- FERC & NERC: Someone must establish reliability rules for natural gas infrastructure.

- A new think tank study favors spreading competitive market models to increase the reliability of an electric grid that is under severe threat.

- Two former FERC chairmen, from Democratic and Republican administrations, sound the alarm on grid reliability, urging market solutions.

- U.S. House leaders warn of a reliability crisis because of government policies. A Congressman calls for a legislative fix.

- Natural gas gets a boost from FERC Chair Phillips just as a court pressures the Commission toward possible restrictions on the fuel.

- A decision on the Dakota Access Pipeline, critical to carrying crude oil from one of the most productive areas in the U.S., is delayed by the Army Corps of Engineers.

- California sues six energy companies, blaming them for costs due to climate change. Does the lawsuit stand a chance?

- A tale of two Gulf of Mexico leases. One is limited by the Biden administration; a second is delayed by a whale.

FERC & NERC: Whose Job Is It, Anyway?

Recently, the Federal Energy Regulatory Commission (FERC) used its open meeting to discuss initial findings from examining emergencies and reliability problems that repeatedly arise in electricity markets during extreme weather emergencies.

The Sept. 21 “Joint Inquiry” involving FERC and the North American Electric Reliability Corporation (NERC) looked specifically at Winter Storm Elliot and its contributions to power outages for millions along the East Coast last Christmas. The report outlined important recommendations, including monitoring of how the industry is implementing current cold weather reliability standards.

Certainly, the topic is critical. According to the inquiry, Elliott was the fifth unplanned cold-weather event in the past 11 years to produce “outages [that] jeopardized bulk-power system reliability.” It was also the worst, with 90,000 megawatts of outages.

Todd Snitchler, president and CEO of the Electric Power Supply Association (EPSA), an organization that represents the providers of natural gas generation resources and other competitive power suppliers, echoed support for the findings and recommendations of the report:

We take seriously the findings from the FERC-NERC inquiry and look forward to the final report, which when released will provide necessary and helpful data as we address the events, lessons learned, and next steps to improve access to essential natural gas power generation resources during all weather conditions.

But one call to action from the agency’s report was a bit unclear.. The report states that someone needs to establish reliability rules for natural gas infrastructure to ensure cold weather reliability.

But who? Congress, state legislatures, regulators? The problem is that currently no entity has been tasked with setting standards or monitoring reliability of the natural gas infrastructure that is crucial to grid functionality — especially during times of stress. During the meeting, FERC Chairman Willie Phillips declared,“I have said repeatedly: Someone – it doesn’t have to be FERC – must have authority to establish and enforce natural gas reliability standards.”

It is a classic question of “whose job is it, anyway?” Someone should do something to determine industry’s directives around winterization and preparedness. But until the question of who is ironed out among policymakers, problems around cold-weather reliability will proliferate, especially in markets made up of vertically integrated utilities – or markets that have limited resource competition.

The final Joint Inquiry report is due out in the fall.

Monopoly Utilities Need Restructuring to Increase Electric Grid’s Reliability at a Critical Time, Says New Think Tank Paper

As government bodies and officials push hard for an energy transition, thought leaders are advocating extending market solutions to mitigate the risk to the reliability of the electric grid.

In a paper for the R Street Institute, Michael Giberson, a senior fellow at the think tank, and Devin Hartman, director of Environmental and Energy Policy, make the case for restructuring monopoly utilities to improve “the reliability behavior of power plants by aligning their profit motive with performance and increasing voluntary demand reduction during times of grid stress.”

