In today’s issue:

- Oil-producing countries, including Saudi Arabia and Russia, announced cuts on Oct. 5, leading to calls for ending restrictions on production at home.

- Will the OPEC cuts help revive Sen. Manchin’s permitting reform legislation?

- Tom Friedman of the New York Times, an ardent environmentalist, advocates a strategy of energy transition from fossil fuels, not an abrupt, disruptive change. He writes that businesses and investors need assurance that “government will help them to quickly build the transmission lines and pipelines.”

- A Congressional bill aimed at suing the OPEC cartel would have dire unintended consequences for American consumers, critics say.

- FERC Chairman Richard Glick thinks his chances of confirmation are improving, but are they?

- Because of a lack of pipelines and the protectionist Jones Act, New England is preparing for a tough winter that could include expensive competition with Europe for natural gas.

- The Strategic Petroleum Reserve is at its lowest level since 1984 as more oil is released in an attempt to counteract the OPEC cuts.

- The comment period ends for a large offshore wind project off the New England coast as the U.S. plays catch-up with an “all-of-the-above” energy strategy.

- Doubts are swirling around a federal program for offshore petroleum leasing. If lease sales are limited, one casualty will be the valuable Land and Water Conservation Fund.

As OPEC Cuts Quotas, Manchin and Others Ask Why the U.S. Itself Isn’t Producing More Petroleum

On Oct. 5, OPEC Plus, the Organization of the Petroleum Producing Nations (OPEC) and 13 non-OPEC nations, including Russia and Mexico, agreed to cut daily production by two million barrels starting in November. The decision should have been expected. The oil producers have said they want to be “proactive and preemptive” – in this case, getting out ahead of an expected global economic slowdown that will surely reduce demand for oil and gas.

According to the Financial Times, “the actual cut to supply will be less — probably closer to 1 million barrels — as many members such as Nigeria are already producing below their targets.” In addition, the effect of the decision has so far been minimal. The price of a barrel of oil on the futures market for December delivery went from $87 on Oct. 5 to $92 on Oct. 9 but has since settled back to $85, far below the peak of $110 in early June.

Still, if you take into consideration the invasion of Ukraine, the move came as a shock – and a particularly unwelcome one since it was seen as benefiting Russia, which depends on petroleum revenues to fund the war and is counting on a scarcity of energy to put pressure on Europeans this winter to reduce their support for a total Ukrainian victory.

But probably most important, the decision by the oil producers, led by Saudi Arabia, was a wake-up call – as if one were needed – for the U.S. to produce more natural gas and oil domestically. Blaming the Saudis misses the point. The real issue is American energy policy. Sen. Joe Manchin (D-WV), the chairman of the Energy and Natural Resources Committee, wrote to President Biden on Oct. 11:

The reckless steps OPEC+ has recently announced to cut production and fuel Vladimir Putin’s war machine have made it clearer than ever that the United States must step up and increase our energy production, both for our own domestic use and also to support our friends and allies. It is unconscionable for America, with our abundant natural resources that can be produced cleaner than anywhere else in the world, to continue relying or consider increasing reliance on authoritarian regimes to do for us what we can do for ourselves.

Manchin was especially concerned about reports that the White House would “unlock sanctioned oil production from Iran or Venezuela.” He notes that both countries, in addition to being global miscreants, are dirty oil producers: “Iran emits more than twice as much methane per barrel of oil produced than the U.S., and Venezuela emits a staggering six times as much.”

Instead of unreliable, high-emission sources, Manchin wants U.S. policy to encourage our own producers in the Marcellus, Utica, Permian, and Alaska – and in Canada’s Alberta. He added, “At the same time, we must continue to invest in and deploy clean energy technologies—including solar and wind, nuclear, hydrogen, carbon capture, and energy storage—because all of our energy resources can play a key role in energy security and decarbonization.”

Reviving Permitting Reform?

Manchin in his letter advocated “comprehensive reforms to our energy permitting processes that accelerate permitting decisions without bypassing environmental protections or community input.” This is a brief description of his permitting reform legislation, which has hit a major roadblock with opposition from both the left wing of the Democratic Party and from Republicans, as we explained in our Issue No. 16 of this newsletter.

