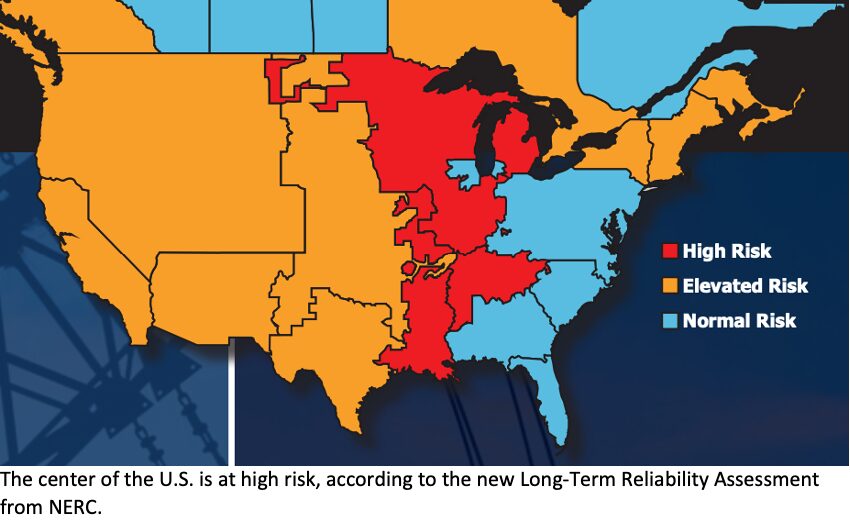

- The North American Electric Reliability Corp. (NERC) offers a sobering assessment of the next decade: generator retirements plus increases in demand equals serious risks to the electricity supply, especially in the middle of the country.

- In the near term, NERC sees reliability dangers for most of the U.S. this winter.

- New analysis throws doubt on assumptions about the real-life costs of different energy options.

- Key Senators write their third letter on the EPA’s controversial power plants rule. They urge FERC to take a more vigorous role, with electric reliability threatened.

- A Dakota pipeline, with strong national and energy security implications, earns the backing of state and national respondents in new polling.

- Report illustrates American LNG’s boon to Europe and climate goals

- Scholar raises questions about whether monopoly utilities should ever be allowed to donate to their regulators.

NERC’s Long-Term Assessment Reveals Serious Threats to Electric Reliability

With more generator retirements colliding with sharp increases in peak demand over the next 10 years, the non-profit North American Electric Reliability Corp., or NERC, issued a sobering 2023 Long-Term Reliability Assessment (LTRA) on Dec. 13.

“We are facing an absolute step change in the risk environment surrounding reliability and energy assurance,” said John Moura, NERC’s director of Reliability Assessment and Performance Analysis, in a press release. He added:

In recent years, we’ve witnessed a decline in reliability, and the future projection does not offer a clear path to securing the reliable electricity supply that is essential for the health, safety and prosperity of our communities.

NERC’s new report forecasts that demand growth rates will rise significantly compared with the projections of the 2022 LTRA, “reversing a decades-long trend of falling or flat growth rates.” Higher demand is being driven by projections for growth in data centers and electric vehicles, plus the electrification of heating systems.

Meanwhile, “more than 83 GW (gigawatts) of fossil-fired and nuclear generator retirements are anticipated through 2033, and more generators have announced plans for retirement…. Most areas are facing resource adequacy challenges, with many expected to have reserve shortages or emerging energy risks in future years. In addition, the new mix of resources heightens fuel supply concerns as the reliance on just-in-time delivery of natural gas fuel to generation increases.”

Mark Olson, NERC’s manager of Reliability Assessment, stated, “The critical interdependence between the electric and gas sectors in this year’s assessment stands out as a significant risk to future reliability.” Olson’s particular concern is that another Winter Storm Uri or Elliott will disrupt the flow of natural gas to generators, causing an electric supply shortfall that, in turn, affects natural gas infrastructure – a deadly cascading effect.