Giberson and Hartman begin their paper by laying out the electric power landscape. In the last century, nearly all consumers were served by vertically integrated monopolies, but by the 1990s, they write, “consumer unrest over rising rates prompted reforms in roughly one-third of states, allowing for competition at wholesale and retail level. Since then, many additional states have expanded wholesale competition incrementally, although retail competition has remained relatively static.” They add:

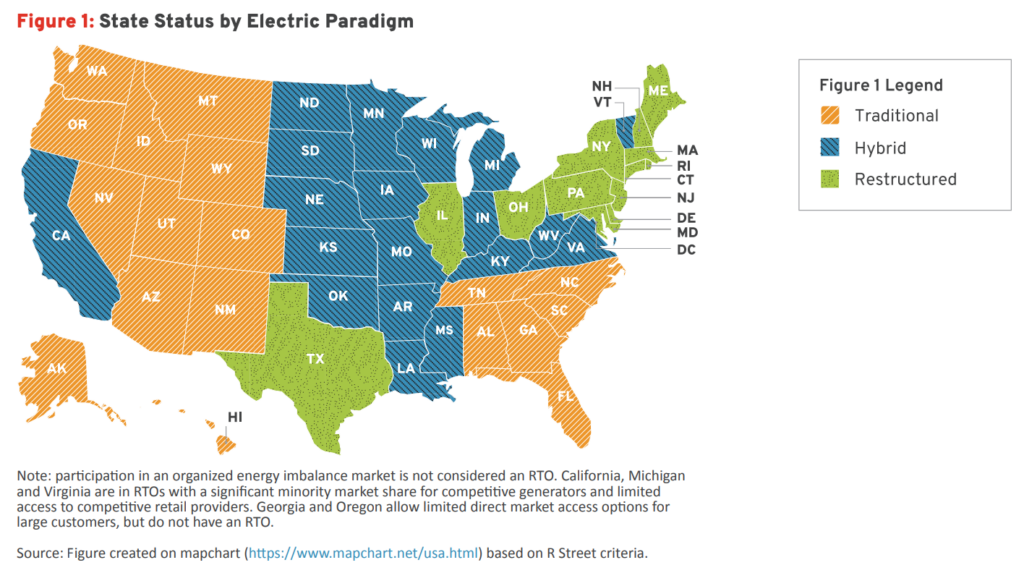

Eighteen states still use the traditional model, relying on state-regulated monopolies. Nineteen states use a hybrid model, in which regulated monopolies serve all or most retail customers and own power plants that participate in wholesale electricity markets administered by regional transmission organizations (RTOs).

That leaves 13 states and Washington, DC, which have adopted “a restructured model, which embraces competition for retail services and power plant owners, who also participate in RTO markets.” Although all three of the “paradigms use different combinations of wholesale generation and retail regulatory structures, distribution remains a regulated monopoly in all of the models.” It is simply inaccurate to call the competitive models “deregulated.”

In making the case for restructuring as the path to greater reliability, the R Street researchers write that “RTO operations use an integrated, region-wide look at generator and transmission availability in real time, coupled with contingency plans to help ensure that the system will remain in service in the case of an unexpected loss of a generating unit or a power line.”

As a result, “the organized markets operated by RTOs further enhance operational reliability and provide incentive for reliable behavior among market participants.”

The authors write that the advantages of restructuring for reliability over monopoly utilities were evident in Winter Storms Uri (2021) and Elliott (2022). Customers of those vertically integrated utilities suffered because their system was not “designed to have the constant situational awareness and instant ability to respond that RTOs possess.”

The paper points to other benefits of competitive markets as well. For example, the authors write:

Emissions have fallen faster in restructured areas. Competition has promoted voluntary emissions reductions through consumers exercising choices for cleaner energy and accelerated clean technology adoption, especially reducing barriers to unconventional technologies.

When it comes to economics, “Restructuring has clear benefits at the wholesale level, while retail benefits are largely tied to the quality of state reforms. Competitive generators operate more efficiently, innovate, manage risks better and make sounder investment decisions than monopoly utilities,” says the paper.

But, while states like Texas have “implemented retail choice well,” reducing costs and expanding service offerings, there are flaws in implementation in many other jurisdictions. The authors note that “retail rates are often higher in restructured states because of unrelated drivers like higher fuel, tax, land, labor and environmental compliance costs in the Northeast.”

