- A new report and a FERC reliability conference examine the lessons from the near catastrophe of last year’s Christmas storm. It’s clear that natural gas is “the most consequential element” for keeping the lights on.

- The bulk power system is performing well, but risks are rising in extent and severity. Someone needs to enforce reliability standards.

- A lawsuit in Hawaii, just updated in federal court, highlights the conflict between clean-energy competitive power providers and monopoly utilities.

- Government pressure to move swiftly to renewables is presenting a special challenge to reliability.

- Midcontinent grid chief warns about ignoring realities, including that we’re counting on technological innovations that are still far off.

- Key stakeholders issue a set of 11 recommendations and principles for avoiding a reliability crisis this winter.

- FERC investigates possible market manipulation during Winter Storm Elliott.

- Alaskan oil-drilling project will move forward after Judge’s ruling.

- Court Rules that Lease Sale 261 in the Gulf of Mexico must be held by the end of the year.

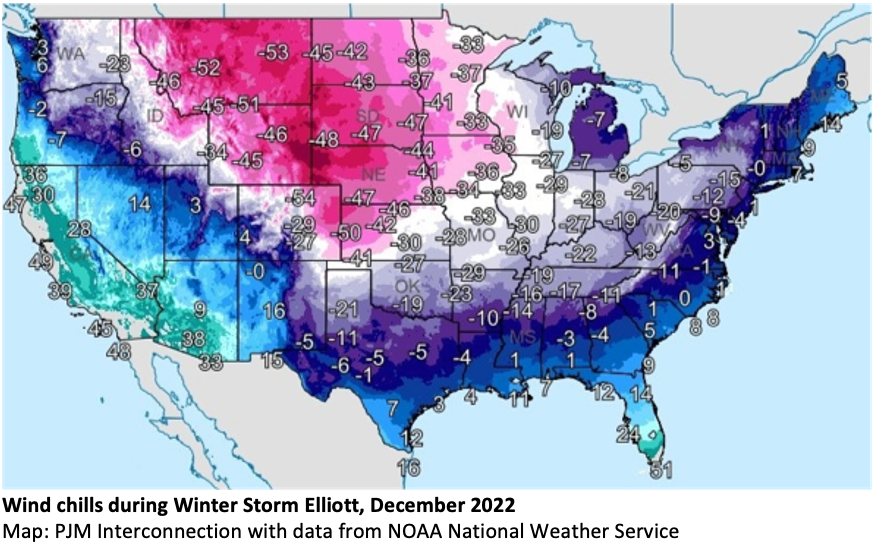

Concerns Grow for a Repeat of Last Year’s Winter Storm Elliott as the Chill Sets In

The eastern U.S. narrowly avoided a catastrophe last winter, and, as the annual chill sets in, concerns are growing for this year.

The Federal Energy Regulatory Commission (FERC) and the North American Electric Reliability Corporation (NERC) tackled the critical issue in a joint report issued on Nov. 7. Two days later, FERC held its annual Reliability Technical Conference.

At that conclave in Washington, Jim Robb, president of NERC, the non-profit whose mission is to reduce risks to the reliability and security of the grid, summarized:

Winter is upon us, and the energy sector needs to implement these recommendations as quickly as possible. As the report lays out, we narrowly dodged a crisis last year. Had the weather not warmed up on Christmas Day, it is highly likely that natural gas service would have been disrupted to New York City.

“Natural gas is perhaps the most consequential element of keeping the lights on during a winter storm,” wrote Anya Litvak in the Pittsburgh Post-Gazette on Nov. 19. The fuel is responsible for generating about 40% of electricity in the U.S., compared with about 20% each for coal, nuclear and renewables, according to the U.S. Energy Information Administration.

During last year’s Winter Storm Elliott, Litvak wrote, “Natural gas was foiled at many points between its trip from the wellhead to the region’s power plants and onto electric wires.” She continued:

Some 70% of all power plant outages in the eastern electric grid during Winter Storm Elliott were related to natural gas snags — either because the fuel couldn’t get to its destination to be burned, or, even more often, because the gas power plants themselves couldn’t start up or broke down trying.

Wrote Livak: “The mechanisms of failure were the same ones that hit Texas’ electric grid in 2021 during Winter Storm Uri, when wells and pipelines and gas turbines froze, resulting in catastrophic power losses and up to 800 deaths. But that’s Texas, where cold weather is more of a shock than a fact of life. Infrastructure in Pennsylvania and the other 12 states that are part of the PJM Interconnection grid is more weatherized than assets farther South.

