interaction, saying, The Tesla CEO pointed out that Gates’ Tesla short bet is contradictory to the latter’s desire to fight climate change and that he should be supporting the company’s EV initiatives.”

An earlier GAIN video concentrated on how elite climate activists like Bloomberg fund expensive campaigns that villainize the American industries on which they themselves rely. And, by the way, waging war on fossil fuels and petrochemicals cannot stop their production and use around the world. Even if such campaigns affect the United States, this nation would be forced to outsource energy production and jobs to places like China.

Should We Ban U.S. LNG Sales to China?

Speaking of China: The House has passed legislation to ban oil sales to China from the U.S. Strategic Oil Reserve (SPR) and the Senate is expected to follow, with bills such as the Fair Trade with China Enforcement Act, Ending China’s Developing Nation Status Act, and Neutralizing Unfair Chinese Export Subsidies Act of 2023 under consideration to punish China for its coercive economic and national security policies.

Writes Marc Busch in The National Interest, “Many of these bills are a step in the right direction. Others are simply political theatre. While bashing China is undoubtedly in vogue, the costs and benefits of these bills need serious scrutiny. Good intentions can backfire; these bills might hurt the US more than China.”

A potential example is the China Oil Export Prohibition Act, a bill just re-introduced by Sen. Marco Rubio (R-Fla) that would prohibit the export of oil and petroleum products from the U.S. to China. The legislation flowed from an essay titled “How Congress Can Protect Americans from Communist China’s Bid for Domination,” in which Rubio explains that “first and foremost, we need to prevent markets from enriching Beijing-controlled firms.” He has sponsored no fewer than eight bills taking aim at China, covering everything from corporate corruption to investment in companies on the U.S. government’s blacklists. No one can excuse Rubio of “being soft” on China.

Busch, who is the Karl F. Landegger Professor of International Business Diplomacy at Georgetown University, writes that what’s important about the China Oil Export Prohibition Act is “that it excludes natural gas and liquified natural gas (LNG). But this might change for several reasons, not all of which are about Beijing. For example, a ban on LNG exports to China could complement the Democrats’ push to move away natural gas.”

Politico on April 13 pointed out that many Republicans, who are anti-China in their rhetoric, are concerned about the possibility of an LNG export ban:

One reason is that contracts with Chinese buyers are critical to the gas industry’s hopes of securing billions of dollars in bank financing for planned export facilities, industry analysts said. Lack of financing led to delays in construction of new gas projects that could export as much as 21 billion cubic feet a day, a volume that if completely built would triple current U.S. capacity, according to figures from the Energy Information Administration.

“Is China still critically important in signing long-term agreements to help secure funding for those projects?” said Charlie Riedl, executive director for the Center for Liquefied Natural Gas trade association. “The answer is absolutely yes.”

If the U.S. bans LNG exports to China, then Russia, now China’s third-largest supplier of natural gas – would make up the difference. That would strengthen an alliance that is a growing threat to U.S. national security.

“China’s imports are going to quadruple over the next 20 years,” said Paul Bledsoe, a former Clinton White House climate aide and strategic adviser at the Progressive Policy Institute. “America should get those economic and trade benefits, not the Kremlin and Putin’s war machine.”

Even Republicans who are leading opponents of China are reluctant to support an LNG ban. One of them, Sen. Ted Cruz (R-Tex), was quoted by Politico as saying, “Individuals and companies can do business with China. We are not boycotting the nation as a whole.”

Others argue that selling LNG to China bolsters our national security. “If you want to think of it geopolitically, why wouldn’t we want China dependent on our natural gas for their own economy?” House Speaker Kevin McCarthy (R-Calif) said in a recent CNBC interview. “Would the world not be safer and would we not be stronger? Why wouldn’t we create more American jobs at the same time?”

Busch notes that U.S. LNG exports to China reached an all-time-high of 400,000 million cubic feet in 2021. But last year, “this figure had plunged to 100,000 cubic feet, in part due to political uncertainty about the prospect of future sales. This puts American jobs on the line.”

In an opinion piece for The Hill, Dr. Ellen Wald, a senior fellow at the Atlantic Council, writes that banning LNG sales to China would have serious negative consequences: “U.S. oil and gas producers would suffer much more than China, American consumers would not see lower energy prices, and closing off this avenue of trade would make diplomacy with China more challenging.”

She notes that it “has taken a long time for U.S. LNG to penetrate the Chinese market,” but “in 2018, Chinese companies finally started executing long-term contracts with American LNG companies. This was a huge boon to the U.S. LNG industry and is why, in 2021, America rose to became China’s second-largest supplier of LNG (behind Australia but above global LNG powerhouse Qatar). China was America’s single largest purchaser of natural gas exports in 2021, responsible for nearly 50 percent of the export market.” She adds:

U.S. companies have made plans, secured loans, and invested money with the surety that Chinese buyers would be purchasing their product for 20 years. Congress could jeopardize contracts that would affect a major segment of the American business community by banning LNG sales to China. These contracts cannot be replaced with sales to Europe because Europeans continue to shun 20-year contracts for LNG even though they need to replace Russian natural gas with LNG.

She writes that while “some organizations have argued that exporting U.S. natural gas makes energy prices higher for American consumers and businesses,” the truth is that a ban on sales to China ”will not help lower domestic energy prices.”

The reason is that, because of infrastructure constraints, we can’t transport all the natural gas we produce to parts of the United States. We produce more natural gas in the U.S. in certain areas than we can use domestically. But, because of infrastructure and shipping constraints, we cannot transport that natural gas to other parts of the country. So, gluts will occur. Natural gas prices will fall in some parts of the country, but soon, “if there is nowhere for that natural gas to go, they will have no choice but to reduce oil production and produce less associated natural gas to comply with environmental regulations. The result: higher oil prices for American consumers.”

Dr. Wald urges Congress to “consider the negative consequences American companies and consumers will face before proposing a ban on LNG sales to China.”