Two regions stand out as “not having the reserves to meet resource adequacy criteria.”

One is the area served by the Midcontinent System Operator (MISO), which, starting in 2028 will have a 4.7 GW shortfall “if expected generator retirements occur, despite the addition of new resources that total more than 12 GW.” MISO is a regional transmission organization (RTO) that serves the center of the U.S., from Louisiana to North Dakota and into parts of Canada.

The other is SERC-Central, a reliability corporation serving 16 mainly Southeastern states. Which faces a shortfall in the 2025-27 period “as demand forecasts increase faster than the transitioning resource mix grows.” The region will add more than 7 GW of natural gas generation but will retire more than 5 GW in the same period.

The LTRA offers four recommendations for energy policymakers, regulators, and industry officials:

- Add new resources with reliability attributes, manage retirements and make existing resources more dependable.

- Expand the transmission network to provide more transfer capability.

- Adapt bulk power system planning, operations, resource procurement markets and processes to a more complex power system.

- Strengthen relationships among reliability stakeholders.

Adding new resources in the current environment may be easier said than done. Governments, both federal and state, are forcing rapid retirements of existing generating sources without easing the ability to add new ones. The transition to clean energy may be an important goal, but, as the LTRA shows, it comes with severe risks to reliability.

In the Shorter Term, a ‘Large Portion’ of the U.S. Is ‘at Risk of Insufficient Energy Supplies’ This Winter

The LTRA is a long-term assessment, covering the next decade. More immediate concerns are reflected in NERC’s Winter Reliability Assessment, which was released in November.

Among report’s key findings was that “a large portion of the North American BPS [Bulk Power System] is at risk of insufficient electricity supplies during peak winter conditions.” The report added:

Prolonged, wide-area cold snaps threaten the reliable performance of BPS generation and the availability of fuel supplies for natural-gas-fired generation. As observed in recent winter reliability events, over 20% of generating capacity has been forced off-line when freezing temperatures extend over parts of North America that are not typically exposed to such conditions.

The winter report pointed to potential capacity shortfalls this winter spread through nearly the entire eastern two-thirds of the United States – not only MISO and SERC-Central but PJM Interconnection, the largest RTO, serving the Mid-Atlantic and parts of the industrial Midwest; ERCOT, which serves Texas; SPP (Southwest Power Pool), mainly in the Plains states and parts of the Southwest; plus New England, the Canadian Maritimes and Quebec. All these areas are rated as having “elevated risk,” meaning that they have the potential for insufficient operating reserves for worse-than-normal winter conditions. Saskatchewan Power in Canada is rated at high risk. Western states, Florida, New York, and Alabama are assessed at low risk.

A Report Evaluates Real-Life Costs of Energy Options

A new analysis by FTI Consulting, commissioned by the Electric Power Supply Association (EPSA) and released Dec. 18, evaluated the real-life impacts of different energy resource options in the PJM region on the reliability of the electric grid. To introduce the analysis, EPSA, which is digging deeper to find solutions to the reliability threat, hosted a webinar in which Robert Kaineg, the study’s author, discussed his methodology, assumptions, and findings. The recording of the webinar is available at this link.

Key findings:

- The cost of providing resource adequacy services is more than 100% of the traditional levelized cost of electricity (LCOE) of wind and solar units. LCOE is defined as the price at which generated electricity should be sold to break even at the end of its lifetime. It is a way of comparing costs of technologies.

- While traditional LCOE is lower for wind and solar units compared to combined cycle natural gas units in the PJM region in 2026, natural gas plants are more competitive when you account for the full cost of connecting to the system and providing resource adequacy services.

- Tax credits are critical to making carbon capture and storage (CCS)-equipped units economical, even at the low technology costs assumed by the National Renewable Energy Laboratory.