Litvak concluded that “every step in the gas journey becomes a point of vulnerability during a freeze. Wells and pipelines can freeze…. Compressor stations and gas processing plants can and did malfunction. One problem cascades into another — low flow from one source can drop the pressure in a pipeline so much that none of the gas can get to its destination.” She added:

On Christmas Eve last year, Marcellus Shale gas production was down 23% compared to the day before Winter Storm Elliott began to pummel the country with a mix of snow and rapidly dropping temperatures. Utica Shale production was down 54% on Dec. 26…. This meant less gas was going into pipelines.

After the fact, when FERC reliability officials surveyed gas producers — whom they don’t regulate — “most said they experienced freeze-offs at the well, had trouble getting to their infrastructure to defrost it because of road conditions, or had experienced roadblocks downstream that worsened their situations.” Even so, all of them said they had “implemented some cold weather preparedness activities for winter.”

America needs to learn from Elliott – first of all, by prioritizing reliability in energy policy. That goal sounds simple, but it is being eclipsed by other concerns, including the move to zero-emissions without a solid transition strategy (as we elaborate below).

Chairman Phillips: ‘Someone Must Have Authority to Establish and Enforce Gas Reliability Standards’

Speaking at FERC’s conference in November, Jim Robb of NERC echoed calls for Congress and state legislatures to create something akin to his organization, but for natural gas. He noted the paradox of the modern grid. On the one hand, “the bulk power system is performing exceptionally well.” And yet, “all of our reliability assessments show an expansion of risks both geographically and [in] severity.”

The 167-page joint FERC-NERC report recommended “completion of needed cold weather reliability standard revisions initially identified after 2021’s Winter Storm Uri, and improvements to reliability for U.S. natural gas infrastructure.” The report also advocated:

- “Robust monitoring of how the industry is implementing cold weather Reliability Standards” and obtaining an “independent technical review of the causes of cold-related mechanical and electrical generation outages to identify preventive measures.”

- Action through “congressional and state legislation or regulation…to establish reliability rules for natural gas infrastructure to ensure cold weather reliability.

- Having the “North American Energy Standards Board convene a meeting of gas and electric grid operators and gas distribution companies to identify any needed communications improvements” and commissioning “an independent research group analyze whether additional gas infrastructure is needed to support grid reliability.”

Said FERC Chairman Willie Phillips:

The FERC and NERC teams analyzed what happened, what went wrong, and the steps utilities, grid operators and stakeholders must take to avoid this in the future. I want everyone to take time during this Reliability Week to read this report and begin implementing these recommendations, particularly those addressing the interdependence of gas and electricity. The report highlights what I’ve called for before: Someone must have authority to establish and enforce gas reliability standards.

Robb agreed. “I echo the Chairman’s call for an authority to set and enforce winterization standards for the natural gas system upstream of power generation and local distribution,” he said. “The unplanned loss of generation due to freezing and fuel issues was unprecedented, reflecting the extraordinary interconnectedness of the gas and electric systems and their combined vulnerability to extreme weather.”

Lawsuit Pits Provider of Biomass Power Against Hawaiian Monopoly Utility

The tension between the competitive model of providing power for electricity and the monopoly utility model was highlighted by a recently updated legal complaint, Hu Honua Bioenergy, LLC vs. Hawaiian Electric Industries, Inc., playing out in US District Court. The complaint involves not just issues like affordability and reliability but the provision of less carbon-intensive electricity.

In May 2017, the two parties agreed to a conditional settlement of Hu Honua’s claims, and the case was closed by the court in 2019. As part of the conditional settlement, the parties entered into an amended power-purchase agreement, Bloomberg Law reported. “But the state’s Public Utilities Commission in May 2022 rejected Hu Honua’s amended power-purchase agreement.” The Hawaii Supreme Court then affirmed the PUC’s decision in March of this year.

Said the court: “The PUC understood its public interest-minded mission. It faithfully followed our remand instructions to consider the reasonableness of the proposed project’s costs in light of its greenhouse gas emissions and the project’s impact on [a] right to a clean and healthful environment.

