In today’s issue:

- Federal energy regulator gets a new leader, who affirms that reliability is “job number one.”

- SEC considers changing a controversial proposed rule requiring disclosure of minimal climate costs.

- The financial regulator also faces criticism for its rule on reporting emissions up and down the supply chain.

- President Biden calls for energy infrastructure investment, but is he doing enough to reform permitting delays that tie up projects for years?

- As Republicans take over the House, they call for offsetting drawdowns in Strategic Petroleum Reserve by increasing leases on federal lands.

- N.J. Governor moves clean energy target date from 2050 to 2035. But is it doable?

- Reliability will increase if Western and Southeastern states join or start Regional Transmission Organizations, concludes new report.

- Confusion and overcharges plague customers of Pennsylvania monopoly utility companies.

New FERC Head Calls Reliability Job One

At his first open meeting as the new head of the Federal Energy Regulatory Commission (FERC), Willie Phillips immediately declared on Jan. 20 that reliability is “job number one,” emphasizing the importance of protecting the grid from cyber-attacks, physical assaults, and extreme weather.

The White House two weeks earlier had named Phillips, a FERC commissioner since December 2021, as the commission’s acting chairman, replacing Richard Glick, who was denied a hearing on his quest for a second term. Glick fell afoul of Sen. Joe Manchin (D-WV), chairman of the Senate Committee on Energy and Natural Resources. As we noted in Newsletter No. 13, a Politico piece a year ago carried this headline about Glick, “Biden’s most effective climate warrior faces potential doom in the Senate.”

In a March 3, 2022 hearing, Senator Manchin blasted FERC for proposing to apply climate considerations to decisions about natural gas pipelines. Manchin called the policy change a “shortsighted attack on fossil fuel resources,” especially with an “energy war” underway, a reference to the Russian invasion of Ukraine. Senator Manchin told reporters that Glick “went way out of his wheelhouse” with the policy statement and should “just do your damn job.”

Following this pushback, FERC made what Manchin called a “course correction,” delaying but not definitively ending implementation of the new rules.

Will Phillips be a different kind of FERC chairman? His comments about reliability were made in the context of Winter Storm Elliott, which plagued many parts of the country with power outages. But he certainly has not abandoned climate change concerns. Phillips said, “It just reminds us that while we think about the clean energy transition and its importance, we have to continue refocus our efforts on reliability and resilience.”

We need to incentivize smart investments in transmission to accommodate new generation, while also ensuring grid reliability and reducing costs for consumers.

At the same time, Phillips stressed “environmental justice” as part of his agenda. “It is important that we consider the voices of historically disadvantaged communities in our decisions,” he said at the Jan. 20 FERC meeting. Environmental justice (EJ) is a broad, catch-all phrase that includes assuring that all groups in society have participation in the government’s environmental decisions. Among the “focus areas” for EJ, according to the Environmental Protection Agency, are “Impacts from Climate Change.”

Climate change is a legitimate concern of some federal agencies, but Senator Manchin, among others, has shown he does not want it to take precedence over reliability.

Still, according to an article Jan. 4 in the Houston Chronicle, Phillips, the first African American to lead FERC, “is viewed as a more moderate vote on climate change issues than Glick,” paraphrasing Christine Tezak, a managing director at the consulting firm Clearview Energy Partners. The Chronicle added:

In March Phillips sided with Republican Commissioner Mark Christie in approving three gas pipeline projects, stating that FERC should wait on deciding how to judge greenhouse gas emissions until the White House Council on Environmental Quality decides what constitutes “significant” emissions for individual projects.

Senator Manchin called Phillips “a supremely qualified and reasonable person” who “understands the need to balance affordability and reliability.”

Phillips previously served as chairman of the Public Service Commission of the District of Columbia and before that as assistant general counsel for the North American Electric Reliability Corporation. He also worked for two law firms, where he advised clients on energy regulatory compliance and policy matters.

Meanwhile, as an indication of the issues with which Phillips may have to grapple, the California-based organization Peninsula Clean Energy recently issued a report claiming that providing 100% renewable energy on a “99% time-coincident basis” – in other words, practically every time consumers want it – “results in only a 2% cost increase relative to our baseline, while achieving critical emission reductions and providing other benefits to the grid.”