Finally, the authors contrast the “business model of monopoly utilities” which is “predicated on securing favorable regulatory and legislative treatment” with that of the models that have shifted “decisions to market forces.” The paper concludes that “patterns of government cronyism and corruption follow the monopoly utility model” — as this newsletter has pointed out many times, notably in Illinois — “whereas better governance is evident under competitive structures.”

Two Former FERC Chairmen Sound the Alarm on Reliability, Urging More Market Competition

In another piece highlighting the benefits of market competition, former FERC Chairmen Jon Wellinghoff and Pat Wood III wrote in a recent Utility Dive column that “electricity reliability is an issue of increasing concern with more frequent and severe weather events and a growing national reliance on sources that vary in their energy output, like wind and solar.” They offer the antidote:

Competitive markets facilitate the implementation of demand response programs, incentivizing customers to adjust electricity usage during peak periods and alleviating strain on the grid. By fostering innovation, investment and efficient coordination, competitive electric markets play a crucial role in enhancing grid reliability and resilience.

Wellinghoff, who served as FERC chairman under President Obama, and Wood, who served during the presidency of George W. Bush, have been preaching the importance of reliability for years. In June 2021, they were signatories to a letter to FERC that stated:

As the pace of decarbonizing the grid accelerates, we are convinced that the time for organized market expansion is now. Hence, we…urge the Commission to use the broad authorities and tools available under the Federal Power Act to move toward well-structured organized power in all regions of the country.

When this newsletter reported on the letter signed by Wellinghoff, Wood and seven other former FERC commissioners, we noted that “RTOs and ISOs [independent system operators] were developed in the 1990s, and they manage about 60% of the U.S. power supply, according to the U.S. Energy Information Administration (EIA). Major gaps are in the Southeast, Plains, and West (with the exception of California). Entire states such as Florida, Georgia, Colorado, and Washington are not covered.”

In urging that FERC become more proactive in expanding the reach of RTOs and ISO, the former commissioners wrote: “There is no longer any doubt that these markets are reliable, resilient and highly attractive to innovative new technologies and clean energy resources.” They noted that “more than 80% of renewable generation has been deployed in organized market regions and emissions are falling faster in such regions.”

In their Sept. 15 Utility Dive opinion piece, Wellinghoff, who is the founder of Grid Policy Consulting, and Wood, CEO of the Hunt Energy Network, wrote that “competitive markets facilitate the implementation of demand response programs, incentivizing customers to adjust electricity usage during peak periods and alleviating strain on the grid. By fostering innovation, investment and efficient coordination, competitive electric markets play a crucial role in enhancing grid reliability and resilience.”

They concluded:

At the end of the day, competitive market systems have proven more effective at driving cost-effective decarbonization than single-utility markets, all while fostering reliability and long-term planning…. Amid the debates over climate change, energy policy and grid security, it is crucial to recognize that a system anchored in a competitive market structure still delivers the best results.

‘Keeping the Lights On’ Is the Concern of U.S. House Hearing

Similarly, concerns about grid reliability surfaced on Sept. 13, when the House Energy and Commerce Subcommittee on Energy, Climate, and Grid Security held an important hearing, aptly titled: “Keeping the Lights On: Enhancing Reliability and Efficiency to Power American Homes.”

The chair of the full committee, Rep. Cathy McMorris Rodgers (R-WA), stated in her opening remarks:

America’s electrical grid is critical in every part of our lives. It keeps our hospitals, military bases, homes, and businesses powered. An unreliable grid threatens our safety, our health, and our economy…. We must ensure American families have the freedom of reliable, affordable, and efficient energy sources and home appliances. Right now, however, these vital American resources are being undermined.

The chair of the subcommittee, Rep. Jeff Duncan (R-SC), in his own opening remarks, went into more detail about the challenges to grid reliability. He specifically pointed to government policies, such as “state and federal subsidies aimed at promoting the deployment of renewables – to interfere with electricity price formation.” These subsidies have “contributed to the early retirement of reliable generation assets, like nuclear and natural gas.”

