- President Biden’s three nominees for the five-person Federal Energy Regulatory Commission faced a Senate confirmation hearing.

- Senators asked tough questions, with a focus on natural gas, climate change and overall electric grid reliability. Some were skeptical about one nominee’s answers.

- Industry stakeholders and Senators were generally supportive, but Sen. Manchin will have the last word.

- EPA makes its tailpipe emissions rule final. There were some modifications, but it is still an aggressive policy to shift Americans to electric vehicles at a time when EV enthusiasm has waned.

- The environmental board in Maine rejects California-style regulations to require EVs to represent 82% of vehicle sales in just eight years.

- The demand for electricity takes a turn upward. The reasons: manufacturing and Artificial Intelligence. Reliability Will Be Tested.

- For reasons of economics and security, critics in Europe, Japan and the U.S. want the White House to end its moratorium on new LNG exports.

- In another big decision, the EPA modifies its controversial proposed rules for power plants. Existing natural gas facilities will be exempt, at least until after the November elections.

Senate Hearing Tests Biden’s Three FERC Nominees

Reliability was front and center on March 21 when the Senate Energy and Natural Resources Committee held a confirmation hearing for three nominees to fill seats on the Federal Energy Regulatory Commission (FERC).

Two seats – one for a Democratic nominee and one for a Republican – are currently vacant. A third will be open when the term of Democrat Allison Clements expires in June.

If all three are confirmed, FERC will be up to its full complement of five members. Sen. Joe Manchin (D-WV), who chairs the committee, said a “fully-seated, bipartisan” commission offers “more opportunity for advancing long-lasting, sensible energy infrastructure policy.”

“I am eager for there to be a five-person commission, I think having a full commission adds value to what they produce,” said Sen. John Hickenlooper (D-CO). “We will get a more collaborative effort and get better rules.”

The last time FERC had five commissioners was in January 2023, when Richard Glick, who was then chairman, departed the agency after Manchin blocked his reconfirmation bid. Glick backed additional climate considerations for pipeline reviews – a position that Manchin and other members of the committee vigorously opposed.

When Clements announced in February that she would not seek a second term, the FERC board faced a potential crisis because, with just two members, it would lack a quorum and be unable to transact business.

The three nominees are Democrats Judy Chang (for a term expiring in June 2029) and David Rosner (June 2027) and Republican Lindsay See (June 2028).

Chang appears to be the only controversial choice —and only in some circles. An adjunct lecturer at the Harvard Kennedy School, she was formerly Undersecretary of Energy and Climate Solutions for Massachusetts and a member of the board of the Massachusetts Clean Energy Center. According to her biography, in her role as a state official, she led the “effort in setting policies across the energy sector in the state, working across agencies in aligning the strategies and plans for decarbonization and climate mitigation.”

Rosner is an energy industry analyst for FERC, currently on detail to the U.S. Senate Energy and Natural Resources Committee Democratic staff. Manchin recommended him to the Biden Administration as a commissioner, according to media reports last fall. He was previously a senior policy advisor at the U.S. Department of Energy’s Office of Energy Policy and Systems Analysis and an associate director of the energy project at the Bipartisan Policy Center (BPC). Sasha Mackler, executive director of the energy program at the BPC, said Rosner is a “pragmatic and strategic thinker.”

Some environmental activists disagreed. “The only thing worse than a Joe Manchin staffer on FERC is a Joe Manchin staffer who used to work for a fossil fuel front group,” said Lukas Ross, Friends of the Earth’s climate and energy deputy director, in a statement, referring to BPC.

See is the Solicitor General of the State of West Virginia, Manchin’s home state. She previously practiced appellate and administrative law for several years with Gibson, Dunn & Crutcher in Washington, D.C. She graduated magna cum laude from Harvard Law School and clerked for Judge Thomas B. Griffith on the D.C. Circuit.

As E&E News reported, See argued on behalf of Republican-leaning states and energy interests in West Virginia v. EPA, a landmark decision the Supreme Court issued in June 2022. “The court’s 6-3 opinion said the Clean Air Act did not give EPA the authority to craft a broad power plant emissions rule like Obama-era Clean Power Plan, a proposal announced in 2015 that never went into effect,” said E&E. “The Supreme Court’s ruling restricted how the federal government can regulate carbon emissions from power plants.”

During the hearing, Republicans appeared unhappy with some of the answers they received from Chang, but, as the Washington Examiner reported, “Democrats, on the other hand, didn’t have as much of an issue with the Republican pick Lindsay See, or David Rosner.”