The White House and congressional leadership had agreed to bring permitting reform to a vote, and the strategy was to attach it to the must-pass Continuing Resolution (CR) to fund the government after Sept. 30. When it became clear that the CR wouldn’t pass this way, Manchin agreed on Sept. 27 to pull his legislation, known as the “Energy Independence and Security Act.”

According to an eight-page summary, the legislation would give the administration authority to designate 25 large projects of “strategic national importance,” updated every six months, that would receive “priority Federal review.” The list would include projects involving “critical minerals, fossil fuel (including biofuel), non-fossil fuel (including storage), electric transmission, carbon capture, and hydrogen projects.”

A Bloomberg Law report on Oct. 20 stated, “Democrats and Republicans are far apart on overhauling federal permitting, leaving little common ground if and when lawmakers take another stab at moving” the Manchin bill. However, the legislation could still hitch “a ride on a must-pass vehicle such as the fiscal 2023 National Defense Authorization Act or a year-end omnibus spending bill.”

In a Forbes opinion piece on Sept. 28, David Blackmon, a Texas policy analyst, wrote:

It doesn’t really matter how much money is thrown at a given energy infrastructure project: If you can’t get the permits to move forward, the project can’t and won’t get done. Despite the apparent conceit of progressive members of the U.S. House and Senate and the anti-fossil fuel activist groups who help fund their campaigns, this principle applies every bit as directly to renewable energy projects as it does to oil, gas and coal projects. It’s a reality they do not yet appear to fully grasp.

Manchin’s letter to Biden goes beyond permitting reform legislation as a means of increasing U.S. energy production. For example, he urges the White House to “finalize and implement the next offshore oil and gas leasing Five-Year Program as soon as possible, including the proposed program of 11 offshore oil and gas lease sales under consideration in the July draft.” He also wants to “ensure Clean Water Act implementing regulations are focused on compliance with water quality standards and do not create an opportunity to deny needed projects for reasons unrelated to water quality.”

Manchin also asked the Administration to “identify any projects pending federal review that can bring new energy production online within the next year and expedite reviews for those projects.” He cites the Mountain Valley Pipeline, which runs from his home state to Virginia. The original application for the project was filed in 2015. It will “create capacity for an additional 2 billion cubic feet per day of natural gas production at a time when our natural gas prices are the highest in decades.”

As for Republicans, they generally agree with a spokesperson for Rep. Cathy McMorris Rodgers (R-WA), ranking member of the House Energy and Commerce Committee: “If President Biden and the Democrats want to lower energy prices and not be dependent on OPEC+, they would reverse their war on American energy and join Republican-led efforts to reclaim our energy dominance to lower costs for hardworking families.”

Tom Friedman of the NY Times: You Can’t Just ‘Flip a Switch’

Manchin and Republicans in Congress aren’t the only ones espousing a policy of energy transition by reducing mindless restrictions on fossil fuel production and transmission vehicles like pipelines. Tom Friedman, the New York Times columnist and ardent environmentalist, takes a similar position. He wrote on Sept. 13:

“The U.S. and its Western allies [must] stop living in a green fantasy world that says we can go from dirty fossil fuels to clean renewable energy by just flipping a switch.” He added:

We have a long transition ahead, and we will make it only if we urgently embrace smart, pragmatic thinking on energy policy, which in turn will lead to greater climate security and economic security. Otherwise, Putin can still hurt Ukraine and the West badly.

If we want to get oil and gas prices down to reasonably low levels to power the U.S. economy and, at the same time, help our European allies escape the vise grip of Russia while we all also accelerate clean energy production — call it our “Energy Triad” — we need that transition plan that balances climate security, energy security and economic security.

But the most important factor for quickly expanding our exploitation of oil, gas, solar, wind, geothermal, hydro or nuclear energy is giving the companies that pursue them (and the banks that fund them) the regulatory certainty that if they invest billions, the government will help them to quickly build the transmission lines and pipelines to get their energy to market.

Friedman wrote in May, using the same metaphor: “For too long, too many in the green movement have treated the necessary and urgent shift we need to make from fossil fuels to renewable energy as though it were like flipping a switch — just get off oil, get off gasoline, get off coal and get off nuclear — and do it NOW, without having put in place the kind of transition mechanisms, clean energy sources and market incentives required to make such a massive shift in our energy system.”

