In today’s issue:

- A growing number of sectors, from transportation to energy to agriculture, are objecting to the EPA’s proposed tailpipe emissions rule.

- A new report analyzes the real emissions cost of switching to electric vehicles. The cost-benefit ratio is not so favorable, writes the Manhattan Institute’s Mark Mills.

- By shutting down power plants, New York City now faces a critical shortfall in electric-generating capacity, says independent system operator.

- Americans put a high value on electricity reliability, says a new poll.

- EPA’s assumptions on its controversial power plant rule are raising eyebrows and leading to calls for a reconsideration.

- Congress might have thought it approved the Mountain Valley Pipeline, but environmental activists found a friend in court to delay implementation.

- Louisiana is an energy powerhouse that has kept the lights and heat on in Europe, so why doesn’t it get more support from Washington?

- Demand for critical minerals is rising, says new IEA report, with China dominating the field.

- Ironically, foreign companies, including Chinese ones, are some of the main beneficiaries of the clean-energy subsidies in the IRA.

Objections Mount to EPA’s Proposed Rule to Speed Adoption of Electric Vehicles

Criticism is mounting over the EPA’s proposed tailpipe emissions rule, which would, as Politico reported, “speed up the electrification of the transportation” sector. Once the rule is implemented, a remarkable 67% of purchases of new sedan, crossover, SUVs and light trucks; up to 50% of bus and garbage trucks; 35% of short-haul freight tractors; and 25% of long-haul freight tractor will be required to be electric by 2032, the White House projected.

The rule has come under fire for several reasons, including the strain that a rapid conversion to electric vehicles (EVs) will put on the electric grid, diminishing its reliability at a critical time.

As we noted last month, dozens of members of the Senate and the House have written separate letters to EPA Administrator Michael Regan, calling on him to withdraw the regulations, which, opponents say, overstep the EPA’s authority and will lead to higher costs for consumers, industry layoffs and other negative consequences.

Members of Congress notably pointed to the Supreme Court’s decision last year that limited the EPA’s regulatory authority in its decision on power plant emissions, West Virginia v. EPA. “If finalized, these proposals will effectively require a wholesale conversion from powering vehicles with widely available liquid fuel to charging BEVs [battery electric vehicles] off our nation’s electric grid,” said the Senate letter, led by Sen. Shelley Moore Capito (R-WV), ranking member of the Environment and Public Works Committee.

In addition, attorneys general from several Western states complained that the proposed rules would jeopardize a critical source of funding for new transportation infrastructure and restrict necessary expansions and upgrades to America’s roads.

States are dependent on gasoline and diesel taxes that could suddenly be reduced, placing “significant downward pressure on highway and bridge investment, which already faces an investment backlog of $786 billion,” said June comments to EPA from the states of Idaho, Montana, North Dakota, South Dakota and Wyoming. The AGs argued for a more gradual approach.

On July 11, more than 100 groups representing agriculture, transportation, energy, and business interests – from the American Farm Bureau Federation to the Wisconsin Fuel and Retail Association — wrote a letter to President Biden opposing the rule and urging it to be reconsidered. The letter states:

EPA’s proposals inhibit the marketplace from identifying the most efficient, lowest cost opportunities to reduce GHG emissions from vehicles and greatly restrict consumer choice. We are concerned that such a prescriptive policy is not in the best interest of the consumer or of U.S. energy and economic security.

According to the EPA, fuel and vehicle technologies have reduced emissions from common pollutants by roughly 99 percent in both light- and heavy-duty vehicles and buses, and CO2 emissions from light-duty internal combustion engine vehicles (ICEV) have decreased 25 percent since model year 2004.

Forbes Media Editor-In-Chief Steve Forbes, a former candidate for president, tweeted, “Pretty telling, over 100 farming, transportation, & energy strange bedfellow groups reject the Biden EPA’s de facto #GasCarBan.”

The letter argued that, with the regulation, the U.S. would become more reliant on countries like China for “critical minerals that are necessary for rapid expansion of electric vehicle markets.” (For more on critical-mineral dependence, see the section below.)

In fact, a major complaint of the letter from wide-ranging organizations is that the EPA tailpipe emissions rule puts all its emphasis on wider use of EVs, but there are other ways to lower emissions without causing as much economic risk and immediate damage.

“A diversified portfolio of vehicle and fuel technologies that meets the multitude of transportation needs of Americans and makes meaningful GHG [greenhouse gas] reductions can be achieved while also allowing new zero-emission vehicle (ZEV), and specifically battery electric vehicle (BEV), technologies to advance,” said the letter, which added:

Improved crop yield, innovative biofuel and refined product processing, and manufacturing efficiency tied with carbon capture each represent promising advancements for current liquid and gaseous fuels to continue to accelerate emissions reductions.