“I thought all three did a good job,” said Sen. John Hickenlooper (D-CO). “They demonstrated they’re willing to work together and collaborate. They weren’t going to get bogged down in partisan issues. They’re going to look at doing everything they can to create a resilient, reliable network of transmission at the lowest possible cost.”

Nominees Are Probed on Where They Stand on Key Issues. One of Them Triggers Skepticism.

FERC faces important decisions regarding natural gas and its role in providing reliability at a time of intense pressures, including the Biden Administration’s desire to speed the transition to renewable energy sources, the increasing demand for electricity from electric vehicles (see section below), Artificial Intelligence (AI) needs (also, see below), and uncertainties regarding severe weather events.

Several recent reports have warned of rising reliability risks, and during the hearing, Republicans on the committee pressed nominee Judy Chang over her prior comments about natural gas.

For example, in an interview with the Washington Examiner while she worked as a consultant for the Brattle Group in 2018, Chang predicted that New England would move away from natural gas within five years, so it would be fiscally irresponsible to invest in gas pipelines.

“If you have states already setting goals and policies to bring onto the grid more hydropower, offshore wind, plus other renewables and clean energy, does it make sense at the same time to build more gas pipelines or gas plants?” Chang said at the time. “To me, it doesn’t make sense, because all those costs will be paid by ratepayers in one way or another.”

At the hearing, Sen. John Barrasso (R-WY), the ranking member of the committee, referred to the Examiner piece and said, “Under the law, FERC is responsible for ensuring the development of abundant supplies of natural gas at reasonable prices. Ms. Chang in the past has advocated for the direct opposite…. The last thing FERC needs is someone eager to impose the failed policies of Massachusetts upon the rest of the nation.”

He cited a March 18 report issued by ISO New England, the grid operator for the region, and said, “The future grid for New England may lack sufficient natural gas pipeline infrastructure to meet the region’s winter fuel demand.”

Chang responded, “I think the issue is very complex in New England.”

Sen. Barrasso asked again if she thought building pipelines was fiscally irresponsible, and she responded, “If I had my magic wand, I would love to have more gas infrastructure and gas supply to New England. But the issues are complicated in New England, and I look forward to an opportunity to work on that.”

Addressing another key issue for committee members, Sen. Steve Daines (R-MT) asked the nominees their views on the proposal that triggered Manchin’s ire and led to Chairman Glick’s downfall: “changes in how FERC certifies natural gas infrastructure, with the goal of formalizing a review of its impact on greenhouse gas emissions,” as Roll Call put it.

Did the nominees believe that creating a more climate-centered process for approving natural gas pipelines was outside FERC’s jurisdiction – that is, did they support the commission’s eventual decision to reject Glick’s position and retreat on those plans?

Pursuing the same issue, Sen. Mike Lee (R-UT) asked Chang if she thought it was “appropriate for FERC to regulate downstream emissions from a natural gas pipeline project, to which she said that the Natural Gas Act doesn’t specify greenhouse gas emissions as a criteria for denying pipeline projects or specify climate change in its determinations,” E&E News reported.

But Chang’s response equivocal to some at the hearing. “I understand the tension,” she said. “I have not reviewed everything in those policy statements. And if I were fortunate enough to be confirmed, I will dedicate my time to better understand the issues at hand.” But, as the Washington Examiner reported, “She later stated that she supported the current commission’s decision to pull back from Glick’s approach.”

She also said: “Senator, it’s about our individual lives and our personal contribution to the climate crisis that we face. As far as FERC’s role is concerned, if I have the honor to be confirmed, I will make sure that I follow the law and Congress is in the position to set the law and FERC is an agency that follows the law.”

That didn’t satisfy Sen. Daines. “She wouldn’t give me a straight answer,” he later told the Examiner. “I’m going to look through it in detail, but I have got some real concerns.”

Lindsay See, the West Virginia official, emphasized that FERC should not overstep its authority. “My role as a state lawyer also solidified my respect for the interplay between state and federal regulators,” she said, adding, “I take the rule of law and separation of powers seriously. I’m committed to the simple notion that agencies have only the power that you, Congress, give to them.”

Sen. Martin Heinrich (D-NM) noted that the committee had heard testimony from FERC, the North American Electric Reliability Corp. (NERC), and the energy industry that transmission of electricity across regions was critical to reliability. He asked the nominees if they would commit to a final rule with strong provisions on interregional transmission capacity.

Utility Dive summed up the responses: “Rosner said this was a priority for him, while Chang said she sees ‘many benefits’ associated with building out transmission infrastructure, including interregional, and would make it a priority if confirmed to ‘better understand the constraints’ and work with stakeholders. See said she views transmission as a very important issue and supports the ‘orderly buildout’ of needed transmission.”