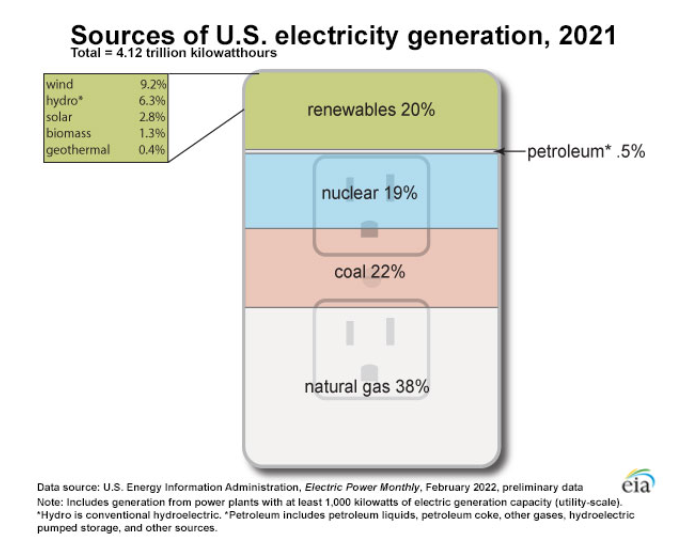

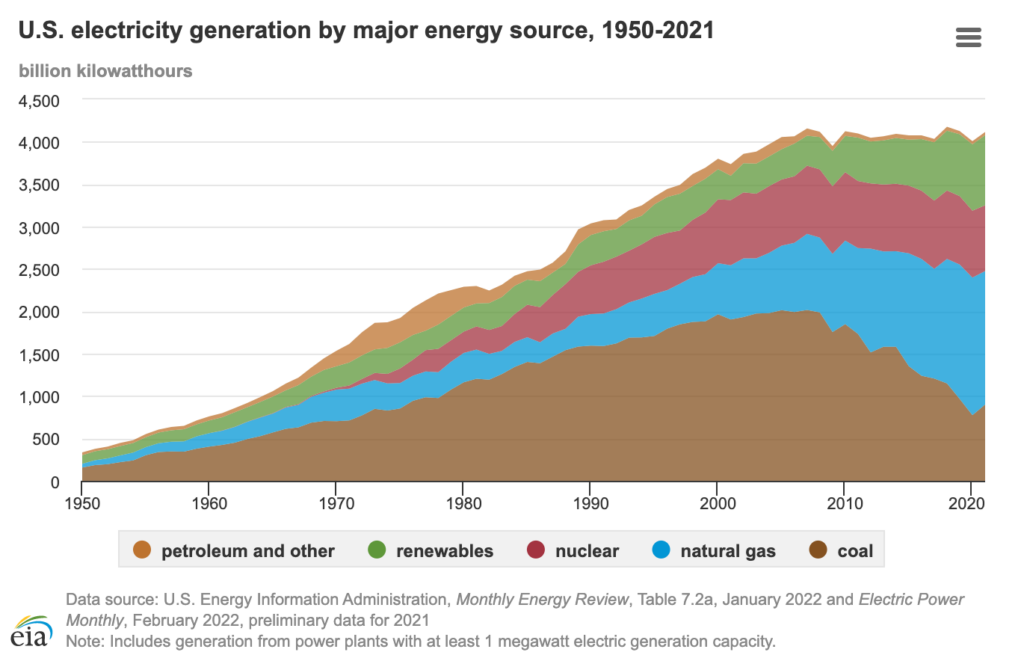

Friedman also refers to a McKinsey’s 2022 Global Energy Perspective, which concludes that “the global energy demand for electricity could triple” by 2050, “primarily driven by increased electric vehicle uptake.” That electricity can’t come solely from renewable sources. Fossil fuels are a necessity for decades to come. Currently, according to the Energy Information Administration (EIA), 38% of electricity in the U.S. is generated by natural gas, 22% by coal, 19% by nuclear, and only 20% by renewables (9% wind, 6% hydro, 3% solar, 2% biomass and geothermal).

Renewable use for electricity generation has doubled since 2010, but is still far behind fossil fuels.

Friedman refers to “transition incentives” not yet in place. One problem is that “many people don’t want wind farms, solar fields, electricity lines — or natural gas pipelines — in their backyard.” He cites a $3 billion power line, the TransWest Express, which would connect a massive new wind farm in Wyoming to the Southwestern U.S., supplying renewable energy to about two million customers. That project has been held up by red tape for 17 years, and not a single wire has been strung.