He also cited other factors contributing to early retirements of electricity-generating plants, including “unrealistic environmental polices like the EPA’s unlawful Clean Power Plan 2.0 and the Agency’s overarching power plant ‘Electricity Generating Unit Strategy.’ NERC predicts power plants will have to comply with standards by limiting their hours of operation, taking more reliable generation off the grid.”

NERC recently concluded that “the vast majority of this country faces potential blackouts,” said Duncan. In Issue No. 25 of this newsletter, we reported on a Senate hearing where Jim Robb, president of NERC, worried that the EPA’s proposed rules for power plants would “force dispatchable natural gas off the electricity system.”

Robb said, “It’s highly troubling because we are retiring these plants before their attributes are being replaced. . . The important thing [dispatchable sources] provide for the grid is the ability to maintain voltage, and to maintain frequency, and resist disturbances. Other resources can’t do that nearly as well as a large spinning mass generation.”

Said Duncan: “These vulnerabilities are not a result of severe weather or lack of transmission capacity, but because reliable, dispatchable, firm generation units are being retired at an alarming rate.”

Duncan highlighted his bill, called the “Guaranteeing Reliable Infrastructure Development, or GRID, Act.” It would “amend the Federal Power Act to require coordination between FERC and any Federal agency promulgating a regulation that could threaten the reliability of the bulk power system.” The bill has yet to be introduced, but the language is available here.

Among those testifying was B. Robert Paulling, CEO of the Mid-Carolina Electric Cooperative. He discussed the challenges to grid reliability, including a huge increase in electrification of the economy, driven in large part by electric vehicles (EVs).

“Recent modeling by the Electric Power Research Institute concluded that achieving net-zero economy-wide emissions by 2050 could require generation capacity to increase by as much as 480% compared to what is in place today,” he said in written testimony.” The transmission grid would have to expand three-fold, according to the National Academies of Sciences.

South Carolina, as the third-fastest-growing economy in the country, “needs more power supply – lots of it – to keep up with these trends,” Paulling said. “In addition to building new power plants, we also need to preserve the existing generation fleet, no matter the fuel source, until adequate replacements and reserves are in place.”

The EPA, however, “recently proposed rules to further regulate power plant carbon emissions that will exacerbate existing challenges to reliability…. We fear this EPA rulemaking, as currently written, poses serious harm to cooperative members across South Carolina.”

We have reported extensively on the EPA’s power plants rule, including a discussion in last month’s newsletter on critical comment letters pouring into the agency.

Paulling’s testimony on Sept. 13 also noted that “current federal and state permitting costs and timelines are unreasonable and unacceptable. They present significant obstacles to building new electric generating assets and other energy infrastructure, including transmission lines that will be required to accommodate additional generation and natural gas pipelines necessary for reliable and affordable natural gas power generation.”

He noted that “nearly anyone [can] bring forth a lawsuit challenging permitting and construction.”

Paulling used as an example of permitting issues surrounding Central Electric Power Cooperative’s attempts to upgrade overloaded infrastructure in the areas surrounding the Town of McClellanville, SC. Efforts to build a needed new transmission line have stalled for nearly two decades, “in part due to the complicated federal regulatory process and the lack of required coordination and streamlining among federal agencies.”

FERC Chair Phillips: ‘There Will Be No Transition of Our Energy System Without Natural Gas’

Natural gas is widely considered a crucial energy source for the transition to a zero-emission economy, but gas generation is under severe threat from environmental activists.

Willie Phillips, the acting FERC chair, defended natural gas at the recent Gastech 2024 conference in Singapore. On Sept. 5, he stated:

I don’t see a tension between the steps we have taken to fight climate change and the use of natural gas and LNG [liquefied natural gas, the state needed for shipping]. Natural gas and LNG will be a feature of our energy mix far into the future. When it comes to considering new projects, one of the key things I consider is the impact that these projects will have on the climate. There will be no transition of our energy system without natural gas.