Sen. Lee worried about fair cost allocation across regions. He asked See if she thought FERC should require Utah ratepayers to pay for California’s future transmission projects if they were built “solely for the purpose of satisfying California’s public policy goals.”

See responded, “I think it’s certainly important for the commission to be looking at what it looks like to have fair allocation in terms of just and reasonable rates.” She added, “I’d be looking very closely at that statutory authority in any of these questions.” Both Chang and Rosner agreed that only beneficiaries should pay the transmission cost allocation.

Another issue with which FERC will certainly deal is LNG, or liquefied natural gas (see separate section below). The Biden Administration ordered a temporary pause on LNG exports in January because of climate concerns, and stakeholders are eager for a full commission to advance projects like Calcasieu Pass 2 in southwestern Louisiana, which has suffered commissioning delays.

The nominees “will play an essential role in continuing to advance the growth of U.S. LNG, and we look forward to working with each of them once confirmed,” said Charlie Riedl, executive director of the Center for Liquefied Natural Gas, according to E&E News coverage.

Comments About the Nominations from Industry Stakeholders

Reliability remains the major concern of industry stakeholders.

INGAA, the Interstate Natural Gas Association of America, applauded Biden’s nominations and called for a speedy process to fill FERC vacancies and not jeopardize “the development of the energy infrastructure needed to deliver natural gas to American homes and businesses and to our allies abroad.”

As the hearing began, EPSA, the Electric Power Supply Association, issued a press release stating:

As the merits of these nominees are considered, it is imperative that Senators focus on the bedrock functions of FERC and ensure that the reliability of America’s energy system is the top priority for any nominee that is confirmed. Clarity on how these nominees will regulate the energy system as FERC commissioners is essential to ensure Americans have the reliable power they need to run their lives and businesses.

In the release, EPSA reminded Senators of the “five essentials” to which the organization says the nominees must commit: prioritizing system reliability; addressing current operational realities, “specifically the growing delta” those realities and “aspirational goals”; improving results within markets through pragmatic reforms; adopting a holistic approach to energy infrastructure regarding electricity and natural gas; and facilitating reliable energy expansion to meet rising demand.

“Regulators must recognize the energy sector is undergoing more than a fuel source transition,” said EPSA.

Similarly positive statements about the nominees came from groups with diverse interests such as the Environmental Defense Fund and the industry group Advanced Energy United, and from a joint statement by the Center for LNG and the Natural Gas Supply Association.

Democratic committee members like Sens. John Hickenlooper (CO) and Alex Padilla (CA) said they expect to support all three candidates. The Examiner concluded that with doubts about Chang, “the key vote…will be from the centrist committee chairman himself, Democratic Sen. Joe Manchin, in order to advance the nominee out of the panel.” So far, a committee vote has not been scheduled.

With Some Requirements Delayed, EPA Makes Final a Sweeping Rule to Facilitate Rapid Shift to Electric Vehicles

On March 20, the Environmental Protection Agency (EPA) issued its final rule for vehicle emissions, a regulation whose effect will be to facilitate a rapid shift from gasoline- to electric-powered vehicles. The New York Times called it “one of the most significant climate regulations in the nation’s history.”

Last year, Americans purchased 1.2 million electric vehicles (EVs) – a record, but still just 7.6% of total U.S. car sales. The target for 2032 under the new rule is that 56% of new cars be full EVs, with an additional 16% being hybrids.

An EPA press release on a rule officially termed “Multi Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles,” but better known as the “tailpipe rule,” stated that new regulations for model years “2027 through 2032 and beyond…will avoid more than 7 billion tons of carbon emissions and provide nearly $100 billion of annual net benefits to society, including $13 billion of annual public health benefits due to improved air quality, and $62 billion in reduced annual fuel costs, and maintenance and repair costs for drivers.”

The rule made concessions to automakers and labor unions by delaying some of the requirements in its original proposal. The United Auto Workers, a union that has endorsed Biden, has expressed concerns because electric vehicles (EVs) could require less labor to build.

The new rule “will ultimately reduce nearly as much emissions as the original proposal, [but] it will do it gradually and build in more flexibility for automakers in the beginning,” reported CNN.

The Administration was quick to say that the new rule is not a “mandate,” or a requirement for Americans to buy EVs. As EPA Administrator Michael Regan told reporters, “When you look at the differences between the proposal and final, you will see that there is absolutely no mandate.” He added that his agency was staying “well within the confines of the law.”

Others disagreed about the mandate. Automakers will have flexibility in meeting the new regulations (for example, building a mix of hybrids and full EVs), but they will have to sell vastly more EVs than they do today.

