- Grid operators and regulators tell Pennsylvania and Ohio legislators that they need more, not less, power generation from natural gas to ensure reliability.

- Meanwhile, in a Congressional hearing, state public service commissioners warn of the dangers to grid reliability due to various EPA regulations.

- The Biden administration’s moratorium on new LNG export permits is drawing fire, including from Democrats.

- In a bipartisan vote, the House passes a bill taking regulatory power over LNG permits away from the Department of Energy and giving it to FERC.

- JP Morgan and State Street drop out of a council pushing for financial action against climate change, and BlackRock pares its participation. What’s happening?

- New York’s plan for zero emissions by 2040 is leading to higher utility rates, and taxpayers are footing much of the bill.

To Keep the Lights on, Grid Operators and Regulators Say They Need More Natural Gas

At a hearing Feb. 1, grid operators and regulators told more than two dozen state lawmakers from Pennsylvania and Ohio that they needed more power generation from natural gas to ensure reliability for manufacturers, businesses, and consumers in the face of federal policies encouraging renewable energy.

An E&E News report on the joint hearing quoted Jim Robb, CEO of the North American Electric Reliability Corp. (NERC) as saying, “The resource that keeps the lights on is natural gas,” said. “And it’s not because I love natural gas. It’s because I love the performance of natural gas generation.”

The hearing was the second in recent months involving legislators from the two states, which are major energy consumers and natural gas producers in the territory covered by PJM Interconnection, the nation’s largest grid operator.

Robb’s message on natural gas was echoed by the head of the Public Utilities Commission of Ohio and executives at PJM. “They argued that EPA’s proposal to limit power plant pollution — and the Biden administration’s other efforts to move to a carbon-free grid — puts electricity reliability at risk,” reported Jeffrey Tomich of E&E News.

The lawmakers themselves also sounded alarm bells. For example, Republican Rep. Dick Stein of Ohio stated: “Our constituents, like ourselves, have been lulled into complacency with the fact that the lights always come on. This complacency tends to make all of us quick forgetters.”

In addition to Stein, Center Square quoted Pennysylvania state Sen. Gene Yaw:

We’re just not producing that reserve capacity that we’ve been living on and used to having at our fingertips for the last 75 years. We have a problem, and we have a serious problem. It’s not Pennsylvania’s problem or Ohio’s problem — it’s a countrywide problem that we need to face. And if we don’t, we’re on a downward spiral.

The Center Square headline summed up the situation: “Red Tape Closes Power Plants Before Replacements Ready.”

The hearing followed a PJM analysis a year ago that highlighted four trends, which, “in combination, present increasing reliability risks during the transition, due to a potential timing mismatch between resource retirements, load growth and the pace of new generation entry.” Those trends include:

- The increased growth rate of energy demand from electrification of vehicles “coupled with the proliferation of high-demand data centers.

- The rapid retirement of thermal generators “due to government and private sector policies as well as economics.”

- Retirements of power plants at risk of outpacing the construction of new resources, due to a combination of industry forces, including siting and supply chain.

- PJM’s own interconnection queue being composed primarily of intermittent and limited-duration resources. “Given the operating characteristics of these resources, we need multiple megawatts of these resources to replace 1 MW of thermal generation.”

Tomich’s article noted, “While the near-term reliability risks in PJM’s region are lower than in neighboring areas, such as the Midcontinent Independent System Operator [MISO], the report found that they’re growing.”

At the hearing, Asim Haque, PJM’s senior vice president of state policy and member services and a former top Ohio utility regulator, said, “In 2030, you get a pretty big drop-off in resources due to the particular state policy in our footprint. But prior to that, it’s actually a lot of federal EPA rules.”