The timing of the Acting Chair’s remarks was propitious, or maybe ironic. In early September, the U.S. Court of Appeals in the District of Columbia is deciding “whether it should put more pressure on the Federal Energy Regulatory Commission to define when natural gas projects pose significant climate risk,” as Politico reported Sept. 6, adding:

Environmental groups said the D.C. Circuit should require FERC to consider the collective environmental effects of three related facility upgrade and pipeline expansion projects designed solely to feed a liquefied natural gas export terminal in southeastern Louisiana.

Judges wanted “a progress report on a proposed policy for determining when new natural gas projects require a more rigorous form of National Environmental Policy Act [NEPA] review to assess climate impacts.”

Adopting such a policy could hinder the reliability of electricity. Currently, 39.8% of U.S. electricity is generated by natural gas, compared with 21.6% by renewables. Natural gas is an essential transmission fuel, as Phillips pointed out.

The case, Politico reported, “is the latest in a series of NEPA lawsuits before the D.C. Circuit in recent years aimed at pushing the commission to overhaul how it accounts for how new and proposed gas projects will affect rising greenhouse gas emissions.”

Meanwhile, there’s no doubt that natural gas has delivered progress in lowering emissions. According to an analysis by the U.S. Energy Information Administration:

Between 2005 and 2021, the carbon intensity of electricity has fallen from 0.61 mt [megatons] per megawatt-hour to 0.39 mt per megawatt-hour. Had carbon intensity remained the same as in 2005, an additional 905 MMmt [million megatons] of CO2 would have been emitted in 2021…. Of these avoided emissions, 58 percent (526 MMmt) were due to a switch from higher-carbon fossil generation to natural gas generation, and 42 percent (379 MMmt) from growth in zero-carbon generation.

In other words, the switch from coal to natural gas reduced emissions more than the adoption of renewables like wind and solar.

Natural gas helps bridge gaps when renewables can’t be used. In May 2022, for example, California broke renewable generation records, but, as National Public Radio put it, “fossil fuels aren’t fading away yet.” Natural gas plants had to remain online to prepare for sunset when solar facilities stopped producing energy.

As Phillips reminded the audience in Singapore, exports of LNG from the U.S. play a critical role in providing energy security for our allies overseas. A Rystad Energy study, co-sponsored by the American Petroleum Institute and the International Association of Oil and Gas producers, found that that LNG supplied by the U.S. is the best solution for Europe’s natural gas needs in the long run.

The study concluded that, with the right policy decisions, starting in 2026, “new long-term supplies [of gas] from an abundance of low-cost global resources can fully substitute Russian supplies and result in pre-crisis price expectation levels.” Even if demand falls, new LNG imports will have to be considerable through—and beyond—2045.

It is clear that constraining natural gas production and export would be harmful to U.S. and European economic growth and national security.

Environmental Study Stops Short of Recommending Continued Operations for Dakota Access Pipeline

In early September, the U.S. Army Corps of Engineers released a widely anticipated draft of an environmental study for the Dakota Access Pipeline. But the draft, reported Bloomberg, “stopped short of recommending whether it should receive an easement to continue operating.”

Still, the draft stated, “Overall, analysis of incident data, frequency and consequence analysis, and review of existing pipeline safeguards indicates that sufficient safeguards are in place to prevent, respond to, mitigate, and remediate releases of crude oil into the Project Area.”

The Corps considered a wide range of options, advocating none for now. One was a request by Energy Transfer, LLP, which owns the pipeline, to “increase the amount of oil allowed to flow under the existing easement,” said Bloomberg. Other options were to allow “the pipeline to continue operating with new requirements or abandoning or rerouting the pipeline.

The long-delayed environmental impact statement [EIS] even suggested alternatives such as removing the pipeline by digging it up.

“An easement was previously granted for the pipeline to cross under Lake Oahe [a reservoir on the Missouri River, extending between North and South Dakota] and the pipeline has continued to operate while the review is being carried out,” said Bloomberg, which added that “the agency said it would make a recommendation in a final version of the study after considering public comment.”

Comments on the draft EIS must be received by the Army Corps of Engineers by Nov. 13.