Another concern arose in late June, when Ford announced plans to lay off at least 1,000 salaried employees and contract workers in an effort to defray the cost of investing in EVs. The Wall Street Journal reported that Ford said it expects to lose $3 billion in operating profit on its EV business this year.

What Are the Real Costs of Requirements to Transition Quickly to Electric Vehicles?

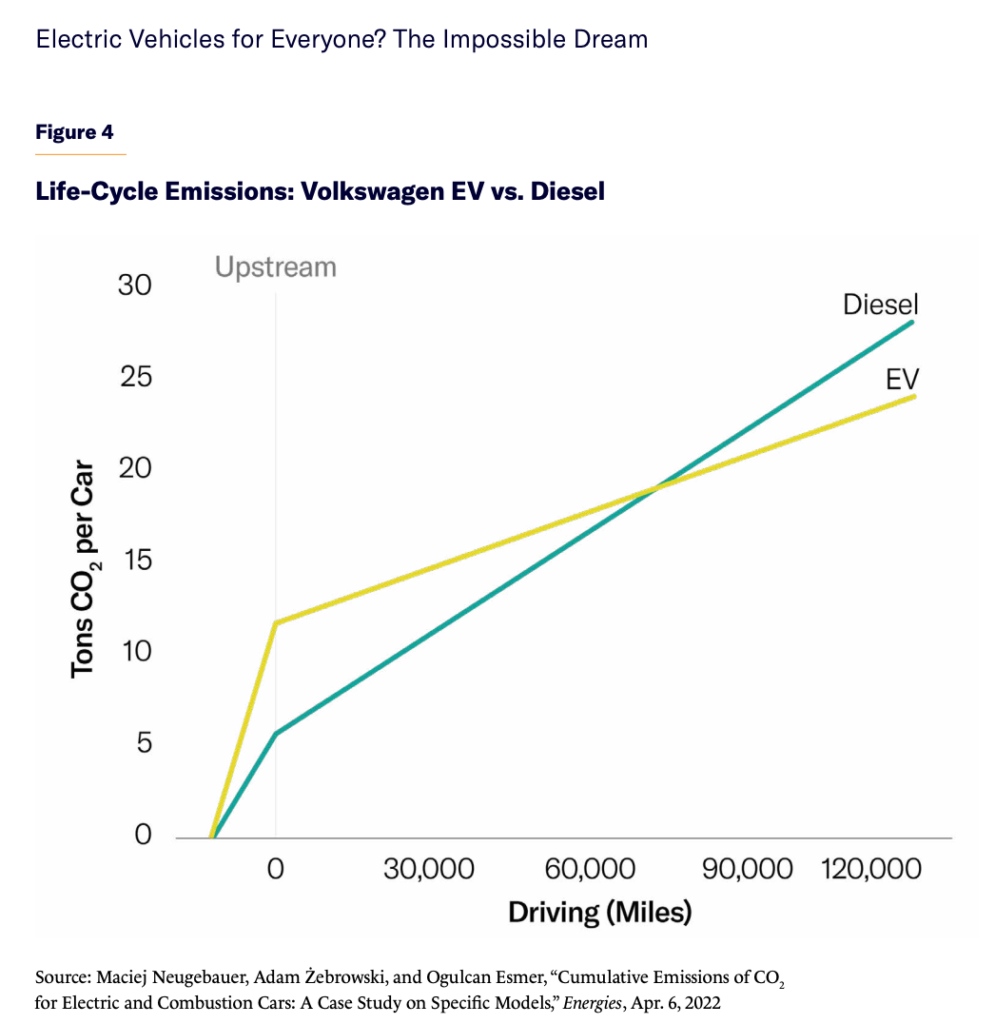

Meanwhile, Mark Mills, a widely published experimental physicist and engineer who is a fellow at the Manhattan Institute and Northwestern University, issued a report this month titled, “Electric Vehicles for Everyone? The Impossible Dream,” which concludes:

Ultimately, if implemented, bans on conventionally powered vehicles will lead to draconian impediments to affordable and convenient driving and a massive misallocation of capital in the world’s $4 trillion automotive industry.

Mills writes, “No one knows how much, if at all, CO2 emissions will decline as EV use rises. Every claim for EVs reducing emissions is a rough estimate or an outright guess based on averages, approximations, or aspirations. The variables and uncertainties in emissions from energy-intensive mining and processing of minerals used to make EV batteries are a big wild card in the emissions calculus.”

According to Mills, those emissions from extraction and processing “substantially offset reductions from avoiding gasoline and, as the demand for battery minerals explodes, the net reductions will shrink, may vanish, and could even lead to a net increase in emissions. Similar emissions uncertainties are associated with producing the power for EV charging stations.”