“Make no mistake,” said a Wall Street Journal editorial on March 20. “This is a coerced phase-out of gas-powered cars.”

The new rule comes as Americans are balking at EVs. “Electric vehicle sales slowed in the first quarter of 2024, compared to the last quarter of 2023, according to Cox Automotive,” reported NPR, which added that the decline came after 13 consecutive quarters of increased EV sales.

One problem is charging infrastructure. “The federal government was supposed to help with this,” reported the New York Times. “In 2021, Congress allocated $7.5 billion to build tens of thousands of E.V. chargers around the country. But as of December, not one had been installed.”

An even bigger problem is cost – though the gap has narrowed. A year ago, “the average new EV cost about $15,000 more than the average gas-powered new car; by the end of the first quarter, 2024, that gap had narrowed to about $5,300.”

But that reduction is partly due to a slowdown in sales and dealers’ need to get new EVs – especially those made by Tesla, the industry leader – off their lots. Tesla reported that it delivered 8.5% fewer EVs in the first quarter of 2024 than the same period a year earlier.

Tesla has special problems, including poor service and a divisive CEO, but the demand for EVs appears to have declined. For example, the rental car provider Hertz was charging $49.35 a day for a gas-powered small SUV but just $35.62 for a similar electric-powered one.

The Journal editorial noted that while EVs made up about 8% of total new U.S. auto sales last year, they accounted for less than 4% of sales by General Motors and Ford but 13% of sales by BMW and 11% by Mercedes. “The average cost of a new EV is roughly $50,000, and only two cost less than $40,000 as of December: the Chevy Bolt and Nissan Leaf,” said the editorial. “Some makers have slashed EV prices to boost sales, but they are also losing money. Ford ran an operating loss of $4.7 billion on its EV business in 2023, equivalent to $64,731 per EV sold.”

These U.S. companies are “heavily subsidizing EVs with profits from gas-powered cars,” said the Journal. “This means middle-class Americans in Fargo are paying more for gas-powered cars so the affluent in Napa Valley can buy cheaper EVs. This cost-shift won’t be financially sustainable as the Biden mandate ramps up, and it may not be politically sustainable either.”

In a Wall Street Journal op-ed on March 26, Jonathan Lesser and Mark Mills of the National Center for Energy Analytics expressed concern at the massive investment needed to deliver vehicle-charging electricity. They wrote:

Widespread adoption of EVs will require an unprecedented and staggeringly expensive expansion of local electrical grids. This will require a huge increase in the production of electrical transformers, along with more power plants and transmission lines to produce and deliver energy.

They continued, “This overhaul must include upgrading local grid distribution at the roughly 3,000 electric utilities across the country—the wires, poles and transformers that line our streets…. On an individual level, millions of homes and apartment complexes will need electrical upgrades to accommodate at-home chargers.

“Consumers and taxpayers will pay for that multibillion-dollar price tag, whether through taxes or higher utility rates. Electricians will need to install new circuits for EV chargers, and many older homes will need new power panels to handle increased demand.”

Lawsuits challenging the rule are already being filed. E&E News reported on March 25, “A brewing legal battle against the Biden administration’s efforts to curb the largest source of planet-warming pollution in the United States has the potential to go all the way to the nation’s highest bench.”

The main issue is whether the rule exceeds the EPA’s authority under the U.S. Supreme Court’s 2022 decision in West Virginia v. EPA. That decision embraced the “major questions doctrine,” which, according to an analysis by the law firm Akin Gump Strauss Hauer & Feld, “threatens to limit agency authority in a narrow but exceptionally significant band of administrative rulemakings—i.e., the biggest, most innovative, and most consequential ones.”

On the day the EPA issued the final rule, Sens. Pete Ricketts (R-NE) and Dan Sullivan (R-AK) introduced a Congressional Review Act (CRA) resolution to block it. The CRA provides Congress with the power to overturn certain agency actions, subject to a presidential veto, which would be certain in this case.

“President Biden’s EV mandate is completely delusional. It’s foolish. It’s just plain wrong,” said Sen. Ricketts in a press release. “We lack the power generation, infrastructure, and domestic supply chain of critical minerals to make Biden’s mandate work. The end result of this EV mandate will be higher prices, greater dependence on the Chinese Communist Party, and less choice for consumers.”

The issues of the Chinese threat and consumer choice could be powerful politically. The Chinese automaker BYD surpassed Tesla last year as the world’s number-one EV maker, and the Chinese are by far the largest purchasers of EVs overall. But BYD, which makes EVs that sell for as little as $11,000, is not coming to the U.S. any time soon.