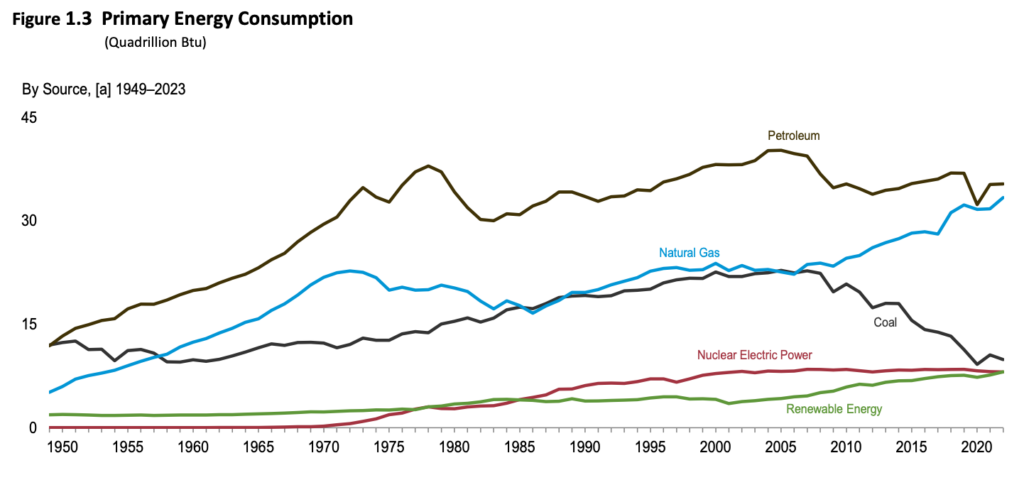

A January FERC report on the performance of independent system operators (ISOs) and regional transmission organizations (RTOs) also underscored the importance of natural gas as the most in-demand fuel for grid operators.

That “2023 Common Metrics Report” stated:

All RTOs/ISOs report natural gas-fired capacity as the largest single fuel type from 2019 to 2022. The largest increase in natural gas-fired generation capacity occurs in NYISO [New York], increasing from 58% in 2019 to 64% in 2022. ISO-NE [New England], MISO, and PJM report modest increases in natural gas-fired generation capacity over the four-year time period.

In contrast, natural gas-fired capacity relative to total capacity decreased in CAISO [California] and SPP [Southwest Power Pool], falling 8 percentage points in CAISO from 49% in 2019 to 41% in 2022, and from 43% in 2019 to 40% in 2022 in SPP. The decline in the share of natural gas-fired capacity in these regions is likely driven by the relatively large increases in wind and solar generating capacity, instead of natural gas retirements.

California, especially, has prioritized wind- and solar-generating capacity, which is intermittent. It is no surprise that the state has faced considerable reliability challenges in recent years.

As Anthony Hennen wrote in his Center Square report on the hearing: “Despite the key positions states like Ohio and Pennsylvania hold to solve future energy problems, shifting the power grid from coal and natural gas to wind and solar isn’t as easy as flipping a switch.”

State Utility Commissioners Express Concern About the Impact of the Various EPA Regulations on Reliability – And Feds ‘Seizing Control From States‘

The Energy and Commerce Committee of the U.S. House, under Chair Rep. Cathy McMorris Rodgers (R-WA), has been laser-focused on the reliability of the grid. The panel’s Subcommittee on Energy, Climate and Grid Security held a hearing on Feb. 14 with the title, “Powered Up: State Utility Regulators on Challenges to Reliable, Affordable Electricity.”

As a prelude to the hearing, Rep. McMorris Rodgers and Rep. Jeff Duncan (R-SC), the subcommittee chair, issued a statement saying, “America’s electric grid is critical to every aspect of our lives and our economic prosperity — powering our homes, businesses, and schools. Ensuring its security and reliability is one of our top priorities on Energy and Commerce.”

Witnesses at the Valentine’s Day hearing included utility commissioners on the front lines of the battle for a reliable grid in the face of mandates to move quickly to retire current infrastructure and bring on wind- and solar-powered electricity generation.

Georgia Public Service Commissioner Tricia Pridemore called attention to the proposed power plants rule that the U.S. Environmental Protection Agency is seeking under Section 111 of the Clean Air Act. The rule, said Pridemore, “would set limits for new gas-fired combustion turbines, existing coal, oil and gas-fired steam generating units, and certain existing gas-fired combustion turbines.” She added:

Utilities have a legal obligation to…oversee a healthy electric utility system, but EPA 111 puts the utility, the customer, and the state regulator in an impossible position. Penalizing utilities for operating generation facilities this EPA doesn’t like opens a Pandora’s Box for third-parties to sue utilities. The EPA is seizing control from states – control over systems that state agencies and officials spend their deep expertise and research capabilities analyzing and planning healthy systems.