Mills cites a European Union analysis that found that the upstream emissions of the Volkswagen e-Golf, an EV, “combined with emissions from the power plants that supply EU electricity, yield cumulative CO2 emissions greater than the diesel version of that car for the first 60,000 miles of driving. After 120,000 miles, the accumulated emissions for the EV are estimated to be about 20% lower than the ICE version.

Mills also raises doubts that EVs will ever “reach economic parity with the cars that most people drive.” He writes that “an EV’s higher price is dominated by the costs of the critical materials that are needed to build it and is thus dependent on guesses about the future of mining and minerals industries, which are mainly in foreign countries.” [Again, see below for more on critical minerals.]

Policy makers in the states and Washington, DC, will do well to pay heed to the alarms being raised by Mills and other experts. Forcing Americans into EVs – especially without a transition period for the electric grid to accommodate the increased demand – could have highly deleterious consequences for the economy, not to mention stultifying limitations on personal and business freedom.

New York City Now Faces a ‘Shortfall of Electric Generating Capacity’ Because of Forced Plant Closures, Concludes System Operator

This newsletter has consistently been ringing alarm bells over threats to the electric grid’s reliability. In their haste to convert to an economy free of GHGs, policy makers are losing sight of the day-to-day realities of providing power to 332 million Americans.

The argument is not theoretical. A new report by the New York Independent System Operator (NYISO) “has officially identified a shortfall of electric generating capacity for New York City in 2025,” reports Marie French of Politico.

According to the article, the NYISO, “which is tasked with ensuring there’s enough electricity available even during heatwaves when people crank air conditioners, has been warning about the potential issue for years.” The shortfall that is now expected “is driven by rising demand and the planned retirement of the fleet of older peaker power plants in response to state environmental rules aimed at reducing harmful co-pollutants in the downstate region.”

The report explains:

Combustion turbines known as “peakers” typically operate to maintain bulk power system reliability during the most stressful operating conditions, such as periods of peak electricity demand. As of May 1, 2023, 1,027 MW of affected peakers have deactivated or limited their operation. An additional 590 MW of peakers are expected to become unavailable beginning May 1, 2025, all of which are in New York City.

Without those peakers, “the bulk power transmission system will not be able to securely and reliably serve the forecasted demand in New York City,” which is “deficient by as much as 446 MW for a duration of nine hours on the peak day during expected weather conditions when accounting for forecasted economic growth and policy-driven increases in demand.”

The retirement of peaker power plants came in response to a New York State Department of Environmental Conservation rule intended to reduce co-pollutants. What the rule means, as the NYISO’s 169-page report underlines, is that the rule forces accelerated power facility retirements with no adequate replacement supply. So, grid reliability is in jeopardy in the very near future in the most populated and economically critical part of the United States.

In an article about the report, Reuters noted the threats to reliability could also become intensified by other policies underway: “Increased electrification of the transportation and building sectors” among other factors could “fuel the supply deficit.”

New York City’s predicament is one this newsletter has highlighted in the past: As public policy demand for electrification of vehicles rises and retirements of fossil-fuel-driven plants also increase, reliability becomes more and more in jeopardy – all over the United States.