On Nov. 16, Hu Honua, also called Honua Ola, went back to court – federal court – with an amended complaint that “seeks to clarify the alleged ongoing anticompetitive scheme and the antitrust injuries resulting from it,” Bloomberg reported.

Hu Honua seeks more than $1 billion in damages that the company says were incurred by the cancellation of its power purchase agreement with Hawaiian Electric, the monopoly utility serving Hawaii’s residents. That cancellation led “to a delayed transition to renewable energy as mandated by state law,” according to Hu Honua’s claim, as reported by Bloomberg Law on Nov. 17. The Bloomberg piece added:

Hu Honua, which focuses on energy from biomass, says the cancellation violated US antitrust laws by unlawfully expanding monopoly power over the wholesale market for power generation to the exclusion of rivals.

The utility said it cancelled the agreement because Hu Honua missed certain contractual milestones.

According to the Hawaii Tribune-Herald, a group of investors financed construction of a 21.5-megawatt biomass plant in Pepeekeo on the Big Island of Hawaii. “Hu Honua’s newly constructed facility would bring reliable, renewable energy to Hawaii Island at a competitive price, but sits idle today solely due to Hawaiian Electric’s predatory and anticompetitive conduct, which it has ruthlessly wielded to entrench and expand its monopoly over Hawaii’s power sector,” said Daniel Swanson of Gibson, Dunn, and Crutcher, an attorney for Hu Honua.

The Tribune-Herald reported:

The complaint alleges Hawaiian Electric has a near-total monopoly over the wholesale firm power generation market on the Big Island and is the only purchaser of that power. Claims in the lawsuit include that Hawaiian Electric has cornered more than 90% of and, at times, almost all firm power generation capacity on the island, while ratepayers…have seen price hikes of 50% to 100% or more, with slimmer energy reserves and a higher risk of power outages.

According to the EIA, “Petroleum accounts for about four-fifths of Hawaii’s total energy consumption, the highest share for any state, [and] Hawaii has the highest electricity retail price of any state and it is nearly triple the U.S. average.”

The Tribune-Herald reported that Hu Honua blames Hawaiian Electric’s high rates on “imported petroleum products and aging power generation facilities.”

Hawaiian Electric is also facing mounting legal risks from “more than 60 lawsuits blaming it for a devastating Maui wildfire in August that killed at least 99 people,” said the Bloomberg article.

The utility’s monopoly position has allowed it to avoid investing in updates to its inefficient power plant and grid systems, say critics in a refrain heard about other large utilities as well. The antiquated infrastructure has, according to the Hu Houna suit, failed to perform at least nine times between August 2022 and March 2023, with the monopoly utility asking customers to reduce power consumption during peak hours. In March, Hawaii Island residents experienced rolling blackouts initiated by Hawaiian Electric.

Reliability Is Strained by Government Pressure to Transition Swiftly to Renewables

FERC’s mission: “Assist consumers in obtaining reliable, safe, secure, and economically efficient energy services at a reasonable cost through appropriate regulatory and market means, and collaborative efforts.”

It’s no accident that “reliable” is the first adjective. One of the factors straining reliability is the political pressure to transition toward renewables in the generation of electricity without laying the proper groundwork. The mix of resources is changing rapidly. As recently as 2007, just 8% of electricity came from renewables and nearly 50% from coal. Today, while coal use has been cut by more than half, the proportion of renewables has nearly tripled.

The most popular renewables are solar and wind, which are intermittent sources, that is, “They only produce electricity when the wind is blowing or the sun is shining,” says the U.S. Energy Information Administration (EIA). Coal and natural gas have to take up the slack, but their infrastructure is under pressure from federal and state governments.

In her Post-Gazette article cited earlier, Litvak noted that “coal plants continue to retire” in Pennsylvania, and, “after a slew of new natural gas power plants that came online over the past several years, the pipeline of future installations is drying up.”

She added:

The latest example is the Allegheny Energy Center, a natural gas power plant project eight years in the making that confirmed last week that it has abandoned plans to build in Elizabeth Township. Of all the new electric projects in Pennsylvania that are in a queue to connect to the regional grid, about 1% represents natural gas generation. More than two-thirds are solar projects.

We have reported for many months now on the controversial rule proposed by the Environmental Protection Agency (EPA) that will require most fossil fuel power plants – including those powered by natural gas – to cut their emissions by 90% between 2035 and 2040, or else shut down (see more below).