In a Wall Street Journal opinion piece, Mohammed Alyahya, a fellow at the Harvard Belfer Center’s Middle East Initiative and a senior fellow at the Hudson Institute, wrote on Oct. 13, “Blaming Saudi Arabia, or OPEC+, or Vladimir Putin, for an energy crisis that results from a policy of switching from carbon fuels to ‘clean energy’—on the basis of what look like utopian assumptions—is disingenuous…. The oil prices U.S. consumers pay are due to choices their leaders made.” He added:

The causes of this reversal, which left the U.S. dependent on imported oil at a dangerous geopolitical moment, aren’t a mystery. In the 2020 election, American politicians, from Joe Biden down, ran and won on a set of policies intended to wean the American economy off fossil fuels in favor of so-called clean energy. These policies included bans on fracking, bans on drilling, closing down the Keystone Pipeline and other infrastructure built to serve future energy needs, and subsidizing alternative energy, such as solar, and electric cars.

Now, we’re reaping the whirlwind we created. In a separate editorial, the Wall Street Journal’s editorial board stated:

The White House does all it can to discourage U.S. oil production in the name of climate change, but then it begs foreign countries to produce more to reduce soaring gasoline prices. It alienates allies like Saudi Arabia that could produce more, but then courts the dictators who lead Iran and Venezuela so they can sell more oil and have more money to stir anti-American trouble. Wouldn’t it be easier, and better for U.S. interests, to unleash U.S. oil production?

Just Saying No to NOPEC

By contrast, some in Congress are advocating an end to military cooperation with Saudi Arabia and other OPEC countries, which would appear to be a wildly counter-productive measure at a time when Russia and China are threatening global security.

Perhaps a more dramatic proposed punishment comes in the form of a so-called NOPEC bill, standing for “No Oil Producing and Exporting Cartels.” The legislation, which was approved by the Senate Judiciary Committee in May, would let the Justice Department file antitrust suits against OPEC and its national oil companies, which are currently exempt from this kind of jeopardy because they have foreign sovereign immunity by law.

The bill has bipartisan backing. It was introduced by Sen. Chuck Grassley (R-IA), the ranking member of Judiciary, and was co-sponsored by Sens. Mike Lee (R-UT), Amy Klobuchar (D-MN), and Patrick Leahy (D-VT. The committee’s chairman, Sen. Dick Durbin (D-Ill), says he wants it passed by the end of the year. But Majority Leader Chuck Schumer (D-NY), who has a packed to-do list between the Senate’s return after the November election and year-end adjournment, hasn’t said whether he’ll bring the measure to the floor.

The NOPEC bill was first introduced by Sen. Herb Kohl (D-WI) back in 2000 and was re-introduced in 15 more iterations through 2012 and again in 2021, but it took on more urgency as a result of OPEC’s action on Oct. 5. If the bill reaches a vote on the Senate floor, passes both houses and becomes law, it is doubtful it will affect OPEC’s behavior, nor will it impact current oil prices, which are influenced by forces of supply and demand that are beyond OPEC’s ability to control. But a NOPEC law would almost certainly encourage other countries – perhaps beyond OPEC – to take similar steps against U.S. firms, especially in the technology sector.

According to a Politico report on Oct. 7, the “threat of NOPEC and similar legislation might serve as a fast ball to brush back OPEC on occasion, analysts said. But enacting it and unleashing lawsuits against OPEC members would lead to a new level of antagonism between the U.S. and the cartel, potentially spooking oil markets. It also wouldn’t necessarily bring down prices at the pump anytime soon, analysts said.” For this reason as well as for political strategy, Republican support (beyond a few Senators) for a NOPEC bill is uncertain.

Not only the Wall Street Journal, which said the bill would help push “our erstwhile allies in the Middle East further into the arms of Russia and China,” but also the Washington Post have raised criticisms of the NOPEC legislation. The Post’s editorial board on Oct. 8 urged Congress and the Administration “to avoid any action, in the heat of an election campaign, that might make matters worse” after the OPEC decision. While taking a softer position on the bill than the Journal, the Post said the legislation was “fraught with potential unintended consequences, including retaliatory legal action against the United States and its businesses.”