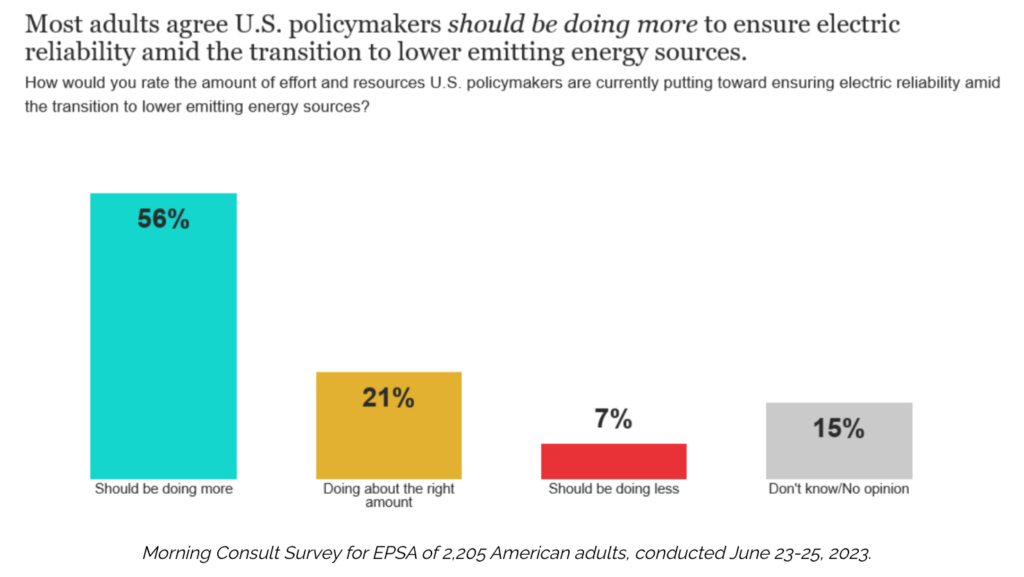

A New Poll Finds Americans Put a High Value on Electricity Reliability

The NYISO report comes as a Morning Consult poll, commissioned by the Electric Power Supply Association (EPSA) and released July 12, finds that 70% of Americans don’t want electricity reliability sacrificed to new laws and regulations addressing climate change. Other findings:

- 83% rank reliability or affordability as their top energy concern.

- 68% are concerned that government policies leading to power plant closures do not provide adequate replacements to support reliable electricity.

- 66% are very or somewhat concerned about the likelihood of power outages this summer.

Again, these views of U.S. adults offer a cautionary tale for public officials intent on pursuing policies to force power source retirements without any plan to ensure reliable electricity.

New EPA Data on Power Plant Rule Indicate ‘Unrealistic Assumptions [That] Change the Entire Cost-Benefit Equation’

Tailpipe emissions aren’t the only focus of EPA emissions policy. On May 9, EPA proposed Greenhouse Gas Standards and Guidelines for Fossil Fuel-Fired Power Plants and on July 7, issued modeling to estimate the impacts of the rules.

In an eye-opening new report, the U.S. Chamber of Commerce’s Global Energy Institute states: “Perhaps the most surprising part of this analysis is that EPA’s own modeling shows its powerplant rule will reduce power sector carbon emissions by a grand total of about 1% in 2040.” As the report noted, this is a significant miscalculation.

The reason, says the U.S. Chamber’s study, is that the EPA’s regulatory impact analysis assumed that private sector emissions would decline by 80% below 2005 levels by 2040 under a baseline scenario without the EPA’s regulations. With the regulations, though, the agency assumes emissions will decline 81%, a meager 1% difference.

“Why is this important?” asked the Chamber report. “Because the completely unrealistic baseline assumptions change the entire cost-benefit equation. When agency mandates are met even without the rule, the forecasted compliance costs on utilities and the resultant economic impacts on families and businesses effectively disappear.”

At the same time the EPA is trying to force Americans to increase their use of EVs, it has issued a power plants rule that makes accelerated electrification goals in the transportation sector more difficult to reach. As the Chamber report states on page 9:

Underestimating the future demand for electricity biases the cost-benefit calculation presented with the powerplant rule. Simply put, the investments in generation needed to meet existing and new electricity demand while complying with the proposed regulations are certain to be much higher than EPA has stated. Further, the reliability implications of projected retirements will be greater than EPA has considered.

It’s no wonder that in a comment letter to the EPA on July 13, the U.S. Chamber wrote that, because of its analysis of the EPA data released July 7, “it is clear that a substantial extension of the comment deadline is required in light of the Administrative Procedure Act (APA) and by related provisions of the Clean Air Act (CAA). The U.S. Chamber also noted the July 7 “Memo to the Docket” puts forward technical and factual claims, “including claims concerning cost and demand assumptions, that raise significant questions on their face and require careful review and analysis.” Hopefully the EPA came across the U.S. Chamber’s report panning the rule’s miscalculations.

The National Rural Electric Cooperative Association and American Public Power Association also sent the EPA a comment letter following the EPA’s release. “We have uncovered issues that call into question the accuracy of certain aspects of the modeling,” wrote the two groups. They asked for an additional 60-day extension of the comment deadline, which is currently Aug. 8.

Despite Congressional Approval, the Mountain Valley Pipeline Project Is Landing in the Lap of the Supreme Court

The saga of the $6 billion Mountain Valley Pipeline (MVP), which is meant to carry natural gas 303 miles between northwestern West Virginia and southern Virginia, still isn’t over. According to the project’s website:

MVP construction began in 2018 after the project secured each of its necessary permits and authorizations. By spring 2023, total project work for MVP was roughly 94 percent complete… Since the start of construction, industry opponents have continued to challenge MVP’s previously authorized and issued permits through ongoing litigation, placing their specific policy agendas above that of environmental protection and national energy security.

Facilitating completion of the project, a key link in bringing Appalachian shale gas to the Eastern U.S., was one of the goals of Sen. Joe Manchin (D-WV), when he agreed to back President Biden’s Inflation Reduction Act (IRA) last year. Sen. Manchin voted to pass the IRA, but he didn’t achieve the other part of the bargain when the left wing of the Democratic Party in the House thwarted him.