Pridemore continued, “Consider this from the utilities’ point of view.” They are forced to “choose between using generation assets this EPA doesn’t like and being sued by environmentalists and paying fines to the federal government. And this choice is being made at critical pinch periods when solar is failing and demand is surging. The alternative is for utilities to not generate electricity, force blackouts, and thus open themselves up to other legal actions.”

Even without a Renewable Portfolio Standard, Georgia has become the number-four state for solar. “Georgia’s electricity-generating portfolio has never been clearer,” said Pridemore. Nuclear and hydro provide baseload energy; solar contributes when the sun is shining; natural gas and coal offer dispatchable energy. But the power plants rule puts “all this thoughtful and implementation at great risk.”

In his own testimony, the chairman of the Indiana Utility Regulatory Commission, Jim Huston, also criticized the federal government’s interventionist approach. As recently as the early 2000s, coal accounted for at least 90% of the state’s power generation. Today, that share has been cut in half, and Indiana ranks second in wind for states east of the Mississippi River. Indiana is clearly on its own transitional path.

He cited the proposed EPA rule’s “unrealistic timing, particularly in the context of utilities’ state-sanctioned and regulator-reviewed integrated resource plans.” He added:

It is not obvious that the proposed environmental benefits outweigh the other ‘pillar’ considerations that state regulators must consider to ensure safe, reliable, and affordable service.

Another commissioner, Nick Myers of Arizona, expressed similar concerns. A release from his office noted the “mandates from the U.S. Environmental Protection Agency (EPA) which have and will continue to force early retirement of coal-fired generation plants in Arizona without adequate replacement.”

Myers also cited “the challenges to reliability and affordability posed by the unprecedented growth in load and peak demand which are expected to continue in the coming years.” He pointed to meeting peak summer demand in the face of federal mandates as a significant challenge. He noted that power outages were especially damaging to the health and safety of the state’s vulnerable populations.

Like the other commissioners, Myers said that Arizona’s own regulators and utilities “are best positioned to address these context-specific needs and challenges…. Will outside entities have the same commitment to Arizona?”

While the commissioners made cogent and timely points, most failed to recognize the growing importance of small nuclear reactors (SMRs) and other sources of low-emission power to fill the growing reliability gap. The shortcomings of recent large scale nuclear projects were also given short shrift. In her testimony, Pridemore actually celebrated as innovative the Plant Vogtle Units 3 and 4, a project with disastrous overruns and a hefty burden for customers.

This newsletter has closely chronicled the Vogtle disaster. The project of the state’s monopoly utility, Georgia Power arrived seven years late and $17 billion over original estimates, according to the Associated Press.

In December, state regulators in Georgia voted “to pass most of the tab for Plant Vogtle’s two new nuclear reactors on to Georgia Power customers,” reported the Atlanta Journal Constitution. Georgia Power will “charge ratepayers for $7.56 billion of the $10.2 billion the company ultimately expects to spend completing the nuclear plant…. The company and shareholders of its parent, Southern Company, will absorb the remaining $2.63 billion of the project’s construction costs.”

For a subcommittee holding a hearing whose title includes the phrase, “affordable electricity,” the enormous costs of massive, legacy-style nuclear plants bear examination.

Pridemore did comment on affordability in a more general way, however. “Customers are getting hurt by these regulations and stuck with the bill,” she told the subcommittee. Up to 8% of a customer’s monthly bill already goes to “forced EPA compliance,” she said. And in Georgia, a big chunk of the bill also goes to pay for the Vogtle debacle.

One panelist who mentioned a commitment to small modular reaction (SMR)-driven nuclear power was Keith Hay, senior director of policy for the Colorado Energy Office. SMRs, he said in his testimony, would generate 3.8 megawatts of power by 2040, when the state expects to achieve “deep decarbonization of our electric system.”

But getting to that goal won’t be easy. Hay says that Colorado will have to increase its wind generation capacity by a factor of three and its solar by a factor of five “to provide affordable and reliable electricity by 2040.” Hay was less worried about proposed and current EPA regulations than the other panelists. His concern is the slow federal permitting process for all the new infrastructure that’s needed.