Here’s the main point: The analysis shows that the expense of all-in “firm power” is a much higher cost than generally understood. Policymakers need to take this truth into account and not simply assert that solar and wind are inexpensive, so let’s go full steam ahead with renewables for power generation. The entire system cost needs to be considered.

These findings are at odds with an April report by Lazard on the LCOE for solar and wind units, which had an imprecise view about the costs of renewables.

In light of the EPSA study and the latest warning from NERC, the fragility of the electric grid needs to be the number-one concern of federal and state legislators and other officials.

Senators Continue to Press FERC to Increase Scrutiny of EPA Power Plants Rule

We have reported for many months now on the power plants rule proposed by the Environmental Protection Agency (EPA). The controversial rule will require most fossil fuel power plants – including those powered by natural gas – to cut their emissions by 90% between 2035 and 2040, or else shut down. The rule imperils many natural gas plants – even though natural gas is widely seen as the essential transitional fuel, including by FERC’s own acting chairman, Willie Phillips.

The comment period for the rule ended Aug. 8, but the controversy is accelerating. On Dec. 20, Sens. John Barrasso (R-MT) and Shelly Moore Capito (R-WV) – the ranking members of the Senate Committee on Energy and Natural Resources and the Committee on Environment and Public Works, respectively – sent a new letter to the leadership of the Federal Energy Regulatory Commission (FERC), calling on the commission to raise greater scrutiny of the rule, also known as “Clean Power Plan 2.0.”

A Nov. 2 letter that the two had previously written stated: “If Commissioners and FERC staff do not bring to bear your expertise and fact-based analysis to dissuade the EPA from continuing on its current course, you will bear at least partial responsibility for any blackouts and brownouts that occur as result of electric resource shortages that would be attributable to compliance with a final rule resembling the Proposed Clean Power Plan 2.0.”

The December letter doubles down. It cites comments by Joseph Goffman, principal deputy assistant administrator of EPA’s Office of Air and Radiation, at FERC’s Annual Reliability Technical Conference in November. Goffman, wrote the Senators, “acknowledged that more work is necessary to determine how EPA’s proposed rule could impair electric reliability.” Specifically, Goffman said:

I certainly don’t think we have quite the expertise that you would hope we have to tell you specifically what quote ‘FERC should be doing.’ The most important thing from EPA’s perspective and given our mutual mission here is answer the phone when we call with the next round of questions that we’re going to have.

Again, as you know, I kind of see us between now and final as … going through the circuit several different more times, looking at our record, looking at questions that commenters raised. Going to the RTO’s, the ISO’s, the utilities the balancing authorities and then coming back to [FERC] and [FERC] staff to get your insights and feedback in terms of helping us interpret what we’re hearing and how we can then translate that into the provisions of the final rule.

Wrote the Senators: “EPA does not have the expertise to determine the impact of its proposed rule on electric reliability. The Agency is also unable or unwilling to articulate how it or FERC could improve Proposed Clean Power Plan 2.0 to ensure that the final rule does not threaten reliability.”

The danger, of course, is that the proposed rule would result in major shortages of reliable power. The rule prescribes carbon capture and other projects that are not yet commercially viable for many plants.

The Senators also highlighted the pace of generator retirements that the plan will force and stated, “[FERC] Commissioner [Mark] Christie asked Mr. Goffman if the EPA had analyzed how Clean Power Plan 2.0 would impact financing for traditional resources. Based on Mr. Goffman’s answer, Commissioner Christie concluded, and we agree, “EPA has not performed any serious and credible analysis of the essential question of how Electric Generating Units (‘EGUs’) that will be affected by Clean Power Plan Rule 2.0 will be able to obtain financing for the substantial costs of compliance.”

The letter continued: “In response to a question from Commissioner [James] Danly concerning the impact of Clean Power Plan 2.0 on electricity markets broadly and the currently expected pace of retirements in the organized markets, Mr. Goffman told the Commission that he would like to “actually follow up on this discussion” because “[Commissioner Danly] laid out a lot of issues that I think [EPA will] have to address in terms how we account for potential retirements … that are either occurring or are projected.”