But during debt ceiling negotiations this spring, the issues were back on the table as top priorities. The Fiscal Responsibility Act (FRA), which resolved the debt deadlock, was signed into law on June 3. Among other measures, it ordered the approval of the MVP, stating that Congress:

“hereby ratifies and approves all authorizations, permits, verifications, extensions, biological opinions, incidental take statements, and any other approvals or orders issued pursuant to federal law necessary for the construction and initial operation at full capacity of the Mountain Valley Pipeline.”

On June 28, the MVP received approval from the Federal Energy Regulatory Commission to resume construction. But the story did not end there. The U.S. Court of Appeals for the Fourth Circuit, in Richmond, quickly released a pair of rulings to stop work on the project.

The stay of construction…focuses on a three-mile section of pipeline that cuts through the Jefferson National Forest. Environmentalists say the construction plan will cause erosion that will ruin soil and water quality. The Wilderness Society Organization is challenging a U.S. Forest Service in court.

Now, it appears the Supreme Court may end up the final arbiter. On July 17, the lead developer of the MVP filed an emergency application asking the Justices “to undo orders from a lower court that froze construction of the project,” reported EnergyWire.

The key question for the High Court is whether the judicial branch has the power to take action that appears to contradict the pipeline provision of the FRA that stripped that branch of jurisdiction concerning the project. “Instead of heeding Congress’s unambiguous command, the Fourth Circuit exceeded the scope of its jurisdiction by entering stays of the very agency orders that Congress deprived the Fourth Circuit of jurisdiction to review,” Mountain Valley Pipeline LLC wrote in its filing.

The MVP drama is now coming down to a separation of powers question.

Sen. Manchin himself filed an Amicus Curiae brief with the Supreme Court on July 18, claiming that “Section 324 constitutes a statutory determination that ‘the timely completion of construction and operation of the Mountain Valley Pipeline is required in the national interest.’” The MVP section, wrote the Senator, “ratifies and approves all authorizations, permits,” and other approvals necessary to complete construction of the pipeline and allow it to begin operation.”

In a separate statement, the Senator said,

I was proud to help ensure that the Mountain Valley Pipeline would finally be completed through ratification and approval of the project’s permits without further judicial review in the Fiscal Responsibility Act. But, yet again, this vital energy infrastructure project has been put on hold by the Fourth Circuit despite the new law clearly stating that the Fourth Circuit no longer has this authority. We cannot let this continue any longer. It’s a shame when members of Congress have to ask the Supreme Court to intervene to maintain the credibility of the laws that we have passed and the President has signed.

The MVP story may be more important than the pipeline. It shows how difficult it is to secure reliability in the face of strategies of delay by environmental activists – even at a time when the Russian invasion of Ukraine and other pressures, including global inflation following the COVID epidemic, are reminding Americans that energy security is a vital national security issue.

Energy Powerhouse Louisiana Gets Little Love from Washington

Louisiana is an energy powerhouse. Since the Russian invasion of Ukraine, the state has stepped up production and exports. When Europe turned to the U.S. for energy, Louisiana was there. But will the Biden Administration do its part to encourage further investment in energy infrastructure?

Here are statistics that illustrate Louisiana’s energy importance:

- In 2022, Louisiana shipped 63% of the nation’s liquefied natural gas (LNG) exports. According to the U.S. Energy Information Agency (EIA), Europe is now the primary destination for U.S. LNG, accounting for 64% of exports.

- Louisiana is the third-largest producer of natural gas, accounting for 10% of all production in the U.S.

- The state’s 15 oil refineries represent nearly one-sixth of U.S. refining capacity.

- The Progressive Policy Institute reports: “Louisiana’s $122 billion in exports last year — more than double the $56 billion in 2017 — give the state a 43% export-share-of-GDP ratio when matched against its $281 billion GDP. This is twice the 20.6% ratio of second-place Texas. The boom mainly reflects the roaring growth of U.S. energy exports centered around Louisiana’s three specially designed liquefied natural gas export terminals.”

With such a strong energy sector, playing such a vital role in the economy and our national security, Louisiana should be receiving strong support from the federal government to encourage technologies to sustain the state, which has the second-highest poverty rate in the country. But Washington seems to be giving Louisiana little love.

In that regard, Sen. Bill Cassidy (R-LA), in an opinion piece in the state’s American Press, urged the EPA to allow Louisiana to “have full control” over issuing permits for carbon capture and sequestration (CCS) projects in the state, rather than having to depend on federal agreement. “Both the Louisiana Department of Natural Resources and the Department of Environmental Quality are well-equipped with the technical expertise needed to approve projects,” he wrote.