The Biden Administration’s Moratorium on New Permits for LNG Exports Is Drawing Criticism Across Party Lines

Criticism has mounted since President Biden announced a moratorium on new permits for liquefied natural gas (LNG) exports in late January. Natural gas is converted to a liquid to be loaded on ships for transport, then re-converted back to gas on arrival in port.

On Jan. 26, the White House placed an LNG export halt “while it scrutinized how the shipments affect climate change,” reported Bloomberg. The moratorium is “likely to disrupt plans for billions of dollars in projects,” Bloomberg added.

The decision, reported Politico, is “spooking Europe.” While the European Union plans to reach climate neutrality by 2050, it has set no deadline for the phaseout of gas, said Tom Marzec-Manser, head of gas analytics at the commodities intelligence firm ICIS. Europe will almost certainly “need continued access to American exports well into the next decade.”

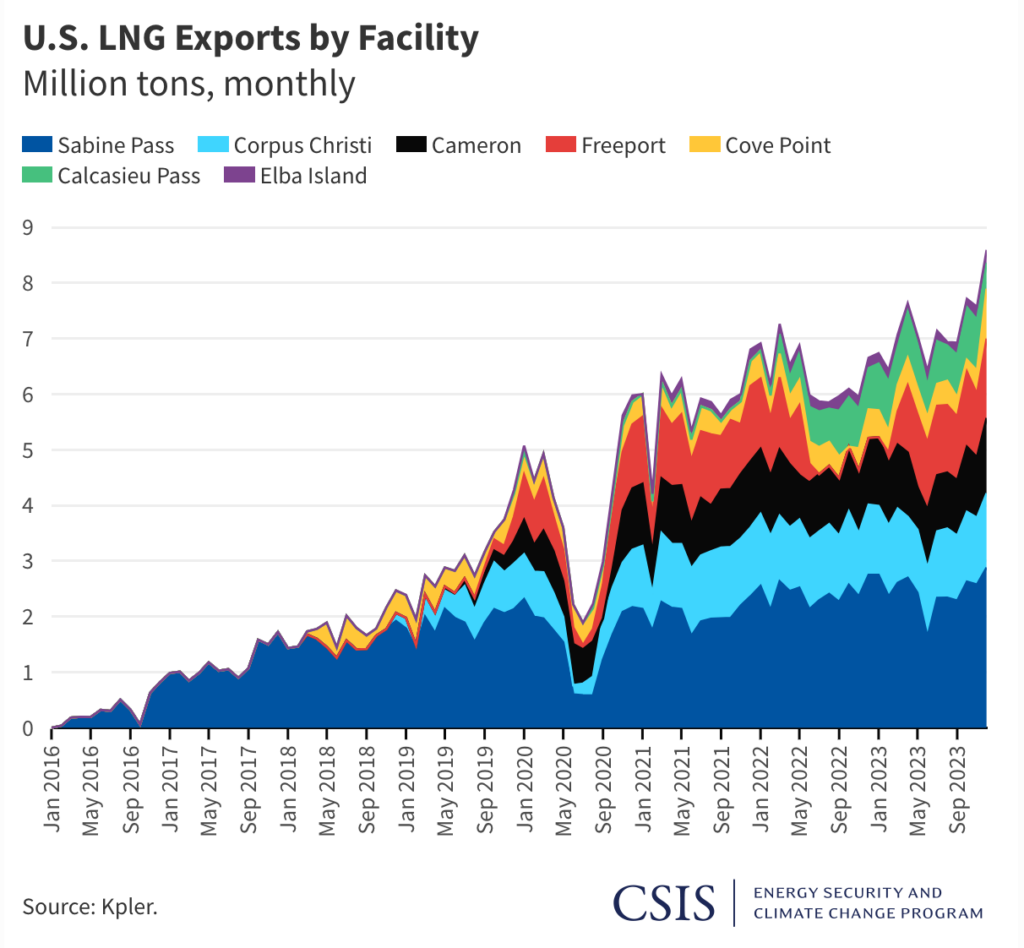

LNG has been one of the triumphs of the U.S. economy in recent years, as both natural gas production and LNG shipments have reached record levels. The U.S. became the largest LNG exporter in the world last year. Meanwhile, domestic gas prices have fallen from over $9 in mid-2022 to less than $3 by the end of 2023. They are now the lowest since mid-2020 in real dollars.