Peninsula, which describes itself as a “community-controlled, not-for-profit, joint powers agency formed as a Community Choice Aggregation (CCA) program by San Mateo County,” based the conclusions in its report on “a new 24/7 clean energy procurement modeling tool, MATCH (Matching Around-The-Clock Hourly) energy.” In other words, this hugely optimistic conclusion comes from a model, not from a practical application – as Phillips, with his experience and intelligence, must understand well.

In Response to Across-the-Board Criticism, Securities Regulator Considers Changing Climate Disclosure Rules

After pushback from investors, lawmakers and businesses, the Securities & Exchange Commission (SEC) is “considering a softening of planned rules requiring companies to disclose the effects of extreme weather and other costs related to global warming when the regulator completes its climate-change proposals,” the Wall Street Journal, citing “people close to the agency,” reported on Feb. 3.

Specifically, the SEC “is looking again at the financial reporting aspect of the climate-disclosure plan it issued last year,” said the Journal. That measure required that companies must “analyze climate-related costs and risks for each line item of their financial statements, such as revenue, inventories, or intangible assets. Any climate costs that are 1% or more of each line-item total would have to be reported.”

Currently, companies are generally required to disclose climate costs and risks that are “material” for investors, and 1% is far from material.

E&E News noted the “thousands of public comments [were] submitted by companies, finance firms and others about the proposal — many of which focused on this element [the 1% threshold] in particular.” Among the companies criticizing the measure as part of a larger joint comment letter to the SEC were Alphabet (Google), Meta Platforms (Facebook), Intel, and Dropbox. Deloitte & Touche said in its comment letter that a threshold “that low is unusual in financial statements.”

Also in opposition were Amazon.com and Walmart, America’s largest retailers, as well banks such as Wells Fargo and Bank of America, plus the Financial Services Forum (FSF), a group of eight large institutions. E&E News reported that FSF “said it would be ‘nearly impossible’ to calculate the specific impacts of climate change on particular line items. Even if companies could do it, the task would require making a range of assumptions that could result in extensive disclosure that may not be useful for investors.”

BlackRock, the largest asset management firm in the world and a high-profile advocate of ESG (environmental, social and governance) investing, said in a comment letter to the SEC that the 1%-threshold rule was “arbitrarily low and inconsistent” and “would result in highly inaccurate disclosures and unduly burdensome compliance costs.” The BlackRock letter continued:

We do not believe these new disclosures are practicable for issuers, and do not believe they are necessary, considering that issuers are already subject to Financial Accounting Standards Board (“FASB”) standards that require them to consider changes in their business and operating environment when those changes have a material direct or indirect effect on their financial statements and related notes. Therefore, we respectfully recommend that the SEC omit the proposed requirement related to financial statement disclosures from the final rules.

E&E News reported that, “even the fiercest advocates of mandated climate disclosure agree that while it is important to tie climate risk to a company’s financial statements, setting such a low, concrete threshold to trigger disclosure is a hard ask.” The article cited Madison Condon, an associate professor at the Boston University School of Law, described “an outspoken proponent of robust climate disclosure rules.” Condon said uncertainty around the provision is “reasonable” given the challenging nature of determining which costs are in fact directly climate-related, among other issues.

Rather than eliminate the 1% reporting rule entirely, the SEC is expected to raise its proposed threshold to some other number that is “less onerous,” said the Journal.

Objections Also Raised to the SEC Proposal on Emissions by Supply-Chain Companies and Individuals

Also meeting scrutiny in comment letters were requirements to disclose Scope 3 emissions, which are generated not by companies themselves but by other firms in their supply chain networks, including customers. According to a Politico piece on Feb. 4, changes in the Scope 3 rule have been debated by the SEC for months, and Commission Chair Gary Gensler is now “considering scaling back [the] potentially groundbreaking climate-risk disclosure rule that has drawn intense opposition from corporate America, according to three people familiar with the matter.”

A primary concern of Gensler is “the wave of lawsuits that are expected to challenge the rule once it’s finalized.” The Politico article explained:

Lawmakers, companies and business trade groups, like the U.S. Chamber of Commerce, have voiced broad objections to the proposal ever since its introduction, saying the changes are unnecessary and would be too burdensome and costly. Lawsuits are expected to challenge both the content of the rule itself and the SEC’s authority to pursue it — an argument that may carry new weight with the Supreme Court moving to rein in the so-called administrative state.