CCS is a process that removes CO2 from industrial sources and moves it to a place, such as a deep geological formation, where it will not escape into the atmosphere with negative climate-change effects. Sen. Cassidy wrote:

Capturing and storing carbon is the next step in creating jobs and growing Louisiana’s economy. It’s important for our state to have the power to permit, site, and provide oversight of carbon storage wells, without relying on the Environmental Protection Agency (EPA). This will help us stay ahead of other states while protecting the environment.

Sen. Cassidy cited the EPA’s proposed standards “that require power plants using fossil fuel to install controls such as CCS and threaten to shut down any and all oil, gas, and coal-based electricity production.” But, he wrote, the EPA is refusing to permit CCS storage in Louisiana or anywhere else in the country. “This is despite the Biden administration’s statements that CCS is necessary to achieve their climate goals,” he concluded.

A July 17 letter to the editor of NOLA.com from James Dill, a business owner and fisherman in Lafayette, La., also called on the EPA to allow independent CCS permits in Louisiana:

Allowing carbon-capture projects to move forward will help create jobs and address our nation’s climate goals. Today, the energy industry employs 150,000 workers throughout Louisiana, and we want that number to continue to grow. Supporting carbon-capture projects here in Louisiana is crucial to driving innovation and job creation in local communities. Natural gas companies should be applauded for investing in carbon capture to lower emissions and reduce their carbon footprint.

The Biden Administration is not only standing in the way of swift implementation of CCS projects; it is also blocking other critical energy infrastructure investments.

In April, the U.S. Department of Energy denied a request by Lake Charles LNG to extend its deadline to start exports from its proposed LNG export facility to 2028. Two months later, DoE rejected the company’s rehearing request on the matter.

The company behind the project, Energy Transfer, nevertheless, plans to go ahead and in July “entered three non-binding agreements to sell liquefied natural gas (LNG) from its proposed Lake Charles export plant in Louisiana.”

According to Reuters, Energy Transfer “has vowed to keep developing Lake Charles even though it usually takes about four years for a project to produce first LNG after construction starts. The company has not yet made a final investment decision (FID) to start building Lake Charles.”

With all that Louisiana has accomplished, one would think that the Biden Administration would be fully cooperative in CCS and LNG infrastructure matters. But it appears that support is not often forthcoming. Why the struggle? Perhaps because environmental activists have little interest in facilitating the use of natural gas as a necessary transitional fuel over the next several decades.

New Report Shows Demand for Critical Minerals Rising, With China Dominating the Market

We mentioned critical minerals above in the item on the report by Manhattan Institute scholar Mark Mills. These minerals are necessary for battery production and are essential to EV expansion. In July, the International Energy Agency (IEA) released its inaugural Critical Minerals Market Review, an analysis of market trends, including projections for growing demand, supply, and investment. The report highlights the dominant market position China holds over critical minerals globally.

The report states:

Record deployment of clean energy technologies is propelling huge demand for minerals such as lithium, cobalt, nickel and copper. From 2017 to 2022, the energy sector was the main factor behind a tripling in overall demand for lithium, a 70% jump in demand for cobalt, and a 40% rise in demand for nickel.

The IEA estimates that the market has doubled to $320 billion since 2017 and that demand will continue to grow through 2030. Much of the investment to increase production is occurring in China, which, for example, between 2018 and 2012 invested twice as much in lithium infrastructure as companies based in the United States, Australia, and Canada combined.

China, says the report, is “the world’s largest metal refining hub” and that the country is seeking to “diversify its raw material supply portfolio.”

According to Recharge News:

As with other recent reports, the IEA study flagged the high level of concentration of supply as a cause for concern for minerals such as nickel and cobalt, “with many new project announcements coming from already dominant players.” Although exploration spending is rising in North America, Australian and other regions, Chinese companies are consolidating their dominant position with regard to accessing materials critical to clean energy after nearly doubling their investment spending in 2022.

China is well aware that Western nations have become dependent on its support of critical minerals and its refining capacity. Apparently in response to U.S. curbs on the sale of sophisticated chips, China in early July imposed export restrictions on gallium and germanium, rare earth elements (REEs) which are used in semiconductors, solar panels and missile systems.

Critics have been warning about over-reliance on China in recent months. In an opinion piece in The Hill, Frank Fannon, a former U.S. assistant secretary of State for energy resources, noted that China controls 50% to 75% of critical mineral resources and that the U.S. “must lead the retaking of the commanding heights of the new energy economy. To do so, America should readjust its thinking, reassess its allies and institutions and reinvent economic statecraft.” Free nations need to “prevent China from using its market power to undercut and bankrupt mining investments at home and abroad.”

Fannon points out that “capital formation has not met the scale of climate goals or national security needs. America should take action to improve investor confidence and rebalance the critical minerals market playing field.”