Nevertheless, the Biden Administration has suggested that gas exports have raised prices in the U.S., an assertion that is false, as the Washington Post editorialized: The “ostensible concern behind the Biden policy — higher domestic U.S. gas prices because of shipping gas overseas — is overblown. Prices for gas in the United States have trended down even as LNG exports have boomed” — from zero in 2015 to 8.6 million tons in December 2023.

In a joint statement cited in a Jan. 31 Washington Examiner column by Salena Zito, Pennsylvania Democratic Senators John Fetterman and Bob Casey Jr. declared that they would push for a reversal of the moratorium. “This industry has created good-paying energy jobs in towns and communities across the Commonwealth and has played a critical role in promoting U.S. energy independence,” they said.

The two Senators expressed concern about the pause’s long-term impact on the thousands of jobs in Pennsylvania’s natural gas industry. The state is the second-largest gas producer after Texas. In an FAQ on LNG, the House Energy and Commerce Committee noted:

According to the American Petroleum Institute, increasing LNG exports could add as much as $73 billion to the U.S. economy and upwards of 453,000 American jobs by 2040. Removing restrictions on LNG will allow the U.S. to export more and encourage domestic production, which will reduce American energy supply vulnerabilities. Increasing LNG exports will also encourage investments in other industries, like manufacturing, which will help ensure we beat China.

Mary Landrieu, a former Democratic U.S. Senator from Louisiana, also expressed disapproval for the Biden moratorium in comments published in the Washington Examiner: “I think politically it’s the wrong step for our economy and it undermines the president’s own climate initiatives, which have been historic.”

Former Senator Landrieu praised the Biden Administration for passing the CHIPS Act and the infrastructure bill to provide a foundation for a U.S. industrial renaissance. But, she said, “This action undermines that entire effort…because natural gas is the only available, scalable, low cost, lower emission fuel or foundational fuel to build this economy.”

Landrieu also noted that the country does not have enough nuclear power or hydropower to facilitate a green transition, adding that, “while wind and solar are coming on and we are excited about that advance, they are not sufficient, nor do they run 24/7.”

The chair of the Senate Energy Committee in 2014-15, Landrieu said the effects of the pause go beyond domestic politics. “There is an international aspect…. This pause undermines our national security and sends the absolute wrong signal to our allies around the world that we’re reconsidering a promise we made to them,” she said.

Elan Sykes, the energy policy analyst who authored a Dec. 12 report on the role of U.S. natural gas in Europe for the Progressive Policy Institute, wrote:

It is impossible to imagine unified support for Ukraine between the U.S. and EU could have continued as it did without the long-term project of expanding U.S. export capacity and the rapid short-term expansion of import terminals in Europe.

Prior to the pandemic and the war, Russian gas accounted for 38% of European Union imports, but through the first nine months of 2023, that figure fell to 6%, said the PPI study. The U.S. has filled the gap.

Other Democrats who have commented on the Biden moratorium include Sen. Chris Coons (D-DE), one of the legislators closest to the President, who said, “We need to be really careful about this.” And Former Ohio Democratic Rep. Tim Ryan, who retired last year, admitted in a post on X that the halt was “a major political issue that the D’s have just put themselves squarely on the wrong side,” hurting his party’s ability to win seats in the industrial Midwest. Ryan went even further in a Feb. 22 Wall Street Journal op-ed when he wrote, “Natural gas is a crucial bridge to a clean-energy future, but with so many environmentalists cheering the new Biden policy, it’s almost impossible for American workers not to conclude that Democrats have moved the goal posts.”

For those who care about climate action, restricting LNG exports makes little sense for advocates of reducing greenhouse gases in Asia, where they are being spewed into the air in the greatest volume by far. Gas will help Asian nations decrease their reliance on coal – a transition the U.S. should encourage, not deter.

As we wrote in Newsletter No. 32, Joseph Majkut, director of the energy security and climate change program for the Center for Strategic and International Studies, stated, “It is now pretty much conventional wisdom that the U.S. LNG industry…is a big part of energy security planning.”