Issue No. 15 of this newsletter noted that critics argue that the SEC’s proposed rule on Scope 3 emissions turns the Commission “into a climate regulator, acting far beyond its jurisdiction and mission.” Like the Politico article, we pointed to the Supreme Court’s June 30 decision in West Virginia vs. Environmental Protection Agency and noted that a July 13 letter to the SEC from 24 state attorneys general pointed out that, in its decision, “the Court confirmed that Congress—not a federal administrative agency—has the power to decide major issues of the day.” The SEC’s proposed rule, wrote the AGs, “offends that doctrine.” The AGs continued:

Indeed, all the factors present in West Virginia are present here. SEC has never applied its authority to require disclosures in this way. It has rarely, if ever, required disclosures focused on non-material, non-financial matters like those found in the Proposed Rule. Environmental regulation is outside the Commission’s area of expertise; if anything, the Commission is even less equipped to regulate in areas concerning climate change than EPA.

In a July 12 op-ed in the Wall Street Journal, former SEC Commissioner Paul Atkins and Paul Ray, former administrator of the White House’s Office of Information and Regulatory Affairs, wrote:

The similarities between the Clean Power Plan and the SEC’s proposed disclosure rule are striking and speak to why both violate the law. Both regulations would impose changes on massive swathes of the American economy…. The SEC’s proposal would tee up shifts of capital from fossil-fuel-based industries, such as oil production and heavy manufacturing, toward industries that are supposedly greener. Both of these monumental economic shifts would affect countless businesses large and small, as well as potentially every American consumer and worker.

Also, Dr. Wayne Winegarden, economist and senior fellow at the Pacific Research Institute (publisher of this newsletter), has taken a lead role in the opposition to the rule. His opinion piece for Forbes concluded that “there is little doubt that investors will be harmed” by its implementation.

Dr. Winegarden pointed out that “to the extent that emissions create potential risks for investors, companies are already legally liable for reporting” information about climate change, so the rule adds no benefits – only severe costs in “additional human and financial resources.” By requiring a company to consider a supplier’s emissions, the SEC is forcing firms to deemphasize “fundamental business considerations — such as choosing the supplier that produces the right inputs, at the right price, that meet the necessary delivery schedule.”

In addition, Dr. Winegarden warned that the reports may “enable outside public interest groups to micromanage corporations’ emission reduction programs” – which, of course, is the reason that activists have pushed for these disclosures for so long in the first place.

One reason that FERC and the SEC sought to become a climate regulator is that the Biden Administration had little chance of enacting legislation in such matters. Now that Democrats have lost the House, all chance of the Administration changing climate laws has been lost, so the pressure on the SEC is even greater. As the Politico article stated, “Any move to substantially limit the regulation could spark a backlash from climate activists, sustainable investors and progressive Democrats, who have been pressing for years for greater insight into companies’ climate footprints.”

Permitting Remains a Major Obstacle to Building Out Energy Infrastructure, for Both Natural Gas and Renewables

In his State of the Union Address on Feb. 7, President Biden stated, “Folks, as you all know, we used to be No. 1 in the world in infrastructure. We’ve sunk to 13th in the world. The United States of America — 13th in the world in infrastructure, modern infrastructure.” But, he said, “We are coming back” because of the passage of the Infrastructure Investment and Jobs Act (also called the Bipartisan Infrastructure Bill) and the Inflation Reduction Act (IRA).

The President made no mention of a major obstacle to the completion of many energy projects – not just oil and gas but renewables as well. That obstacle is the interminable, expensive permitting process.

In the fall, Democratic leadership promised Sen. Joe Manchin a vote on permitting reform in return for his supporting the IRA. But opposition from the left wing of his party prevented Senator Manchin from getting a vote in September.

On Dec. 7, Senator Manchin released the full text of what he called the “Building American Energy Security Act” – with such provisions as a two-year target for reviews of major energy and natural resource projects under the National Environmental Policy Act, or NEPA. The target is one year for projects that require a less thorough NEPA assessment.

Many Republicans objected that the Senator Manchin’s measure didn’t go far enough. The White House issued a statement on Dec. 15 that said:

I support Senator Manchin’s permitting reform proposal as a way to cut Americans’ energy bills, promote US energy security, and boost our ability to get energy projects built and connected to the grid. Today, far too many projects face delays — keeping us from generating critical, cost-saving energy needed by families and businesses across America. That’s an impediment to our economic growth, for creating new jobs, and for lessening our reliance on foreign imports.