Instead, the Post editorialists wrote:

As the world’s second- and third-largest crude oil producers, Saudi Arabia and Russia have leverage — in the short run. Reducing that leverage and restoring U.S. freedom of action over the longer term mean taking advantage of our domestic supplies of fossil fuels and green energy…. Legislation to facilitate the build out of transmission lines and other critical energy infrastructure is now doubly urgent.

The Post ends with this important historical observation: “Ultimately, the 1973 oil embargo backfired on its authors because it shocked the United States and other industrialized countries to use energy much more efficiently. A smart response can turn the OPEC Plus production cut to the United States’ ultimate advantage as well.”

Are FERC Chairman Glick’s Chances of Confirmation Really Getting Better?

The long-running saga of the confirmation of Richard Glick to a second term as chairman of the Federal Energy Regulatory Commission (FERC) seems to be moving to a climax. As we have noted in the past, Glick, who has been called “Biden’s most effective climate warrior” by Politico, was nominated for a new term back in May, but Chairman Manchin and others on the Senate Energy and Natural Resources Committee raised doubts. Manchin is taking his time, and Glick’s nomination still has not been debated in committee at a confirmation hearing.

Politico, nonetheless, reported on Oct. 13 that Glick is saying “he’s optimistic he’ll get a confirmation hearing by the end of the year, in part because of reassurances from Majority Leader Schumer and the White House.

“I’m being told that there’s a lot of folks — the White House, Sen. Schumer, others — that are working hard towards the confirmation,” Glick said during a conference hosted by the American Council on Renewable Energy. “They’re confident, and so I’m going to remain confident.” But he also admitted that the process is not under his control.

Control, of course, rests with Manchin, who has stressed reliability as a priority for FERC, rather than the introduction of issues that go beyond the commission’s stated mission. Earlier this year, Manchin and other members of the committee expressed dismay at Glick’s moves to increase the role climate effects would play in pipeline approvals. In a March 3 hearing of his committee, Manchin criticized FERC for its “shortsighted attack on fossil fuel resources.” The Chairman told reporters that Glick “went way out of his wheelhouse” with the policy changes and told him to “just do your damn job.”

In response, FERC made what Manchin called a “course correction,” delaying but not definitively ending implementation of the new rules. Since then, there’s been no resolution of FERC’s position on the climate framework for pipelines.

Glick’s term ended in June. Under FERC rules, he can remain in his position through December but must leave if no action is taken by then on his confirmation. The commission has a 3-2 Democratic majority.

If Manchin does bring the nomination before the committee, he can be expected to question Glick closely and perhaps better understand commitments on the direction of FERC policy going forward.

New England Forced to Compete With Europe for Scarce Natural Gas

Power producers in New England are preparing for a potentially difficult winter. As demand rises in Europe, it will bump up against reduced supply because of the war in Ukraine. That means much higher prices – several times more than last year if weather is severe.

ISO New England, the regional independent system operator, has warned of possible rolling blackouts as the region competes with Europe for scarce resources. Power producers in New England know about the threat – it’s not a shock – and are taking steps to mitigate it by building reserves and getting ready for conservation steps. But as the Wall Street Journal reported:

Power producers in New England are limited in their ability to store fuel on site and face challenges in contracting for gas supplies, as most pipeline capacity is reserved by gas utilities serving homes and businesses. Most generators tend to procure only a portion of imports with fixed-price agreements and instead rely on the spot market, where gas prices have been volatile, to fill shortfalls. “Anybody who is depending on the spot market for their natural-gas supply is probably going to have a pretty significant sticker shock,” said Tanya Bodell, a partner at consulting firm StoneTurn who advises energy companies in New England.

Another big problem for New England is the Jones Act, a century-old protectionist law that limits which ships can travel between U.S. ports. The law, says the Journal, “makes maritime delivery of domestic supplies nearly impossible, so the region relies on gas produced abroad.” Because New England has limited pipeline capacity, those imports by liquefied natural gas (LNG) carriers can represent one-third of the natural gas supply during periods of peak demand.

As a report by the Cato Institute recently noted, there are about 600 ships carrying LNG around the world, and none of them is “U.S.-flagged, U.S.-built and mostly U.S.-crewed and owned as required by the 1920 law to transport goods within the United States.” The report adds:

Such a vessel isn’t likely to appear anytime soon, if ever…. The result is that the Jones Act has effectively placed U.S. LNG off‐limits to New England (and Puerto Rico). While bulk quantities of U.S. LNG have been exported to 37 countries since 2016, they cannot be sent by ship to other parts of the United States.