The shift away from coal toward natural gas is largely credited with a 35% decline in CO2 emissions by the power sector since 2005, according to a study by the Congressional Budget Office in December 2022. Carbon dioxide emissions in the sector have reached their lowest point in more than 45 years, according to U.S. Energy Information Administration (EIA).

House Passes a Bill to Give FERC, not Energy Dept., Control Over LNG Export Permits, But Compromise Will Be Needed to Win in the Senate

On Feb. 15, members of the House who were distressed by the moratorium took matters into their own hands. They passed H.R. 7176, the “Unlocking our Domestic LNG Potential Act,” by 224-200, with nine Democrats joining a unanimity of Republicans. Among the Democrats voting in favor were Reps. Mary Peltola (AK), Yadira Caraveo (CO), Vincente Gonzalez (TX), and Marie Gluesenkamp Perez (WA).

According to a Congress.gov description, the bill grants the…

Federal Energy Regulatory Commission (FERC) the exclusive authority to approve or deny applications to authorize the siting, construction, expansion, or operation of facilities (e.g., liquefied natural gas terminals) to export natural gas to foreign countries or import natural gas from foreign countries. (Currently, DOE [Department of Energy] authorizes the export or import of natural gas, and FERC authorizes related facilities.)

The description adds: “In determining whether to approve or deny an application, FERC must deem the exportation or importation of natural gas to be consistent with the public interest.”

In short, in the bill introduced by Rep, August Pfluger (R-TX), FERC assumes the “exclusive power” to grant export permits previously granted to DOE. FERC just has to determine if the exporting of gas is consistent with the public interest.

DOE, of course, is a department under control of the White House while FERC is an independent agency, albeit with a chair who was appointed by President Biden. That chair, Willie Phillips, has been a strong advocate both for natural gas and for LNG exports, as we reported in our Issue No. 29. FERC also has a single clear mandate:

Assist consumers in obtaining reliable, safe, secure, and economically efficient energy services at a reasonable cost through appropriate regulatory and market means, and collaborative efforts.

The Speaker of the House, Rep. Mike Johnson (R-LA), hailed the passage of the bill, saying, “When America leads the world in producing and exporting energy, America’s economy is strengthened, its security is ensured, and all our allies benefit as well.”

Rep. Gonzalez, one of the Democrats who voted in favor of the bill, said, “I’m for American energy, I’m for Texas, and I’m for my congressional district, as simple as that. Some people have really lost it on the idea of how we treat American energy in this country.” Gonzalez’s district includes part of the Texas Gulf coast, a focus of LNG activity.

In addition to Sens. Fetterman and Casey, Sen. Michael Bennett (D-CO) has expressed dissatisfaction with the moratorium. “I think it’s been very important for American liquefied natural gas to replace the natural gas that Russia was sending to Europe,” Bennet told Fox News, calling the pause “short-sighted.” He added, “I believe one of the United States’ massive strategic strengths is our energy, our clean energy and our fossil fuels.”

Whether these Senators will vote in favor of the companion bill offered in the Senate by Tim Scott (R-SC) – if it even gets on the floor — is another matter. According to an analysis on Feb. 21 by Tim Tarpley, president of the Energy Workforce and Technology Council, which favors LNG exports:

What are the next steps? Perhaps the most straightforward pathway is if Democratic members continue publicly expressing their concern about the pause, the administration may reverse course (or speed the “review” up) and end the pause on their own. This would clearly be the quickest and cleanest solution.

Tarpley writes that “the other potential scenario is that a compromise piece of legislation, perhaps a bit nuanced from H.R. 7176, gets adequate support to pass both chambers. This could be something along the lines of ending the DOE permit necessity for NATO countries and/or certain other US allies.” Or a new bill could set firm deadlines for the review (moratorium) period to end.

The White House faces strong opposition from the left wing of the Democratic party. “My colleagues on the other side of the aisle know the Senate’s never even going to take this bill up,” said Rep. Diana DeGette (D-CO), ranking member of the Energy and Commerce Subcommittee on Energy, tearing into Republican supporters of H.R. 7176.. “We need to be clear about why the Republicans are bringing this bill to the floor: They think this will be some good campaign ads,” she said.