But Biden’s support was not enough, and the effort failed. Ten Democratic Senators voted against reform in the procedural vote that killed permitting reform for the year.

Despite a near-consensus that fossil fuels must provide a bridge to renewables, Biden’s current stance is ambiguous, at best. “We’re still going to need oil and gas for a while,” Biden said in the State of the Union. A short time later in the speech, he added, “We’re going to need oil for another decade.”

This admission comes three years, almost to the day, after his campaign promise to “get rid of fossil fuels” and his later statement in a Democratic presidential debate that, if he is elected, there will be “no more drilling including offshore. No ability for the oil industry to continue to drill, period. It ends.”

Now, Biden is urging energy companies to make major investments. But with the window shutting in 10 years? Brigham McCown, who headed the U.S. Pipeline and Hazardous Materials Safety Administration, a federal agency, and is now a fellow at the Hudson Institute, stated on Twitter on Feb. 7:

We’re [going to] need Fossil Fuels for a lot longer than a decade but no company would deploy capital with that timeline. Build a hotel but you have to tear it down in 10 yrs. Silly.

In an editorial after the State of the Union headlined, “Did Biden Forget Permitting Reform?” the Wall Street Journal reminded readers that permitting reform had stalled and that the White House could do more. “Mr. Biden could help cut this Gordian knot, but he never mentioned the issue,” said the editorial. “Instead, he told the country that drillers shouldn’t be afraid to invest in new production, because ‘we’re going to need oil for at least another decade.’ Try not to laugh, although many Members of Congress couldn’t help themselves. Only a decade? American energy consumption in 2021 was 79% fossil fuels, 12% renewables and 8% nuclear.”

The President wants 100% clean electricity by 2035. But to reach that goal, according to a report last year in E&E News, “annual installation of new wind and solar generation would have to increase from two to seven times historical levels.” The Journal wonders, “How does he expect to do that without cutting the red tape that ties up construction of all kinds?”

Change in House Control Is Reflected in Action on Petroleum Reserve

The new Republican majority in the House showed its support for new energy policies by passing H.R. 21, the Strategic Production Response Act, with the support of just one Democrat.

The bill, passed on Jan. 27, would require any drawdowns from the Strategic Petroleum Reserve (SPR) be coupled with increased oil leasing on federal lands, including offshore. According to Reuters:

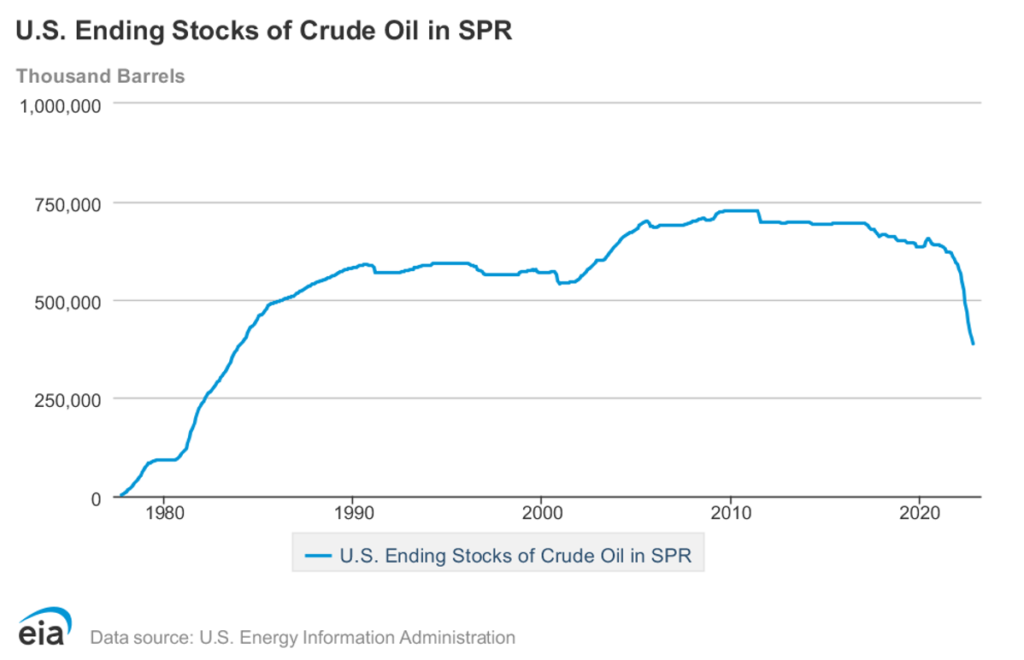

Republican backers of the bill said the Biden administration acted recklessly in selling 180 million barrels from the reserve last year, or 1 million barrels a day for six months, in the biggest release ever. That drawdown and others Biden approved have pushed the level of the SPR to its lowest level since 1983.