The bottom line is that the Senators – as well as other critics – have made it clear that they do not believe the EPA has considered the implications for electric reliability in their proposed rule. FERC has clear responsibility for reliability, so it needs to raise its voice forcefully.

A Controversial Pipeline Earns Public Support, Polls Show

In Issue No. 28 of this newsletter, we covered developments involving the hotly contested Dakota Access Pipeline. In early September, the U.S. Army Corps of Engineers released a widely anticipated draft of an Environment Impact Statement (EIS) for the pipeline, but the draft, reported Bloomberg, “stopped short of recommending whether it should receive an easement to continue operating.”

Still, the draft stated, “Overall, analysis of incident data, frequency and consequence analysis, and review of existing pipeline safeguards indicates that sufficient safeguards are in place to prevent, respond to, mitigate, and remediate releases of crude oil into the Project Area.”

The Corps considered a wide range of options, advocating none for now. One was a request by Energy Transfer, LLP, which owns the pipeline, to “increase the amount of oil allowed to flow under the existing easement,” said Bloomberg. Other options were to allow “the pipeline to continue operating with new requirements or abandoning or rerouting the pipeline.

The public comment period ended Dec. 13 with thousands of letters submitted to the Corps of Engineers. North Dakota Gov. Doug Burgum, a popular state politician who recently ended a short campaign for the Republican presidential nomination, led a contingent of North Dakota officials and agencies in submitting over 200 pages of official comment and supporting materials that explain “why the U.S. Army Corps of Engineers should allow the Dakota Access Pipeline (DAPL) to maintain its current route and continue to safely transport North Dakota crude oil as it has been doing for more than six years…. North Dakota’s comments request the Corps to recommend Alternative 3, which will allow DAPL to continue to safely operate as it has for over six years.”

Supporters argue that the DAPL is vital to U.S. energy and national security. The pipeline runs 1,172 miles underground. It has safely transported crude oil since 2017 with 30-inch pipe from the highly productive Bakken/Three Forks production area in North Dakota to Patoka, Ill.

On the other side, the Sierra Club submitted over 17,000 comments against the pipeline. “The Dakota Access Pipeline is an urgent national climate issue,” said Cathy Collentine, the Sierra Club’s director of the Beyond Dirty Fuels Campaign. “Every day that the pipeline continues to operate, our climate, drinking water, and health and safety of millions are in jeopardy.”

The pipeline has become a politicized issue, but new polling by co/efficient illustrates support for the project and for overall energy security. Two surveys, commissioned by the Grow America’s Infrastructure Now Coalition, found strong support among Americans as a whole, as well as among North Dakotans, for continuing DAPL operations.

Some 88% of national respondents believe the U.S. should be energy-independent, and 57% said that they were against shutting down the DAPL. After learning that the pipeline has been safely operating for more than six years, 60% of respondents said they backed continuing operations while just 15% opposed.

Among North Dakotan respondents, 94% said the U.S. should be energy-independent, and 82% opposed shutting down the pipeline.

The Draft EIS is the second step in the National Environmental Policy Act (NEPA) environmental review process and will be followed by a Final Environmental Impact Statement. That document will consider the public comments received during the comment period.