A Reuters report by Timothy Gardner on Jan. 26 carried the headline, “Biden pauses LNG export approvals after pressure from climate activists.” Wrote Gardner:

The review will take months and then will be open to public comment which will take more time, Energy Secretary Jennifer Granholm told reporters in a teleconference. Biden said in a statement: “During this period, we will take a hard look at the impacts of LNG exports on energy costs, America’s energy security, and our environment.”

In announcing the moratorium, Biden said that the measure “sees the climate crisis for what it is: the existential threat of our time.”

There are, however, other possible existential threats, including the war in Ukraine. Also affected by the moratorium are the health of the U.S. economy and possibly that of the climate itself. Lacking natural gas from both the U.S. and Russia, Europe and still-industrializing nations in Asia may have to keep using coal for electricity and heat.

Amid Growing Scrutiny and Legal Threats, Leading Asset Managers Drop Out of a High-Level Climate Alliance

In a stunning move on Feb. 15, JP Morgan Asset Management and State Street Global Advisors announced they are leaving Climate Action 100+, which calls itself on its website, “an investor-led initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change.”

At the same time, BlackRock, the world’s largest private asset manager, announced that its corporate arm is pulling out of CA100+ and transferring its membership to its smaller international group.

“The decisions,” said Reuters, “remove nearly $14 trillion of total assets from efforts to coordinate Wall Street action on tackling climate change.” The actions came after CA100+ “asked signatories to take stronger action over laggards.”

BlackRock and State Street said that recent changes to CA100+’s strategy would directly conflict with the firms’ fiduciary duties under U.S. law. According to the Financial Times:

BlackRock said in a note that it was dropping its corporate membership because it believes the phase 2 strategy, which takes effect in June, conflicted with US laws requiring money managers to act solely in clients’ long-term economic interest.

The move is a clear reaction to the growing scrutiny being applied it to Environmental, Social, Governance (ESG) criteria by state legislatures, federal officials and think tanks across the country.

A Bloomberg report cited Michael Sheren, a former senior adviser at the Bank of England who’s now a fellow at the Cambridge Institute for Sustainability Leadership, as saying that the asset managers’ decision to quit is indicative of a political environment that’s ignoring the grave future risks posed by a warming planet. Sheren said:

The political winds aren’t rewarding climate-active firms today, but climate risk and regulations aren’t going away in the mid- to long run, so short-term decisions may need to be undone when those longer-term threats begin to manifest, or regulators clamp down harder. JPMorgan pulling out matters because it sends the wrong, short-sighted signal and gives cover for others to do the same.

“I wouldn’t be surprised if we see more defections, especially given that there’s now a cost, such as potential litigation, that wasn’t there when companies joined,” said Lance Dial, a Boston-based partner at law firm K&L Gates LLP, quoted by Bloomberg. “Attorneys general have subpoenaed firms about their membership of these groups.”

The pushback against financial firms began in 2021 when Texas passed laws restricting government contracts with businesses that take punitive stances toward the fossil-fuel industry. According to a Bloomberg report by Danielle Moran on Feb. 8:

Texas has barred some state entities, including pensions, from investing in roughly 350 funds run by asset managers such as BlackRock Inc. that the Texas comptroller says engage in “boycotts” of fossil fuels. The legislation has also prompted state officials to prohibit Citigroup Inc. and Barclays Plc from helping the state and its local governments raise money for infrastructure projects through bond deals.

Financial institutions have found themselves under pressure from competing political interests in recent years over climate issues. Democrats often accuse these firms of not doing enough to combat greenhouse gas emissions while Republicans say the firms are placing ideology over return on investments involving public funds, such as government pensions.

In December, the U.S. House Judiciary Committee, under Rep. Jim Jordan (R-OH), subpoenaed BlackRock, State Street and Vanguard as part of an investigation into the “sufficiency of current antitrust laws to address collusive agreements to promote and adopt left-wing environmental, social, and governance (ESG) goals.” The committee has also subpoenaed an official of Climate Action 100+.