China controls most mining and processing of a group of 17 metals known as rare earths, which are used to produce “permanent magnets” to power EVs. Still, according to a Voice of America report last year, “New motor designs show that permanent magnets are not necessary to produce a commercially successful EV. And some Western EV makers are finding new solutions to produce motors that avoid rare earth minerals.”

The American Fuel & Petrochemical Manufacturers, a trade group, has started a large ad campaign to politicize what it calls “Biden’s E.P.A. car ban” in swing states. The rule, of course, does not “ban” gasoline-powered cars, but it forces automakers to take measures to supercharge sales of EVs. That is no easy task.

The New York Times points out that “at one point last year, two-thirds of U.S. dealerships did not have a single E.V. for sale, according to a Sierra Club report. And about half of dealers said they wouldn’t offer an E.V. even if they could.”

As with so much of American life, preferences have an ideological component. A Gallup poll found that 71% of Republicans would not buy an E.V., compared with 17% of Democrats. Part of that gap is explained by a rural-urban divide based on the greater distances that people outside cities must drive.

Maine Rejects California-Style Rule to Require a Majority of Car Sales Be EVs by 2028

At the same time the EPA issued its new tailpipe rule, Maine’s top environmental regulator, the Board of Environmental Protection (BEP), rejected a proposed state electric vehicle (EV) mandate that would have closely mirrored regulations approved in California, requiring that at least 51% of new car purchases in the state be electric by 2028 and 82% by 2032.

Seventeen states have already adopted California-style standards, but the BEP, according to WABI-TV, said “there are still too many questions regarding…the cost of charging an EV and whether Maine has the infrastructure in place to handle EVs.” In addition, “Board Chair Sue Lessard says with a proposal this big, the legislature needs to have the final say.”

The proposal triggered widespread opposition, including from the Maine Automobile Dealers Association and Democratic Rep. Jared Golden, who represents a largely rural district. On X (formerly Twitter), Golden wrote:

Affordable transportation is a requirement, not a luxury, in rural Maine. Regulations must recognize reality: California-style emissions standards would impose logistic and financial hurdles that Maine isn’t ready to clear. The state BEP made the right decision to reject them.

A further concern is that the Maine electric grid is currently unequipped to handle the increased demand from much broader EV adoption, particularly with the state’s severe winter weather. Its rural population, especially, could be severely affected by power outages and rolling blackouts.

California, which faces “the threat of rolling blackouts for years to come,” according to the New York Times, has told drivers of EVs in the past not to charge their cars during times of peak demand such as periods of excessively warm weather.

New Report Shows Demand for Electricity Spiking, and AI Is a Big Reason; Reliability Will Be Tested

Demand for electricity across the U.S. is spiking – and EVs aren’t the only reason. Extreme weather in parts of the country during the summer has played a role, as has the shift to electric appliances, revamped manufacturing operations, and burgeoning data centers, in part because of the boom in Artificial Intelligence (AI) applications.

A new report from Grid Strategies titled “The Era of Flat Power Demand is Over,” sounds the alarm about the grid infrastructure’s lack of preparedness as near-term electricity demand forecasts increase.

The report, which has received broad coverage, begins by noting that “the nationwide forecast of electricity demand shot up from 2.6% to 4.7% growth over the next five years, as reflected in 2023 filings.”

The report presents a chart based on NERC data that shows the annual rate of growth in electricity use for 10-year forecasts at 2% for 2005, then dropping consistently to a little under 0.6% by 2016. All of a sudden, the rate is now turning up again. It will soon be 1% or even more.

“The numbers we’re seeing are pretty crazy,” said Daniel Brooks, vice president of integrated grid and energy systems at the Electric Power Research Institute, a nonprofit organization.

The report says that “grid planners forecast peak demand growth of 38 gigawatts through 2028, requiring rapid planning and construction of new generation and transmission.” This is, as the New York Times stated on March 14, “like adding another California to the grid.” But, the Grid Strategies report continues, “This is likely an underestimate. Several more recent updates are adding additional GWs to that forecast. Next year’s forecast is likely to show an even higher nationwide growth rate.”

Why? “Beginning in 2022 and especially in 2023, a surge in data centers and industrial development caused sudden, shockingly large increases in 5-year load expectations,” said the report. Other factors such as heat pumps, water heaters and EV charging will be “more impactful in the 2030s.” Also waiting in the wings as drivers of electricity use are hydrogen production plants, which are being heavily subsidized by the Bipartisan Infrastructure Bill and the Inflation Reduction Act (IRA).

Over 200 new manufacturing facilities for transportation and clean energy industries have been announced since the IRA was passed. Those facilities are concentrated, said the report, in the Southwest, especially Georgia and the Carolinas; Southwest, especially Arizona and Nevada; and Midwest, especially Michigan and Indiana.