Rep. Cathy McMorris Rodgers (R-WA), the new chair of the House Energy and Commerce Committee, said that the SPR should be used only in true emergencies. “President Biden,” she said, “has turned a longtime bipartisan strategic asset, the Strategic Petroleum Reserve, into a political tool to cover up the consequences of his expensive rush-to-green agenda.”

The bill faces an uphill battle in the Senate, where a 51-49 Democratic majority prevails.

Just so there was no doubt about the change in the House, the first hearing of the Energy and Commerce Committee under new leadership was titled, “American Energy Expansion: Strengthening Economic, Environmental, And National Security.”

Rogers called for bipartisanship in her opening remarks:

Energy is foundational to every aspect of Americans’ lives. Whether it’s making energy more affordable and reliable, securing our supply chains, beating China, protecting the environment, addressing climate change, or putting energy security back at the center of policymaking. These should be bipartisan goals.

Rep. Jeff Duncan (R-SC), the new chair of the House Energy and Commerce Subcommittee on Energy, Climate and Grid Security, pointed out that while the U.S. leads in energy production, we also lead in emission reductions, thanks to the shale revolution, which has enabled the extraction of oil and gas that was previously inaccessible. Duncan said:

It is estimated that the shale revolution saved US consumers $203 billion annually, breaking down to $2,500 dollars for a family of four… It also lowered energy-related greenhouse gas emissions by 527 million metric tons per year, the most in the world.

Witnesses at the hearing included Paul Dabbar, former Under Secretary of Energy for Science; Robert McNalley, president of Rapidan Energy Group; Donna Jackson of the Project 21 Black Leadership Network for the National Center for Public Policy Research; and Dr. Ana Unruh Cohen, former Majority Staff Director of the House Select Committee on the Climate Crisis.

N.J. Governor Orders 100% Clean Power. Is It Doable?

Claims that the U.S. – or individual states – can accomplish an energy transition in the next dozen years are getting more common despite reports that the goal is unrealistic. Phil Murphy, governor of New Jersey, is accelerating the state’s target from 2050 to 2035 because, he says, the IRA and the state can afford more green projects. According to a tweet by the policy chief of the New Jersey Board of Public Utilities on Feb. 15:

New Jersey’s road to 100% clean energy just got a lot shorter! 15 years shorter! Exec. Order 315 moves NJ’s 100% clean energy goal from 2050 to 2035. As set out in the EO, the Inflation Reduction Act means that a 100% Clean Electricity Standard is more affordable than ever!

The road didn’t actually get shorter. The prediction changed. In fact, the new goal was laid down less than a month after Governor Murphy was forced to rework an energy master plan that was too expensive and difficult to achieve. According to NJ.com:

Before the state can maximize renewable resources on a grander scale laid out by the plan, officials must open the floor to stakeholders like residents and businesses to have a say about what exactly that looks like. Many of them — and really anyone who signed up for the first hearing this week on the plan — were notified Sunday that those discussions have been postponed as the state works on a revision for 2024.

An E&E News piece on Feb. 16 was headlined, “N.J. governor orders 100% clean power. Is it doable?”

The Governor’s plans are certainly ambitious. Sales of gasoline-powered cars in the state would end in 2035 (currently, only 8% of New Jersey car purchases are for plug-ins), and an executive order “sets a target of installing electric heat pumps or other zero-emissions heating equipment in 400,000 homes and 20,000 commercial buildings — the equivalent of 10 percent of the state’s building stock. A tenth of low- and moderate-income properties should be wired for electrification, as well, according to the order,” stated the article.

In addition, Governor Murphy “directed the state’s gas and electric utilities to convene with organized labor and regulators at the Board of Public Utilities (BPU) to plan the future of natural gas distribution in New Jersey in what he called a ‘comprehensive plan for a future that’s less reliant on the burning of fossil fuels.’”