In another recent example, “State attorneys general in Oregon, Washington and California and two Oregon-based environmental groups are asking federal energy regulators to reconsider their approval of a natural gas pipeline project that would increase the flow of gas through the Northwest,” reported the Oregon Capital Chronicle.

At FERC’s November Technical Conference on Reliability, the first panel was titled, “State of Bulk Power System Reliability with a Focus on the Changing Resource Mix and Resource Adequacy.” It began with a presentation by NERC of the findings of its annual State of Reliability Review, which found:

Extreme weather events continue to pose the greatest risk to reliability due to the increase in frequency, footprint, duration, and severity. In 2022, the National Oceanic and Atmospheric Administration identified 18 separate billion-dollar weather-related disasters in the United States…. Thirteen of these events affected the performance observed on the days with the most significant reliability impacts on generation, transmission, and loss of customer load.

The NERC report highlighted the “changing resource mix” as a factor in decreasing reliability” – specifically noting the “unavailability of the gas-fired generation fleet” during winter months when it was sorely needed.

FERC described the first panel this way:

The transformation of the Bulk-Power System is resulting in significant changes to the nation’s power supply portfolio. These changes include…the increased use and importance of natural gas generating units for system balancing…. Ensuring the adequate supply of electric energy to service loads during peak hours and during extreme weather conditions is also becoming more challenging in many regions of North America

The Commission asked panelists to address such questions as: What should the Commission’s top reliability priorities be for the next one to three years? How should reliability oversight adapt to the biggest changes to the resource mix in this century? Is the existing reliability oversight model flexible and agile enough to help lead the change?

In its response, the Electric Power Supply Association (EPSA), which represents America’s competitive power suppliers, outlined its number-one recommendation for improving gas-electric interdependence in a pre-conference statement. EPSA urged a “focus on developing market-based services or products to maintain continued market efficiency for energy, capacity, and ancillary services for all power system resources.”

The statement added:

Even to address unexpected critical periods that truly test both systems, all means should be taken to develop market-based solutions which maintain market integrity. While we must do all we can to avoid outages, load losses, or exorbitant costs during these extreme periods, we will not have gained any ground or made meaningful improvements if our approaches compromise market signals and functions for normal operations – which perform extremely well for upwards of 355 days a year.

EPSA on Nov. 13 released its Principles of a Reliable Energy Expansion:

- “Competitive wholesale power markets are the most effective tool to achieve policy objectives by encouraging private capital deployment and innovation at the lowest cost while appropriately shifting investment risk to resource developers and operators, not consumers.”

- Existing dispatchable resources – that is, coal, nuclear, and natural gas, which are in constant, not intermittent, supply – “will be needed to keep the power grid reliable.”

- Improving wholesale markets and coordination between electric and natural gas industries are “vital to ensuring a reliable and cost-effective clean energy expansion and must be prioritized policy aims.”

- Expanding clean energy requires “greater certainty and efficiency in the federal permitting process rather than focusing merely on favored resources based on industrial planning criteria or picking winners and losers.”

Midcontinent Grid Chief Warns That New Technologies Still Far from Commercial Viability

In comments to that first FERC panel, Clair Moeller, president of the Midcontinent Independent System Operator (MISO), a regional transmission organization (RTO), began by saying:

Reliability is something that is an expectation in our society, and it’s become easy to take it for granted. Today, however, the landscape has changed significantly to make it much more complex to deliver electricity with the reliability our society has come to expect.

Unfortunately, there is a focus on debating the virtues of different resources and letting that distract us from the realities of reliability, so I am hopeful we can get back to some of those today. These should not be seen as “grim” realities, but I like to think of them as “grid” realities.

Moeller then pointed to several realities facing the electric grid, the most “realistic” of which is that “new technologies are far from commercial viability.”

For example, the National Rural Electric Cooperative Association, in an August comment letter to the EPA, noted that the power plant proposal “hinges on the widespread adoption of nascent technologies: clean hydrogen and carbon capture and storage. Electric cooperatives are involved in the development of five carbon capture projects and are national leaders in the development of the technology. And while both technologies are promising, they are not yet widespread or commercially available.”