The Washington Post reported, “In Georgia, demand for industrial power is surging to record highs, with the projection of new electricity use for the next decade now 17 times what it was only recently. Arizona Public Service, the largest utility in that state, is also struggling to keep up, projecting it will be out of transmission capacity before the end of the decade absent major upgrades. Northern Virginia needs the equivalent of several large nuclear power plants to serve all the new data centers planned and under construction. Texas, where electricity shortages are already routine on hot summer days, faces the same dilemma.”

The increased demand means that “the U.S. electric grid is not prepared for significant load growth,” said the report. In the first half of the 2010s, the U.S. installed 1,700 miles of new high-voltage transmission lines, but that figure dropped to just 645 miles in the second half of that decade. “Low transfer capability between regions is a key risk for reliability if load growth outpaces deployment of new generation in some regions,” said the report.

A major factor in the increased need for electricity Is not just the manufacturing boom triggered by the IRA but also rapid innovation in AI, which, says the Washington Post, “is driving the construction of large warehouses of computing infrastructure that require exponentially more power than traditional data centers. AI is also part of a huge scale-up of cloud computing.”

The Post’s article by Evan Halper on March 7 continued, “Tech firms like Amazon, Apple, Google, Meta and Microsoft are scouring the nation for sites for new data centers, and many lesser-known firms are also on the hunt. The proliferation of crypto-mining, in which currencies like bitcoin are transacted and minted, is also driving data center growth. It is all putting new pressures on an overtaxed grid.”

Reuters reported on March 29 that “Microsoft and OpenAI are working on plans for a data center project that could cost as much as $100 billion and include an artificial intelligence supercomputer called ‘Stargate’ set to launch in 2028.” (First reported by The Information the day before.)

According to Scientific American, a peer-reviewed analysis in the journal Joule of AI electricity use, published in September, is “one of the first to quantify the demand that is quickly materializing. A continuation of the current trends in AI capacity and adoption are set to lead to NVIDIA shipping 1.5 million AI server units per year by 2027. These 1.5 million servers, running at full capacity, would consume at least 85.4 terawatt-hours of electricity annually–- more than what many small countries use in a year, according to the new assessment.”

The data scientist who produced the assessment told Scientific American:

If you were to fully turn Google’s search engine into something like ChatGPT, and everyone used it that way—so you would have nine billion chatbot interactions instead of nine billion regular searches per day—then the energy use of Google would spike. Google would need as much power as Ireland just to run its search engine.

The Post’s Halper views the energy crunch as preventing the attainment of climate goals, threatening “to stifle the transition to cleaner energy, as utility executives lobby to delay the retirement of fossil fuel plants and bring more online.” Similarly, the crunch, says the Post, imperils the ability of utilities “to supply the energy that will be needed to charge the millions of electric cars and household appliances required to meet state and federal climate goals.”

Brad Plumer and Nadja Popovich of the New York Times made a similar point:

In an ironic twist, the swelling appetite for more electricity, driven not only by electric cars but also by battery and solar factories and other aspects of the clean-energy transition, could also jeopardize the country’s plans to fight climate change.

Irony aside, another way of looking at the Grid Strategies report is that it shows how reaching climate goals through electrification and the smart solutions that AI engenders will require an efficient and abundant supply of energy across the nation. In order to prevent needless blackouts, cutbacks, and other reliability challenges, the U.S. today appears to require an all-of-the-above strategy for energy sources. No single source should be favored to fortify the grid.