Gordon Van Welie, the CEO of ISO New England wrote to Energy Secretary Jennifer Granholm in August in support of a July letter to Granholm signed by the six New England governors in July. The governors asked “to suspend the Jones Act for the delivery of LNG for all or part of the winter of 2022-23.” Van Welie also warned of a serious long-term problem for the region: growing demand for the use of electricity to power vehicles at the same time that natural gas for generating that electricity is so difficult to procure.

In the Journal piece on Oct. 17, reporters Katherine Blunt and Benoît Morenne pointed out that “this summer, the European benchmark price for natural gas topped $100 per million British thermal units. Gas prices in New England, by comparison, rarely reach much above $30.” That differential now “encourages suppliers to provide gas to Europe rather than New England.”

Public officials at all levels will have to do everything in their power to prevent a catastrophe in New England this winter.

The Strategic Petroleum Reserve Gets Much Smaller

Gas prices and inflation are shaping up to be the most important issues on voters’ minds as they head to the polls in November. This reality presents challenges for the incumbent party, which is why the Biden Administration has released more than 200 million barrels of oil so far this year from the Strategic Petroleum Reserve. Now, right before the midterm elections, the White House announced on Oct. 18 that it will release 15 million more barrels the Reserve, the world’s largest supply of emergency crude, as a means of putting even more downward pressure on prices.

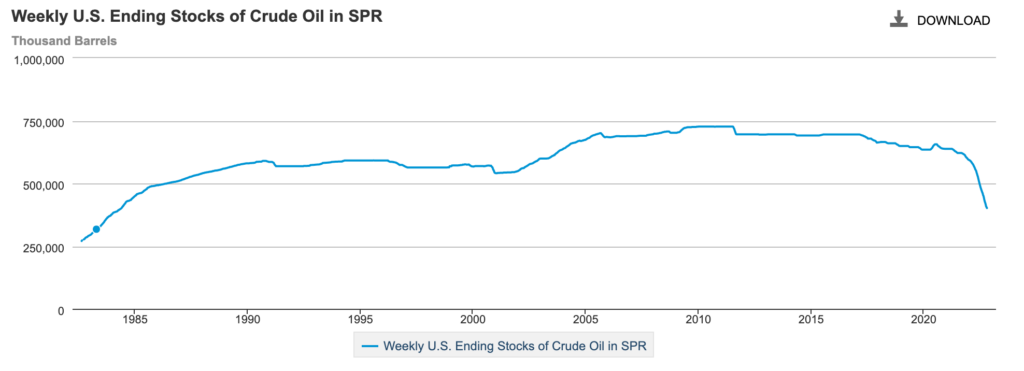

The oil stocks, owned by the federal government, are stored in “huge underground salt caverns at four sites along the coastline of the Gulf of Mexico,” according to the Department of Energy. The size of the SPR “makes it a significant deterrent to oil import cutoffs and a key tool in foreign policy.” As oil is withdrawn, it contributes to global supply, helping to meet demand in the open market and thus limit or reduce prices.

But concern is growing that President Biden is depleting the emergency stash. According to the EIA, the SPR peaked at 727,000 barrels in June 2011. Under President Trump, it fell from 695,000 to 638,000 barrels. After record drawdowns by this White House, the reserve has declined to just 405,000 barrels, as of Oct. 14 – its lowest point in 38 years.

The U.S. produces 12 million barrels of petroleum a day, so the release of another 15 million barrels from the SPR covers only about 30 hours of America’s production. Those 15 million barrels compensate for about 15 days of the reduced supply announced by OPEC on Oct. 5.

Tapping the SPR just before critical congressional elections that could turn on the issue of inflation has struck many critics as short-sighted. Their concerns are that the U.S. is now producing a million fewer barrels of oil a day than it was in March 2020 and that drawing on the SPR is a drain on a critical asset, needed in a national security crisis or natural disaster. Typically, presidents have only tapped into the SPR during times of national emergency, including, for example, Hurricane Katrina in 2005 and Hurricane Harvey in 2017. Draining our emergency reserves leaves the country vulnerable to supply disruptions that may occur in the near future.