Moeller explained that “there is little doubt that technologies will mature and/or new technologies will develop that can effectively and efficiently provide the needed reliability attributes. But we are not at that point, and we won’t be any time soon.” He continued:

Utilities could certainly install massive amounts of 4-hour batteries to provide the required attributes, but at massive cost. Simply put, time is needed to resolve this challenge, and, in the meantime, we have to maintain the existing sources of these attributes, understanding that their usage will decline.

Also at the FERC conference, there were remarks by Joseph Goffman, Principal Deputy Assistant Administrator for the Office of Air and Radiation (OAR) at EPA, who lauded the power plants proposal, what some are calling Clean Power Plan 2.0. “EPA projects that the proposal would have significant benefits –reducing CO2 emissions from the power sector by at least 617 million metric tons through 2042 (over and above reductions anticipated under the IRA) and yielding significant health benefits including 1,300 premature deaths avoided in 2030 alone,” he said.

Goffman added that the EPA had significant discussions with concerned stakeholders. “I want to personally thank everyone here today who answered our call and met with my team as part of this vitally important reliability-specific outreach, which will not conclude here,” he said. “Let me assure you, we are listening.”

As we reported previously, officials have been sounding alarm bells over the expensive and unrealistic demands of the power plants rule and its potential to harm reliability. Ahead of the FERC conference, Rep. Cathy McMorris Rodgers (R-WA), chair of the House Energy and Commerce Committee, as well as the chairs of two relevant subcommittees, Reps. Jeff Duncan (R-SD) and Bill Johnson (R-OH), sent a letter to the FERC commissioners criticizing the EPA rule.

A press release about the letter on Nov. 8 stressed that the three chairs were warning FERC about grid security:

Given the looming threats to reliability from EPA regulations, the importance of this year’s Annual Reliability Technical Conference cannot be overstated. A major focus of this technical conference is proposed regulations that have a severe negative effect on electric reliability. It is appropriate and necessary that Federal Energy Regulatory Commission step up and evaluate the impact of EPA proposals.

McMorris and her colleagues added, “We are concerned that the EPA failed to perform adequate and thorough analysis of the impacts on electric reliability when developing its proposed rules on the power sector…. We also believe that FERC must exercise its relevant authorities and expertise and take action to ensure misguided policies do not further undermine reliability.”

Three Associations Issue Recommendations for Avoiding a Reliability Crisis During Severe Winter Events

Also ahead of FERC’s Technical Conference on Reliability, three trade associations – EPSA, the Natural Gas Supply Association, and the Interstate Natural Gas Association of America – formed a new consortium called the “Reliability Alliance,” and provided 11 jointly developed recommendations for avoiding a reliability crisis during severe weather events.

The associations cover the entire natural gas-electricity supply chain. They have a vested interest in making sure the delivery system operates smoothy and reliably, so their principles should be cautionary lessons for officials. Their paper expands on these 11 principles:

Real Time Market Challenges

- Improving pricing in power markets, especially the real-time market.

- Improving certainty in power markets to encourage advance gas purchases.

- Considering ways to facilitate gas purchases during intra-day periods, weekends, and holidays.

- Allowing updates to generator/operating parameters in real time.

- Accounting for RTOs/ISOs for gas system limitations in generator commitment and dispatch.

- Considering enhanced pipeline notices and services to address power system needs.

Gas Infrastructure Challenges

- Considering ways that generators can financially support investment in gas infrastructure required to serve power demand and increased ramping requirements.

- Developing mechanisms for wholesale electric market participants to anchor additional pipelines.

- Considering whether increasing pipeline capacity is commercially viable as part of complying with new emissions mandates.

- Supporting legislation that removes hurdles in the permitting process and asking FERC to rescind pending draft policies that add uncertainty and investment risk.

- Encouraging RTOs/ISOs and NERC to advocate for specific projects, particularly storage, which will enhance reliability of gas supply and provide flexibility.

Possible Market Manipulation During the Winter Storm

On Nov. 16, in its annual enforcement report, issued on Nov. 16, FERC said it is “investigating two possible cases of market manipulation during Winter Storm Elliott.

FERC reported that its “Division of Analytics and Surveillance is reviewing data and information it has gathered in its inquiries into market behavior during the winter storm, which could lead to additional investigations.”

Utility Dive on Nov. 17 stated, “The investigations are based on six inquiries stemming from the division’s ‘enhanced surveillance’ related to last year’s massive storm. The inquiries included outreach and data requests to power plant personnel, marketers and pipelines.”