Critics in U.S. and Europe Call for an End to the LNG Export Moratorium

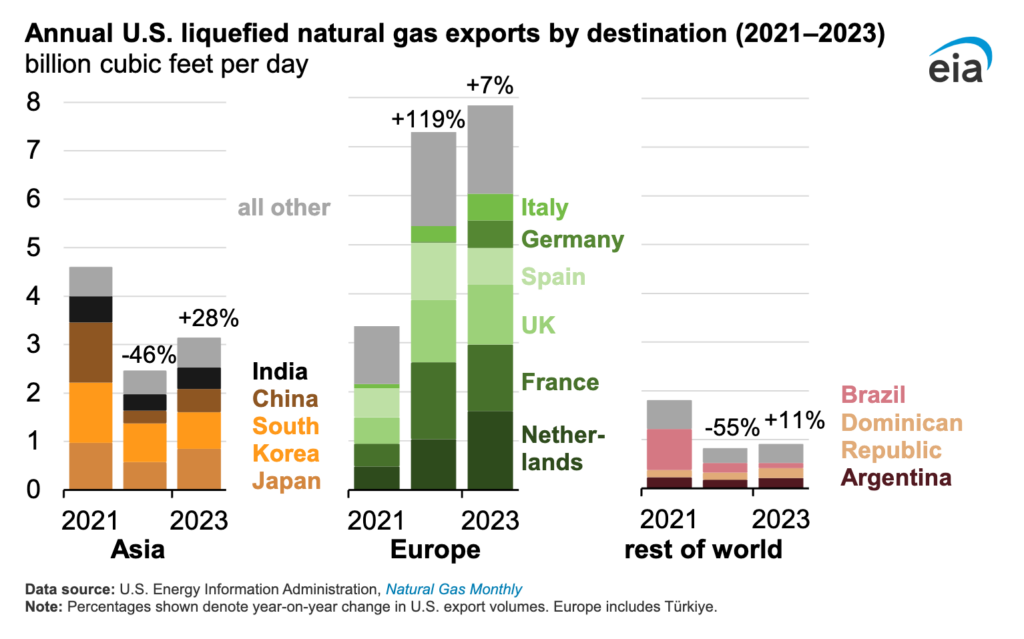

Pressure is mounting on the Biden Administration to end the LNG export moratorium initiated on Jan. 26. The “temporary pause” applies to decisions on allowing exports to countries without a free-trade agreement (FTA) with the United States, which in 2023 became the top exporter of liquefied natural gas in the world. (LNG is converted from a gas to a liquid for ocean transport and then converted back to a gas on arrival.)

Currently, FTAs cover 19 countries, more than half of them in Central and South America and the rest in the Middle East and Asia, plus Australia and Canada. None of the countries are in the continent where most LNG now flows: Europe. Japan, another non-FTA country, is the leading non-European recipient.

The justification for the moratorium on LNG is that the Department of Energy (DOE) needs to “update the underlying analyses for authorizations.” Current analyses, said the White House, “no longer adequately account for considerations like potential energy cost increases for American consumers and manufacturers beyond current authorizations or the latest assessment of the impact of greenhouse gas emissions.”

The White House points to “the perilous impacts of methane on our planet” and the “risks to the health of our…frontline communities in the United States who disproportionately shoulder the burden of pollution from new export facilities.”

On March 21, Louisiana Attorney General Liz Murrill led 16 states, all with Republican governors, in suing the Biden Administration in U.S. District Court, charging that the moratorium has “no legal basis.” Murrill said, “I’m not sure the American people feel the pain of this particular decision yet, but it is part of a larger plan by this administration to destroy the fossil fuel industry.”

According to a Reuters article, “The states said the pause on new approvals for LNG exports oversteps DOE’s authority under the Natural Gas Act, which they said requires the agency to affirmatively show projects are inconsistent with the public interest before denying applications.”

The pause directly affects the $10 billion Calcasieu Pass 2 project in Louisiana (see above), which has an export capacity of 20 million metric tons per year. Currently, the U.S. exports 89 million tons of LNG. The terminal will be an important economic contributor to the region, and local leaders such as Mike Moncla, president of the Louisiana Oil and Gas Association, are encouraging Murrill in the suit.

Europeans are especially concerned that the LNG pause will hurt their security. Europe sharply reduced its reliance on Russian natural gas with the invasion of Ukraine, and LNG from the U.S. has filled the gap. Spanish economics researcher Diego Sanchez de la Cruz, writing in Libre Mercado, and Anna Fotyga, a Polish member of the European Parliament and former Polish Foreign Minister, writing in The National Interest, were dismayed by the Administration’s action. Fotyga wrote:

Money and weapons are essential elements for Ukraine to win this war—and, by extension—for a Europe that wishes to be serious about deterring and defeating Russian aggression. But they are not the whole story. In the same breath, we have to speak about energy, which is too often treated as a secondary concern. It is not. Energy from the United States is essential to the entire question of European security.

She added that “the decision to deepen reliance on Russian gas has now proven to be a grave error—as the late President of Poland, Lech Kaczynski, and I predicted at the time. Instead of cultivating a mutual sense of cooperation, we were met with attacks.”

She continued:

Almost two-thirds of all U.S. LNG exports now flow to Europe, allowing us to wean off Russian gas while continuing to guarantee the security of supply. Russian gas has fallen from a 41 percent share in Europe in 2021 to 8 percent in 2023, which is a huge success. U.S. LNG is also less polluting than Russian gas.

So naturally, Fotya wrote, “we were surprised by the announcement of an effective halt to permits for new U.S. terminals that ship LNG to European and Asian allies. The implications for Europe are worrying.”