Critics have responded. For example, Craig Stevens, spokesman for the Grow America’s Infrastructure Now (GAIN) Coalition of businesses, trade associations, and labor groups, stated Oct. 13 in a press release:

Tapping the SPR is a political band-aid attempting to cover the gash of Biden’s failed energy policy. For nearly two years, this administration has consistently blocked the construction of critical energy infrastructure and made it more difficult to produce American oil and natural gas. President Biden must change course and promote the national security, energy security, and economic security interests of American citizens by allowing more U.S. development of energy.

The U.S. Tries to Catch Up in Offshore Wind Power

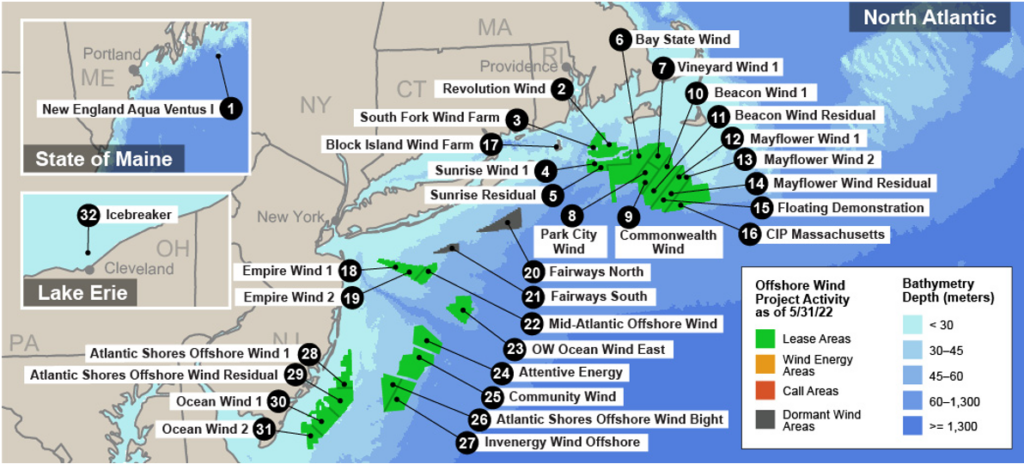

The Interior Department’s public comment period closed Oct. 17 for a major offshore wind project in New England called Revolution Wind, a joint venture of Orsted, a Danish company that’s the world leader in wind generation, and Eversource, the largest energy provider in the region. Located 15 miles south of the Rhode Island coast, 32 miles southeast of the Connecticut coast, and 12 miles southwest of Martha’s Vineyard, Revolution Wind will provide 304 megawatts of energy to Connecticut and 400 MW to Rhode Island. Both states have aggressive goals: Connecticut wants 100% of its electricity to come from zero-carbon sources by 2040, and Rhode Island, by 2030.

Offshore wind generation is an attractive energy source because winds blow stronger far out in the ocean. Until recently, however, technology was lacking to sustain large turbines in deep waters.

Europe has been installing offshore wind generation since 1991 and today has 5,402 turbines across 12 countries, with a capacity of 25 gigawatts, or 25,000 MW. The U.S., as we noted in Issue No. 16 of this newsletter, is a latecomer to offshore wind, but on Sept. 15, the Biden Administration launched an initiative to develop new floating wind platforms, which will serve to speed up deployment. The President, according to a White House fact sheet, set a goal of “deploying 30 gigawatts (GW) of offshore wind by 2030, enough to power 10 million homes with clean energy, support 77,000 jobs, and spur private investment up and down the supply chain.”

Recently, the Bureau of Ocean Energy Management, the agency charged with overseeing the offshore wind industry, announced it would be holding the first offshore wind lease sale in California – a move that opens up 4.5 GW of potential. The lease auction, which is expected to generate significant interest, is slated for December 6.

Currently, offshore wind barely shows up on a graph, and it will take another two years before the U.S. gets to installed capacity of 2 gigawatts, according to the EIA. Revolution Wind, at nearly three-quarters of a gigawatt, will be a big help in getting to the Biden goal, but many other projects are on the books. The Offshore Wind Market Report of the Wind Technologies Office of the Energy Department stated in August that projects with 40 gigawatts of capacity are “now in various stages of development.”