In leaving or paring back their participation in CA100+, the asset managers continue to offer opportunities for their clients to make ESG-oriented investments if they wish. According to the Financial Times, BlackRock “is setting up a new stewardship option allowing clients, particularly in Europe, to set decarbonization as part of their investment objectives. For clients who do not opt do so, BlackRock will continue to prioritize financial results.” In addition, JP Morgan…

said it had made a ‘significant investment’ in its own stewardship team and corporate engagement: “Given these strengths and the evolution of its own stewardship capabilities, JPMAM [JP Morgan Asset Management] has determined that it will no longer participate in Climate Action 100+ engagements.”

The House Judiciary Committee and Utah Attorney General Sean Reyes, among others, celebrated the news on X (the former Twitter).

Meanwhile, the Sierra Club criticized the firms:

Asset managers that cave to disingenuous political attacks from climate-deniers are signaling that they will abandon their fiduciary duty to mitigate climate risk for short-term expediency’s sake…. It is naive for financial firms to think that leaving voluntary climate initiatives will stop the onslaught of attacks from far-right extremists — or change essential imperative to address the climate crisis.

The New York City Comptroller, Brad Lander, a Democrat, said in a press release, “Climate risk is financial risk. Today, BlackRock, JPMorgan, and State Street are choosing to ignore both.” Lander specifically attacked the CEO of BlackRock:

Three years ago, Larry Fink declared that climate risk is financial risk, but today’s announcement makes a mockery of that recognition. Putting clients who take climate risk seriously in their own small silo, while voting most of BlackRock’s shares against even the most minimal climate disclosures is a failure of both leadership and fiduciary duty.

The departures may force CA100+ — or perhaps a successor organization — to view climate policy more broadly as it intersects with capital allocation.

A Drive for Zero Emissions in New York Is Raising Utility Rates, So Taxpayers Are Footing the Bill for Energy-Bill Credits

New York Governor Kathy Hochul announced Feb. 16 that the state’s Public Service Commission “has adopted a $200 million energy bill credit program to be managed by large electric and gas utilities on behalf of their customers.”

The program, paid for by an appropriation of the legislature (i.e., by taxpayers), “aims to aid more than 8 million directly metered electric and gas customers in New York,” according to Reuters.

“Energy affordability continues to be a top priority…and this utility bill credit is just one of many actions New York is taking to reduce costs,” Hochul said in a news release.

Some observers have noted the irony in both the distribution of funds and in Hochul’s statement about affordability. According to the EIA, New York consumers pay the fifth-highest electricity rates in the mainland United States. Despite its own abundance of natural gas in the ground, New York ranks 11th-highest for consumer natural gas prices as of November 2023. A big reason is the state’s refusal to allow natural gas to enter New York through pipelines. A 2019 report by Robert Bryce, formerly of the Manhattan Institute, stated:

While these restrictions are claimed to be necessary to protect the environment from harm, they will likely result in increased use of heating fuel oil, which means increased air pollution and carbon-dioxide emissions. New York and the New England states already have some of the highest residential gas and electricity rates in the country, and these rates will only rise as a result of the blockade.

That’s what has happened. New York is the number-one state for home heating oil use, and after a rate hike was approved in July 2023, the New York Post noted that the following month, “Con Ed [New York’s monopoly utility] will spike rates across the city by a staggering 9% as part of the three-year rate plan greenlighted by the state Public Service Commission.” And there are more increases. The Washington Examiner reported that a customer using 2930 kilowatt hours of electricity a month received a 6.7% increase this January and will get another 6.6% hike next January.

Even higher costs are coming as New York tries to meet the goals of the state’s 2019 Climate Leadership and Community Protection Act, which calls for 70% renewable energy by 2030 and zero emissions by 2040. The state will have to triple its renewable capacity in eight years to meet the targets.

An Albany Times Union report last year said that, according to the New York State Energy Research and Development Agency, which sets contracts for electricity sales by solar and wind developers, “Electricity prices could rise 64% in order to cover inflation and the higher-than-anticipated costs that are becoming apparent in New York’s shift to renewable energy.”

No wonder the Governor is advocating more money from taxpayers to pay for the higher prices of energy. It’s hard to see how long these kinds of transfers from one of a consumer’s pockets to another will last. At any rate, it’s hard to see how the transition to renewable energy, New York-style, is anything close to affordable.