The annual enforcement report noted that FERC’s staff opened 19 investigations in fiscal year 2023, with at least 11 involving potential market manipulation, six dealing with potential tariff violations, and three involving possible misrepresentations. “FERC approved 12 enforcement office settlement agreements totaling about $48.8 million in fiscal 2023 compared with 11 approved agreements totaling $57.5 million in fiscal 2022.”

“Some of the companies reaching agreements with the enforcement office are FirstEnergy, Entergy Arkansas, Leapfrog Power, NRG Energy, OhmConnect and PacifiCorp,” reported Utility Dive.

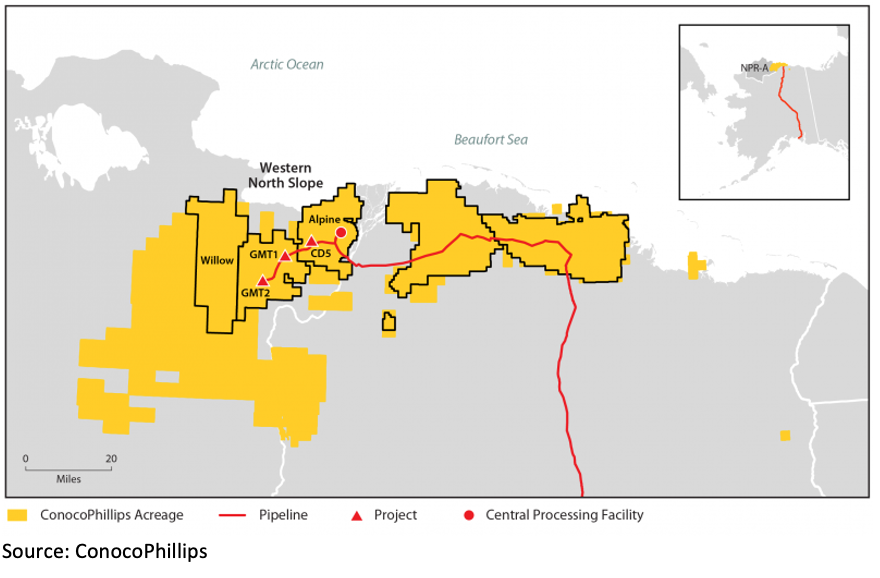

Judge Upholds Oil-Drilling Project on Alaska’s North Slope

A federal judge upheld approval of Alaska’s Willow Project, an oil-drilling initiative by Conoco Phillips on the North Slope of the National Petroleum Reserve in Alaska.

In her decision on Nov. 9, U.S. District Court Judge Sharon Gleason, an appointee of President Obama, rejected challenges from an Alaska Native group and environmentalists to vacate the March decision by President Biden’s Interior Department to permit the project.

According to the Washington Post:

Willow has been a top target of climate activists because it is one of the largest oil developments on federal land…. Willow is projected to produce 576 million barrels of oil over the next three decades…. Biden had promised to end new oil drilling on federal land. But ConocoPhillips has held leases to drill from the region since the late 1990s, which the president and legal experts said limited his ability to reject the project.

Judge Gleason dismissed the lawsuit by the indigenous and environmental groups. She said in her decision that “the U.S. government had adequately analyzed how greenhouse gas emissions from the project would impact the climate and adequately considered how the project would impact endangered species like polar bears,” reported Reuters. The opponents said they will appeal.

ConocoPhillips estimates that Willow will provide between $8 billion and $17 billion in new tax revenue to the federal government, the state of Alaska and North Slope Borough communities. The project is also estimated to create over 2,500 construction jobs and 300 long-term jobs.

Though there was some public pushback, lawmakers in Alaska, both Democrats and Republicans, hailed the decision from Judge Gleason.

Interior Secretary Deb Haaland, the first Native American to serve as a Cabinet secretary, defended Willow’s approval in July when speaking with the Washington Post. She said, “There are a million considerations. I’m not running this department for the progressives who want to keep it [oil] in the ground. This is for the whole country.”

Many Native communities on Alaska’s North Slope “celebrated the project’s approval, citing new jobs and the influx of money that will help support schools, other public services and infrastructure investments in their isolated villages,” reported the Associated Press.

“Just a few decades ago, many villages had no running water, said Doreen Leavitt, director of natural resources for the Inupiat Community of the Arctic Slope…. She said 50 years of oil production on the petroleum-rich North Slope has shown that development can coexist with wildlife and the traditional, subsistence way of life.”