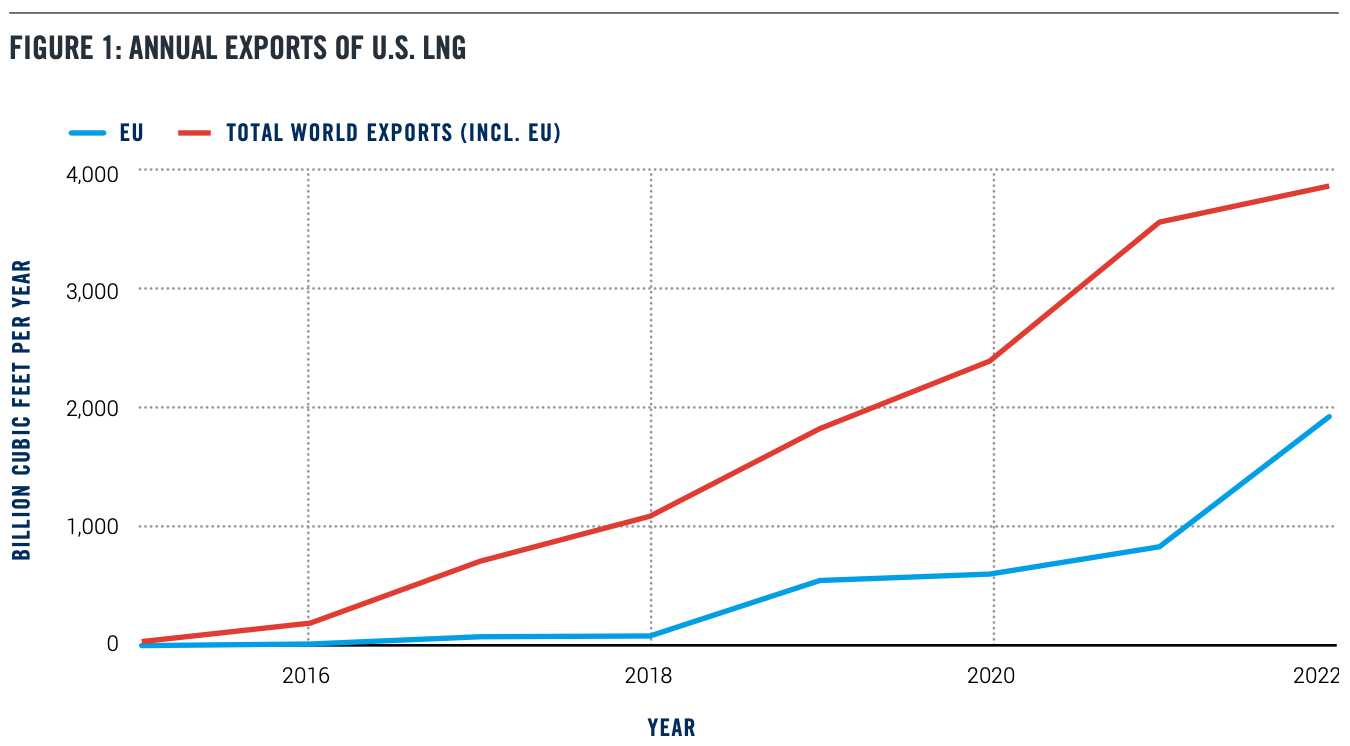

New Report Cites Boon to Europe and the Climate of Increased LNG Exports from the U.S.

A new report from the Progressive Policy Institute highlights the importance of the boom in liquefied natural gas (LNG) exports from the U.S. to Europe. The gas must be converted to that state before being loaded onto ships; it is then re-converted to gas at the other end of its journey.

The war in Ukraine triggered Europe’s decoupling from Russian energy and the shutdown of the Nord Stream pipelines. Those new conditions make U.S. LNG essential for another winter and Europe’s overall energy security. Prior to the pandemic and the war, Russian gas accounted for 38% of European Union imports, but through the first nine months of 2023, that figure fell to 6%, said the PPI study. The U.S. has filled the gap.

“It is impossible to imagine unified support for Ukraine between the U.S. and EU could have continued as it did without the long-term project of expanding U.S. export capacity and the rapid short-term expansion of import terminals in Europe,” wrote Elan Sykes, the PPI energy policy analyst who wrote the Dec. 12 report.

U.S. exports of gas are at historic highs, and the nation is now the largest LNG exporter in the world, with roughly half of U.S. cargoes going to Europe.