A National Interest column by Ambassador Peter Pham, another former State Department official, now with the Atlantic Council, showed how China is manipulating markets. He pointed to REEs, “prized for their strong magnetic properties allowing for energy efficiencies in EVs and other electric devices as well as military uses.” Ambassador Pham noted that, instead of rising because of the export curbs on gallium and geranium, REE prices have dropped more than two-thirds. China’s strategy, it seems, is to prevent competition by making the production of REEs unprofitable for companies based in other countries.

As one analyst told Reuters, “If you’ve got 90 percent market share of magnet processing capacity, there’s a goldilocks price where you earn a return but you don’t encourage anyone else in the rest of the world to build capacity.”

Ambassador Pham calls for a three-part solution to the Chinese challenge in critical materials:

First, governments need to enable more domestic production with “a rational and timely permitting process.” Second, the U.S. and other countries should continue to facilitate the growth of new ventures with the potential to compete and even supplant the current Chinese monopoly, especially by bypassing the midstream processing (refining, alloying) currently dominated by China. Third, he writes:

The United States and like-minded countries [must] help level the playing field for emerging alternative suppliers via instruments like off-take agreements linked to national strategic reserves or incentives to private companies to enter into similar deals. Without this basic lifeline, it would be almost inconceivable for new entrants into the market to survive the cut-throat and uneven competition.

Ambassador Pham points to “the fate of the French firm Rhône-Poulenc, whose now closed La Rochelle factory at one time processed half of the purified REEs in the world, should be a sobering reminder of the raw power that Chinese state-owned enterprises can bring to bear in a yearslong price war to take down a rival.”

He also suggests that where “domestic supply chains are impractical or insufficient, new partnerships have to be developed to secure access to vital resources, such as a ‘buyers’ club’ like the nascent State Department-led Mineral Security Partnership, which includes Australia, Canada, Finland, France, Germany, Japan, South Korea, Sweden, the United Kingdom, the United States, and the European Commission.”

We mentioned critical minerals above in the item on the report by Manhattan Institute scholar Mark Mills. These minerals are necessary for battery production and are essential to EV expansion. In July, the International Energy Agency (IEA) released its inaugural Critical Minerals Market Review, an analysis of market trends, including projections for growing demand, supply, and investment. The report highlights the dominant market position China holds over critical minerals globally.

The report states:

Record deployment of clean energy technologies is propelling huge demand for minerals such as lithium, cobalt, nickel and copper. From 2017 to 2022, the energy sector was the main factor behind a tripling in overall demand for lithium, a 70% jump in demand for cobalt, and a 40% rise in demand for nickel.

The IEA estimates that the market has doubled to $320 billion since 2017 and that demand will continue to grow through 2030. Much of the investment to increase production is occurring in China, which, for example, between 2018 and 2012 invested twice as much in lithium infrastructure as companies based in the United States, Australia, and Canada combined.

China, says the report, is “the world’s largest metal refining hub” and that the country is seeking to “diversify its raw material supply portfolio.”

According to Recharge News:

As with other recent reports, the IEA study flagged the high level of concentration of supply as a cause for concern for minerals such as nickel and cobalt, “with many new project announcements coming from already dominant players.” Although exploration spending is rising in North America, Australian and other regions, Chinese companies are consolidating their dominant position with regard to accessing materials critical to clean energy after nearly doubling their investment spending in 2022.

China is well aware that Western nations have become dependent on its support of critical minerals and its refining capacity. Apparently in response to U.S. curbs on the sale of sophisticated chips, China in early July imposed export restrictions on gallium and germanium, rare earth elements (REEs) which are used in semiconductors, solar panels and missile systems.

Critics have been warning about over-reliance on China in recent months. In an opinion piece in The Hill, Frank Fannon, a former U.S. assistant secretary of State for energy resources, noted that China controls 50% to 75% of critical mineral resources and that the U.S. “must lead the retaking of the commanding heights of the new energy economy. To do so, America should readjust its thinking, reassess its allies and institutions and reinvent economic statecraft.” Free nations need to “prevent China from using its market power to undercut and bankrupt mining investments at home and abroad.”

Fannon points out that “capital formation has not met the scale of climate goals or national security needs. America should take action to improve investor confidence and rebalance the critical minerals market playing field.”

A National Interest column by Ambassador Peter Pham, another former State Department official, now with the Atlantic Council, showed how China is manipulating markets. He pointed to REEs, “prized for their strong magnetic properties allowing for energy efficiencies in EVs and other electric devices as well as military uses.” Ambassador Pham noted that, instead of rising because of the export curbs on gallium and geranium, REE prices have dropped more than two-thirds. China’s strategy, it seems, is to prevent competition by making the production of REEs unprofitable for companies based in other countries.