According to the article, “It’s unclear whether New Jersey will successfully deliver on” these promises “or if successive governors will embrace them as their own.” The piece notes:

While Murphy’s clean energy proposals were mandates, the implementation of some of them, such as the 100 percent clean energy target, may hinge partly on further actions by the Legislature.

New Jersey is currently reliant on natural gas for 56% of electricity generation while 36% comes from nuclear. Almost three-fourths of the state’s households use natural gas as their main source of heat.

The plan was unclear on how to treat gas power plants, but Governor Murphy’s “2019 Energy Master Plan — a document long used as a blueprint for New Jersey’s energy future — concluded that solar would likely become the state’s biggest electricity resource by 2050 under a net-zero scenario. It currently contributes about six percent of all power now,” said the article.

New Jersey is trying to build 11 gigawatts of offshore wind power by 2040, enough to meet one-quarter of power demand — “although none of those facilities are currently in operation.”

We noted in Newsletter No. 14 last year that “New Jersey’s long awaited offshore wind project, Ocean Wind 1,” about 15 miles off the coast had reached “a critical stage in its federal review.” According to the federal government’s permitting dashboard of infrastructure projects, the estimated completion date of environmental reviews and permitting for Ocean Wind 1 is Sept. 21 of this year.

Overall, New Jersey still has a long way to go to meet Governor Murphy’s goals, which, while laudable in some ways, seem to have little connection to the state’s energy reality today.

New Report Cites Reliability Benefits to West and Southeast of Joining RTOs

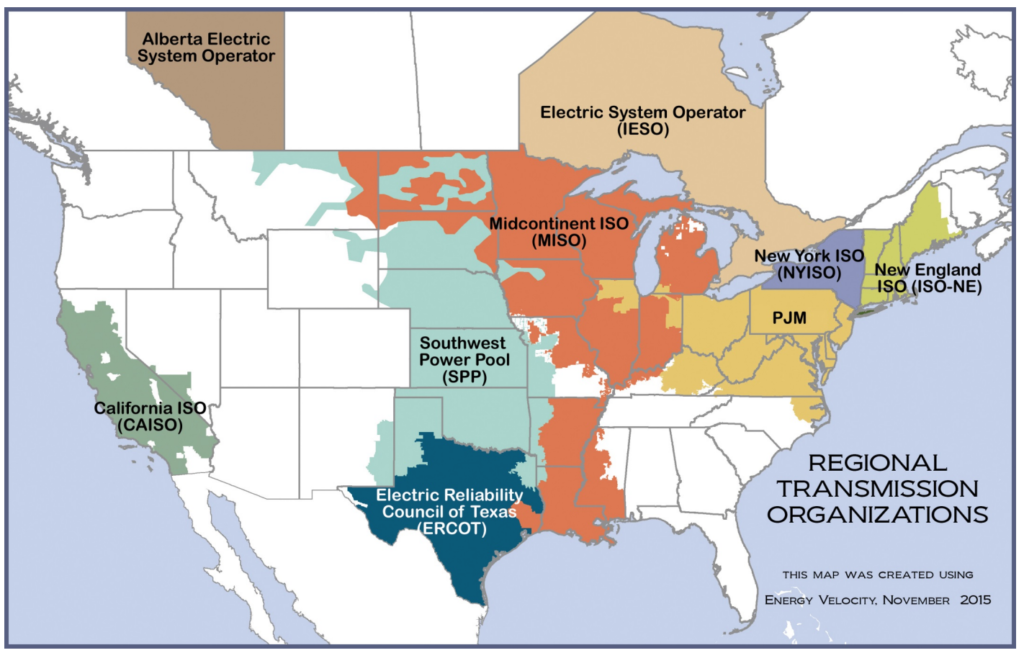

“Independent region-wide transmission planning would bring cost savings and reliability benefits and help create trustworthy and transparent transmission outcomes for energy customers in the U.S. West and Southeast,” concluded a new report by Grid Strategies, a power sector consulting firm.

The report, prepared for the Clean Energy Buyers Association (CEBA), provides concrete evidence for officials in the West and Southeast to join or start regional transmission organizations (RTOs). Right now, these are the regions where RTOs are most scarce.

“It’s clear that all customers in the West and Southeast would benefit from more efficient transmission planning and enhanced grid reliability that could be enabled through greater regional coordination,” said Heidi Ratz, deputy director of market and policy innovation of CEBI, whose members include large energy customers such as Boeing, energy providers such as First Solar, and organizations such as the Smart Energy Power Alliance. “State leaders and stakeholders in these regions should support ways to expand regional coordination and develop independent regional transmission planners and processes.”