The U.S. has moved from a standing start in 2015 to exporting more than 4 trillion cubic feet of gas. The PPI report offers a blueprint for continued expansion:

Moving forward, the American LNG export market should focus on providing LNG to our democratic allies and countries with particularly coal-intensive energy systems, and the U.S. government should support this effort by pursuing domestic and international climate and trade policies that reward low-methane producers and shippers.

Looking further into the future, the case of European overreliance on Russian gas supplies and the relative success of U.S. and EU response should serve as a lesson for the energy transition that highlights the value of three key objectives: supply chain diversity, methane efficiency, and pragmatic all-of-the-above decarbonization.

The inability to rely on Russia for gas threatened to force countries like Germany to turn back to coal to avoid high energy prices and shortages. The continent’s climate goals were in jeopardy, as was economic growth in general.

But LNG came to the rescue. Although the Biden Administration has supported policies hostile to the oil and gas sector, the LNG story illustrates how more gas exploration and production, coupled with transportation infrastructure and export terminals, can actually reduce climate dangers and boost growth.

It’s an important lesson. With so much natural gas under our feet, the U.S. can use the current moment to provide a cleaner alternative to coal and a more secure alternative to fuel from hostile and unreliable nations – and duplicate this approach across the world for carbon-intensive nations.

In order to increase LNG exports, the U.S. needs to continue supporting the build-out of infrastructure, which provides thousands of well-paying jobs and strong tax revenues for state and local communities. The U.S. Energy Information Administration projected in November that North American LNG export terminal capacity will more than double by 2027.

Says the PPI report: “The U.S. is well-positioned to serve as a low-methane backstop LNG supplier while complementary clean energy supply chains scale up as rapidly as possible.”

Research Proposes A Ban on Political Donations From Monopoly Utilities to Their Regulators?

This newsletter has spotlighted the close connection between monopoly utilities and public officials. Monopoly utility companies can exert substantial influence on the regulators that are supposed to oversee their work. Political scientists call this phenomenon “regulatory capture.

In May, a federal jury found four former Commonwealth Edison executives and associates guilty of “conspiring to influence and reward [the] former Illinois House Speaker.” According to the U.S. Attorney’s Office for the Northern District of Illinois, the objective of the conspiracy was “to assist with the passage of legislation favorable to the electric utility company.”

Two years earlier, FirstEnergy signed a deferred prosecution agreement with the U.S. Attorney’s Office, admitting to one count of conspiracy to commit wire fraud and agreeing to pay $230 million in fines in the “largest bribery scandal in Ohio history.” The case involved a $1.1 billion bailout of a nuclear power plant.

Now, in a new Utility Dive column and in a working paper, Mark Van Orden has called for greater scrutiny in this area. He even went so far as to call on states to prohibit utility political contributions. Van Orden is a contributing scholar at the Center for Growth and Opportunity at Utah State University.

He wrote:

Regulation of electric utility companies is best conducted when public utility commission regulators are afforded a significant level of independence from the political process. Close observers of utility regulation, however, recognize that PUCs have become increasingly politicized.

His working paper estimated the effect of legalizing electric utility political contributions on the rate of return on equity (ROE) that PUCs authorize during rate cases. The paper looked specifically at “the 2005 repeal of the Public Utility Holding Company Act of 1935, or PUHCA, a New Deal-era federal law designed to restrict holding company monopoly power.” Van Orden described this law as “a powerful but little-known provision within the law [that] prohibited holding companies and their subsidiaries from using corporate treasury funds to contribute to local, state and federal political parties and candidates.”

A result of his research found that “PUHCA’s repeal left PUCs in a majority of U.S. states susceptible to political influence that, in turn, led PUCs to forsake their responsibility to provide consumers with reliable service at just and reasonable rates.”

Among his solutions? Stop regulated utilities from making any political contributions entirely. Utilities have been able to exploit a power imbalance over consumers, and Van Order argues that putting a clamp on political contributions would avoid this temptation for cronyism and possibly even corruption.