The Dakota Access Pipeline runs 1,172 miles underground. It has safely transported crude oil since 2017 with 30-inch pipe from the highly productive Bakken/Three Forks production area in North Dakota to Patoka, Illinois. In 2021, the U.S. Geological Survey estimated that Bakken/Three Forks formations contain “4.3 billion barrels of unconventional oil and 4.9 trillion cubic feet of unconventional natural gas.” (Unconventional oil is obtained through means other than traditional vertical extraction – in other words, through developing tar sands, directional drilling and hydraulic fracturing).

If the pipeline did not exist, 3,000 tanker trucks would have to travel public roads (or 815 rail cars would have to cross neighborhoods and waterways) in the area every day to carry as much oil to the terminal. These two alternative methods are considerably less safe than moving oil by pipeline.

In 2020, Judge James Boasberg of the U.S. District Court in Washington, DC, ordered the environmental analysis. The next year, the judge ruled that the pipeline could remain open pending the review.

The pipeline is one of the most technologically advanced ever built, traveling at a minimum depth of 85 feet below the riverbed of Lake Oahe, and it has become crucial to carrying crude oil from an especially productive area of the U.S., helping to reduce reliance on foreign sources.

A website for the pipeline states, “All told, more than 1,000 certificates, permits and approvals were granted for the pipeline – that’s about one permit or approval for every mile of pipeline.” And the permitting process still isn’t over.

California Sues Energy Companies for Allegedly Causing Climate Change and Bringing Drought, Wildfires, Flooding to the State

California filed a lawsuit in state court on Sept. 15, accusing several energy producers of deceiving the public on climate change. The suit claims that the companies are responsible for tens of billions of dollars in damages from drought, wildfires, flooding, and extreme weather, “destroying people’s lives and livelihoods.”

California Attorney General Rob Bonta filed the suit with enthusiastic support from Gov. Gavin Newsom. The suit is one of nearly 30, filed by individual states, that follow the same playbook.

According to a report in Law360:

California, like the other states, is claiming oil and gas company executives have long been aware that relying on fossil fuels would lead to ‘catastrophic’ results but hid that knowledge from the public and policymakers. Instead, the executives actively disseminated disinformation on climate change, causing a delayed societal response to already-devastating changes to the climate worldwide, according to the complaint filed in San Francisco County Superior Court.

An opinion piece by Kerry Jackson in the Orange County (Calif.) Register quoted the author’s colleague at the Pacific Research Institute (PRI), senior fellow Wayne Winegarden, as saying that, by suing energy providers, the state will “impose large economic costs on families and businesses” and, when coupled with inflation, hike basic expenses so that “are simply unaffordable for most households.” (PRI is the sponsor of this newsletter). Adds Jackson:

Winegarden also expects that the lawsuits will inhibit economic growth. Potential judgments in these cases, his research found, could raise gas prices by 31 cents per gallon. It is a simple, straightforward calculation: higher energy costs are bridles on economic growth.

The energy industry generated more than $217 billion in economic, trade and job benefits in 2021 for the state, and the lawsuit will be costly to the companies even if it is unsuccessful.

Some signs indicate the suit will indeed fail. It appears to be a gloss on a climate lawsuit the state filed against six automakers in 2007. That suit was dismissed by a federal judge in San Francisco, Martin J. Jenkins, who ruled, according to the New York Times, “The courts do not have the authority or the expertise to decide injury lawsuits concerning global warming.”

Theodore J. Boutrous Jr., a lawyer for the car companies at the time, said Judge Jenkins had shown appropriate deference to the other branches and jurisdictions of government. “Our bottom-line point is that global warming presents exceedingly complex policy issues that must be addressed at the national and international levels by Congress and the president, not through lawsuits seeking damages in the federal courts,” Boutrous said.

Still, the lawsuits are worrisome to fossil fuel producers, as a Wall Street Journal news article on Sept. 21 pointed out:

The energy companies have tried, and largely failed, to keep the lawsuits out of state legal systems entirely. Now, courts are considering whether state and local governments have brought valid legal claims that deserve to go to trial. If judges say yes, the cases could become larger threats to the industry, potentially exposing their internal deliberations to public view and raising the specter of large damage awards that could eat into company profits.