Rob Gramlich, president of Grid Strategies, said, “Customers in two-thirds of the country rely on independent, trusted, expert transmission planners to achieve greater reliability and cost-savings. Western and Southeastern customers deserve the same benefits.”

Large and small energy customers benefit from a robust transmission network driven by regional-level analysis. When the grid is congested, the local utility must dispatch higher cost generation and pass those costs on to customers. End-use customers have no control over this outcome, even when they have power arrangements directly with generators or indirectly through the utility.

The report emphasizes that reliability requirements “necessitate the dispatch of available generation where it is needed, regardless of the type of generation energy buyers have elected to use.” But currently in the Southeast and West, “there is no independent regional process or institution to plan a robust regional grid that would prevent this expensive and potentially customer-unfriendly redispatch.”

Also, in the West in particular, there is a need for geographically broad and robust planning because load centers and energy resources are spaced far apart, covering enormous distances.

Currently, the majority of the U.S. population is covered by an RTO or ISO (independent system operator), which coordinates, controls and monitors coordinate regional electric grids, performing such important functions as creating market mechanisms to manage congestion and serving as a supplier of last resort.

Little or none of the area of the following states, however, is incorporated into an RTO or ISO: Washington, Oregon, Idaho, Nevada, New Mexico, Arizona, Montana, Arizona, Montana, Wyoming, Colorado, New Mexico, Tennessee, North Carolina, South Carolina, Georgia, Alabama, and Florida.

The report offers further validation of the important role that RTOs play in supporting lower-carbon electricity and in ensuring reliability. The report notes that an RTO is “the NERC-certified entity to perform real-time reliability function.”

The report states:

Reliability requirements necessitate the dispatch of available generation where it is needed, regardless of the type of generation energy buyers have elected to use. In the Southeast and West, there is no independent regional process or institution to plan a robust regional grid that would prevent this expensive and potentially customer-unfriendly redispatch.

Pennsylvania Consumers Suffering from Utility Confusion and Overcharges

In Pennsylvania, the fifth-largest state by population, residents are becoming increasingly frustrated by higher utility bills. Sticker shock and confusion abound, leaving the state’s consumers bewildered, with monthly obligations well beyond their budgets in some cases. Here are examples:

PPL Electric Utilities, a monopoly provider for 1.4 million customers in eastern and central Pennsylvania, reported a “technical system issue” that prevented the company from accessing customer usage data. So PPL sent estimated bills, due in January and February, to many customers based on past usage. That practice, reported the Patriot-News, is allowed by the state’s utility regulator, but it caused surprise and confusion and worse. According to TV station WGAL, “Viewers are telling us they’re in shock over higher PPL electric bills, which are hundreds of dollars more than expected.”

PPL hit customers with an 18% rate increase on Dec. 1, but the station reported “incidents of people being billed 50% above what they would have expected to be billed.” The Pennsylvania Office of Consumer Advocate said more than 795,000 customers were affected by the billing snafus.

A PUC investigation also found that PPL had mailed out 12,000 bills incorrectly last year — even to those who were being billed online. Customers reported invoices with different customer names and addresses, and with different amounts owed for electricity.

Duquesne Light Holdings, a monopoly electric utility based in Pittsburgh, sent a mailing to more than 3,000 of its customers that displayed incorrect names and account numbers. More precisely, the envelope was addressed correctly but not the materials inside. The Pennsylvania Public Utility Commission (PUC) imposed a $12,500 fine in December.

PECO, which serves 1.6 million customers in Philadelphia and its suburbs, was fined $225,000 in December by the PUC for improperly terminating 48,500 customers in 2018 and 2019. The Exelon subsidiary violated provisions of the state’s utility code requiring it to have direct contact with customers at least three days before a scheduled service shutoff due to nonpayment.

FirstEnergy charged Pennsylvania customers $2.4 million in “inappropriate costs,” according to a 2022 PUC audit, which did not publicly disclose the nature of the costs. But the Energy and Policy Institute, a watchdog group, obtained records in December that revealed that the embattled company used the money for payments to firms associated with “two individuals described in the deferred federal criminal case brought against the utility company in Ohio.”

In other words, not only were Pennsylvania customers billed incorrectly by the monopoly; they were billed for practices in another state.