The report pointed out that “the estimated levelized cost of energy for commercial-scale offshore wind projects in the United States declined 13% to $84/MW-hour on average.” The Biden Administration over the past year has added “six new lease areas…in the New York Bight, two new lease areas in Carolina Long Bay, and plans to lease new areas in California, Gulf of Mexico, Central Atlantic, Oregon and Gulf of Maine.”

Offshore wind is a good example of the way that the U.S. power grid is being diversified, as part of an “all-of-the-above” strategy to provide reliable and affordable energy. As we noted above, demand for electricity in New England is rising sharply. Revolution Wind will provide enough clean energy to power more than 350,000 homes.

The overwhelming majority of stakeholders who filed comments about Revolution Wind supported completion of the project. For example, James (“Spider”) Marks, a retired Army general, wrote:

I am confident that the final approval and construction of Revolution Wind will help our country become more energy secure and reduce our dependence on foreign sources of energy. As a retired US Army General officer with deep and current experience in national security challenges, I know firsthand how important domestic energy production is to the security of our nation.

Other examples of support came from the North Kingstown, R.I., Chamber of Commerce, and from former Rep. Albert Wynn (D-MD), who noted that “Orsted has already committed $77.5 million of a $157 public-private partnership to redevelop the New London State Pier in Connecticut — a project that is estimated to create 460 construction jobs. Orsted and Eversource have pledged to invest an additional $40 million to improve Rhode Island’s port infrastructure.”

Questions Raised About the Administration’s Oil and Gas Leasing Program; Conservation Project Funding Could Suffer

Another important comment period ended recently as well. This one involves the Interior Department’s five-year offshore oil and gas leasing program, announced on July 1. There are major questions still about the plan, which would allow up to 11 new lease sales – 10 in the Gulf of Mexico and one in Alaska’s Cook Inlet — between 2023 and 2028, but exactly how many is up in the air. The final figure could, in fact, be zero.

If the sales go through large sums, a major beneficiary will be the Land and Water Conservation Fund (LWCF), established in 1964. The little-known LWCF receives $900 million annually from oil and gas leasing revenues, which are dispensed to the states for outdoor recreation and conservation projects.

ConservAmerica, a non-profit organization “dedicated to the development and advancement of sound environmental and conservation policy,” has published a new report and interactive map and website titled, “Land and Water Conservation Fund: State-by-State Outlook: Implications from Offshore Oil and Gas Leasing Policies,” pointing out that the LWCF is the single largest dedicated funding source of conservation and outdoor recreation in the United States. Projects being funded by the LWCF include protecting indigenous people’s cultural sites in Georgia, watersheds in Washington state, and river access in South Carolina.

Said Jeff Kupfer, president of ConservAmerica and a former top Energy Department official:

Some elected officials and groups villainize offshore leasing without considering the full implications of banning it. Besides harming our country’s energy security, banning offshore drilling would bankrupt the LWCF, shattering our ability to provide access to the great outdoors and wildlife conservation.

Doubts about the Biden Administration’s commitment to lease sales are fully justified. The President, after all, campaigned on a promise to end offshore drilling, and in May, the Interior Department canceled the lone Alaska sale that was included in the expiring five-year leasing program. As the Washington Examiner pointed out, “Biden acted to restrict new oil and gas leasing during his first week in office but has seen his power limited. A federal court ruled against his executive order pausing new leasing last summer, a ruling the administration is currently appealing.”

Times have changed. The Ukraine war has demonstrated the importance of the U.S. producing more oil and gas for our national and global security. “Our allies in Europe are facing an energy crisis forcing the closure of manufacturing businesses and impacting supply chains which also leads to inflationary pressures throughout their economy,” 21 Republican Senators, pressing for an expansive final leasing program, wrote to Secretary of the Interior Deb Haaland.

“We are concerned,” they wrote, “by the Department’s suggestion that a no lease option is a possibility for the final program.” The letter added:

Further, failure to conduct any lease sales which encourage bidding could, as the Department says, cause increased air emissions from substitute production, primarily from overseas imports…. American families are struggling to keep up with rising costs due to inflation, high energy prices, and persistent supply chain issues. In addition, local businesses that are part of the ecosystem of U.S. energy production are being confronted with decisions that impact their employees and employees’ families due to uncertainty about future natural resource development.