As one analyst told Reuters, “If you’ve got 90 percent market share of magnet processing capacity, there’s a goldilocks price where you earn a return but you don’t encourage anyone else in the rest of the world to build capacity.”

Ambassador Pham calls for a three-part solution to the Chinese challenge in critical materials:

First, governments need to enable more domestic production with “a rational and timely permitting process.” Second, the U.S. and other countries should continue to facilitate the growth of new ventures with the potential to compete and even supplant the current Chinese monopoly, especially by bypassing the midstream processing (refining, alloying) currently dominated by China. Third, he writes:

The United States and like-minded countries [must] help level the playing field for emerging alternative suppliers via instruments like off-take agreements linked to national strategic reserves or incentives to private companies to enter into similar deals. Without this basic lifeline, it would be almost inconceivable for new entrants into the market to survive the cut-throat and uneven competition.

Ambassador Pham points to “the fate of the French firm Rhône-Poulenc, whose now closed La Rochelle factory at one time processed half of the purified REEs in the world, should be a sobering reminder of the raw power that Chinese state-owned enterprises can bring to bear in a yearslong price war to take down a rival.”

He also suggests that where “domestic supply chains are impractical or insufficient, new partnerships have to be developed to secure access to vital resources, such as a ‘buyers’ club’ like the nascent State Department-led Mineral Security Partnership, which includes Australia, Canada, Finland, France, Germany, Japan, South Korea, Sweden, the United Kingdom, the United States, and the European Commission.”

While China is fully dominant in critical minerals, Ambassador Pham concludes, “there is still an opportunity to shift the play” – even this late in the game

While China is fully dominant in critical minerals, Ambassador Pham concludes, “there is still an opportunity to shift the play” – even this late in the game.

Foreign Companies Benefit Most from IRA’s Clean Energy Subsidies

Chinese companies, as well as other foreign firms, as the Wall Street Journal reported on July 20, are “the biggest winners in America’s Climate Law,” a reference to the Inflation Reduction Act or IRA.

The Journal calculated that the IRA, with its “a torrent of government subsidies,…has spurred nearly $110 billion in U.S. clean-energy projects since it passed almost a year ago,” and companies based overseas, mainly from South Korea, Japan and China, have been the main beneficiaries, accounting for more than 60% of spending. “Fifteen of the 20 largest such investments, nearly all in battery factories, involve foreign businesses, the Journal’s analysis shows.” The article continues:

Japan’s Panasonic, one of the few companies to publicly estimate the impact of the law, could earn more than $2 billion in tax credits a year based on the capacity of battery plants it is operating or building in Nevada and Kansas. The company, which supplies batteries to electric-vehicle maker Tesla, is considering a third factory in the U.S. that would lift that total.

Certainly, U.S. employment is benefiting and so are U.S. firms involved in construction, but the climate law, says the Journal, is designed to build up domestic supply chains for green-energy industries, and “the reality is that the technology for building batteries and renewable-energy equipment resides overseas. The incentives are leading these companies to invest in the U.S., often alongside domestic businesses.”

Forecasters estimate the climate law could unleash some $3 trillion in total clean-energy investments over the next decade, said the Journal, adding, “U.S. companies are also investing heavily, including Tesla, solar-panel maker First Solar and hydrogen producer Air Products and Chemicals.”

But domestic supply chains, or even those based only in North America, “are still years away because foreign companies dominate nearly every step in the process, from raw materials to sophisticated parts,” as we noted with critical minerals above.

At least 10 of the projects analyzed by the Journal involve companies either based in China or with substantial ties to China through their core operations or large investors.

Some of these projects are facing resistance,” including two in Michigan: a $3.5 billion battery factory that Ford is building with technology and expertise from China’s CATL; and a $2.4 billion battery-component factory from China-based Gotion.

“Ford is keeping 100% ownership of the battery factory—in part to sidestep the issue of public funds flowing to CATL, according to a person with knowledge of the deal.” Instead, Ford is licensing the battery-making know-how and services from CATL. “But China hawks say the payments Ford makes to CATL mean the Chinese company reap indirect benefits from government support.”

Another example from the Journal article:

Microvast, a startup that was planning to build a more than $500 million battery-component plant in Kentucky, was named as a potential recipient of a $200 million grant from the Energy Department last year. The department later rejected the application. The move followed criticism from Republicans about the company’s ties to China, which include a China subsidiary that accounts for more than 60% of its revenue.

“We must be assured that these taxpayer dollars are not being funneled to the Chinese,” said Cathy McMorris Rodgers (R-WA), chair of the House Committee on Energy and Commerce, during a June hearing.

The Administration is learning that the reality of expanding clean energy infrastructure and securing U.S. supply chains isn’t so simple. It’s not flicking a switch.