The Journal article noted that “the cases bear resemblance to the sweeping litigation against the tobacco giants in the 1990s and recent lawsuits filed against the pharmaceutical industry seeking damages for the opioid epidemic, both of which ended in multibillion-dollar settlements.”

But the climate lawsuits “have distinct challenges,” said the article, because “a multiplicity of factors contribute to climate change, and the driving forces behind extreme weather events are often complicated.”

Like the lawsuit against the auto companies that was dismissed in 2007, California is claiming that energy firms have created a “public nuisance, misleading advertising and environmental marketing, unfair business practices and failure to warn, among other claims,” according to Law360.

A Tale of Two Offshore Leases: One Plan Limited by the White House, Another Delayed by Whales

On Sept. 29, the Biden administration announced it would allow oil and gas companies “to drill in just three new areas in the Gulf [of Mexico] between 2024 and 2029, the smallest number of lease sales offered since the federal drilling program began decades ago,” reported the New York Times.

Under a new law, the government has to offer leases for oil drilling before it can allow developers to build wind farms in federal waters. The Times reported:

Deb Haaland, the Interior Department secretary, said in a statement that the plan “sets a course for the department to support the growing offshore wind industry and protect against the potential for environmental damage and adverse impacts to coastal communities.

Eight days earlier, a federal court in Louisiana granted a preliminary injunction that affects a previously announced sale in the Gulf. The ruling will put millions of acres off the US Gulf Coast “back on the table as part of an upcoming offshore oil and gas lease sale,” according to S&P Global. The oil industry and Louisiana’s attorney general had accused Interior of violating the Administrative Procedure Act when it removed the acres from the lease sale to protect a whale that swims in the Gulf of Mexico.

Then on Sept. 26, the Interior Department announced it would postpone the sale that had been scheduled for the next day.

Politico reported that Interior “did not provide a new date for Lease Sale 261, which would include federal acres in the Gulf of Mexico, only saying…it would be held before Nov. 8.” The department attributed the delay to the Louisiana judge’s ruling “that forced Interior to include in the sale about six million acres that the department had stripped out to protect the habitat of the endangered Rice’s whale.”

In July 2023, the National Marine Fisheries Service (NMFS) had announced a settlement, or “stipulated stay agreement,” with the Sierra Club, Center for Biological Diversity, Friends of the Earth, and Turtle Island Restoration Network. Although it was not a party to the case, the Department of the Interior (through its Bureau of Ocean Energy Management) announced it would exclude significant acreage from the upcoming Sept. 27 sale and issue recommendations to place restrictions on vessels involved in oil and gas operations (and only such vessels) in areas of the Gulf of Mexico where Rice’s whales travel.

Both steps were significant. If environmental NGOs like the Sierra Club can work with the federal government to restrict interstate commercial activity that had been verified through Congressional action to be in the public interest, then what essential sector could be next?

According to the National Oceanic and Atmospheric Administration (NOAA), the Rice’s whale is a “member of the baleen whale family Balaenopteridae. With likely fewer than 100 individuals remaining, Rice’s whales are one of the most endangered whales in the world.”

The whale, weighing 30 tons and up to 41 feet long, “has been consistently located in the northeastern Gulf of Mexico, along the continental shelf break between 100 and about 400 meters depth.”

Dan Eberhart, CEO of Canary Energy, LLC, an oilfield service firm, wrote in a Forbes opinion piece that the timing of the original decision to restrict drilling in 6 million acres of the Gulf “is horrible for U.S. energy security and consumers. Oil prices will likely rise through the end of this year due to production cuts by OPEC and its allies, creating urgency for more American oil production.”

In a Fox News piece, Steve Forbes, former presidential candidate and chairman of Forbes Media, wrote: “They say they want to save the whales, but what they really want to do is hamstring our access to oil and natural gas produced offshore in the U.S…. Congress should make the rules that govern domestic energy production, not deal-making political appointee bureaucrats and environmental activists.”