The Alaskan state legislature passed a unanimous House Resolution in February of 2023 in support of the project.

“The judge’s ruling today is another victory for the critically-important Willow Project, and excellent news for Alaska’s economy, good-paying jobs for our families, and the future prosperity of our state,” said U.S. Sen. Dan Sullivan (R-AK). Added his colleague, Sen. Lisa Murkowski (R-AK): “This ruling is a victory for Alaskans’ right to responsibly produce our energy resources in the National Petroleum Reserve and to contribute to American energy security.”

Alaska’s lone U.S. House member, Democratic Rep. Mary Peltola, concurred: “This decision is a major win for Alaska and all of us who worked so hard to bring Willow across the finish line. Thanks to a historic coalition of Alaska Natives, laborers, our business community, the state legislature, and everyday Alaskans, our voices were loud and persistent enough to carry through the noise of Lower 48 activists.” She added:

Alaskans have worked for years on this, weighing in on comment period after comment period and attending public meeting after public meeting. Now, we are seeing that hard work pay off as the courts recognize what we have said all along: this well-planned, locally-supported project will create thousands of jobs, reinvigorate our Trans-Alaska Pipeline System, and boost our economy for years to come.

The project’s approval and the Judge’s rejection of challenges is an enhancement to U.S. energy security, obviating the need for reliance on Venezuelan or Middle East oil. Advocates also argue that, by producing oil at home, the U.S. can both benefit our own economy while improving the environment globally – because U.S. guidelines are so superior to those of other oil- and gas-producing nations.

Gulf of Mexico Lease Sale Required by Year-End, Court Orders

In another court ruling favorable to increased U.S. production of oil and gas, the U.S. Fifth Circuit Court of Appeals in New Orleans ruled on Nov. 14 that the Interior Department’s Bureau of Ocean Energy Management (BOEM) – after stalling for months – must hold Lease Sale 261 in the Gulf of Mexico by the end of the year without extra protections for the endangered Rice’s whale.

Louisiana Senator Bill Cassidy, M.D. (R-LA) said in a statement:

Slow-walking congressional mandates is not only a violation of the law, it harms our energy security and economy…. I’m thankful for the 5th Circuit’s decision to force the Biden administration to hold the long-awaited sale. It’s a win for the rule of law and sadly the end of an era with no offshore energy lease sales scheduled next year for the first time in more than 50 years.

According to the National Oceanic and Atmospheric Administration (NOAA), subject of the controversy, the Rice’s whale, is a “member of the baleen whale family Balaenopteridae. With likely fewer than 100 individuals remaining, Rice’s whales are one of the most endangered whales in the world.” Weighing 30 tons and up to 41 feet long, the whale “has been consistently located in the northeastern Gulf of Mexico, along the continental shelf break between 100 and about 400 meters depth.”

In July 2023, the National Marine Fisheries Service had announced a settlement, or “stipulated stay agreement,” with the Sierra Club, Center for Biological Diversity, Friends of the Earth, and Turtle Island Restoration Network. Although it was not a party to the case, the Department of the Interior (through its BOEM) announced it would exclude significant acreage from an upcoming Sept. 27 sale and issue recommendations to place restrictions on vessels involved in oil and gas operations (and only such vessels) in areas of the Gulf of Mexico where Rice’s whales travel.

We wrote in our newsletter No. 28: “If environmental NGOs like the Sierra Club can work with the federal government to restrict interstate commercial activity that had been verified through Congressional action to be in the public interest, then what essential sector could be next?”

The decision by the appeals court puts Lease Sale 261 back on the table. It is now scheduled for Dec. 20 and involves 73 million acres.

“’Here, the causal chain of events necessary to support Intervenors’ theory of standing is so attenuated that the alleged harm is not ‘certainly impending,’ wrote Senior Judge Edith Brown Clement in the opinion for the court.”

Threats were overblown. E&E News pointed out: “Another lease sale in the Gulf of Mexico mandated under the Inflation Reduction Act — Lease Sale 259 — only received bids on 1 to 2 percent of auctioned blocks. Clement added that BOEM’s own analyses indicated that additional protections for the whale were only needed in the eastern Gulf, which is outside the area included in Lease Sale 261.”

The sale is the last required under the Inflation Reduction Act.