The Japanese have also expressed deep concern over the moratorium. “Despite gradually cutting LNG imports over the past decade thanks to nuclear power restarts and renewable energy, Japan still relies on LNG for a third of its electricity mix and the role of the United States as a supplier has been increasing,” said a Reuters article in January. “Imports from the United States jumped last year by 34% to 5.5 million metric tons.”

Jeff Kupfer, former DOE acting deputy secretary, wrote in the Pittsburgh Post-Gazette on March 23 that the moratorium hurts Pennsylvania, the nation’s second-largest natural gas producer after Texas, “and Europe too.” He added:

Many energy analysts suggest, supply could shift to Qatar, which is the world’s lowest cost producer. Commenting on a recent Qatari announcement about a significant expansion of that country’s LNG capacity, one analyst noted, “The signal the U.S. projects need to take from this [is]: if they don’t go ahead, someone will.”

But, writes Kupfer, “one should not forget that Qatar sits in a turbulent region, relying upon shipping lanes vulnerable to harassment by the Houthis and others.”

EPA Delays Draconian Rules for Existing Natural Gas Power Plants

While the EPA issued its tailpipe emissions rule (see above), the agency on Feb. 29 announced it was delaying its power plant rules for existing natural gas facilities until after the November elections. While EPA will not admit it, the decision appears to be a concession to critics.

The agency said it is still on track to finalize rules under Section 111 of the Clean Air Act for coal-fired power plants and new gas plants that have not come online.

The Associated Press reported that, “in a turnaround from previous plans, the agency said it will review standards for existing gas plants and expand the rules to include more pollutants. The change came after complaints from environmental justice groups, who said the earlier plan allowed too much toxic air pollution,” especially in low-income neighborhoods.

EPA Administrator Michael Regan called the new plan a “stronger, more durable approach” that will achieve greater emissions reductions. But environmental activists had their doubts.

“We are extremely disappointed in EPA’s decision to delay finalizing carbon pollution standards for existing gas plants, which make up a significant portion of carbon emissions in the power sector,’’ said Frank Sturges, a lawyer for the Clean Air Task Force, an environmental group, quoted by the AP. And Sen. Sheldon Whitehouse, a progressive Rhode Island Democrat, called EPA’s decision “inexplicable.’’

Pushing the final rules to after the election may be an indication that the White House is concerned about its negative political impact. Lisa Friedman wrote in the New York Times that the decision to delay came because the Biden Administration was “facing intense opposition from major industries and some Democrats.” As a result, existing gas-fired plants will be exempt, “at least for now,” from new regulations.

Instead, the regulations, “expected to be finalized this spring, will apply only to existing coal-burning plants and gas-fired plants that are built in the future. The agency plans to write a separate regulation to address climate pollution and other emissions from gas-fired plants currently in operation, a delay certain to stretch past the November election,” wrote Friedman.

The rules have elicited controversy mainly because they would force existing plants to adopt carbon capture and storage (CCS) technologies that are not ready for prime time. Without such an adoption, plants would have to shut down at a time when electricity needs are accelerating (see above).

The International Institute for Sustainable Development acknowledges that CCS technology has grown over the past few decades at a “snail’s pace,” and the International Panel on Climate Change (IPCC) described serious feasibility concerns in scaling up CCS technology rapidly. The technology is not widely used and very expensive.

The NRECA, which represents America’s electric cooperatives, complains that the EPA proposal “hinges on the widespread adoption of nascent technologies: clean hydrogen and carbon capture and storage. Electric cooperatives are involved in the development five carbon capture projects and are national leaders in the development of the technology. And while both technologies are promising, they are not yet widespread or commercially available and have not been ‘adequately demonstrated’ as required by the Clean Air Act. Requirements for some coal units to co-fire natural gas are similarly flawed.”

The likely result, as we have reported in the past, is the shutdown of natural gas-driven plants that are necessary to keep electricity flowing. Those shutdowns will mean sharply decreased reliability for U.S. manufacturers, businesses, and consumers.

In our Newsletter No. 29 in October, we quoted an opinion piece by Gene Yaw, chairman of the Pennsylvania State Senate’s Environmental Resources and Energy Committee and a widely recognized energy policy leader, who called the power plants rule dangerous and threatening to “Pennsylvania’s severely strained electric grid.” He added:

The Biden Clean Power Plan would set unachievable limits using technology that is unavailable in the United States for new and existing gas-fired combustion turbines and existing coal plants, which currently generate two-thirds of Pennsylvania’s electricity.

The new mandates will impose an effective moratorium on new natural gas plants and force existing natural gas and coal plants to shutter prematurely. Meanwhile, electric ratepayers, mostly families, will bear the brunt of this dual attack on electric reliability and affordability.

Friedman of the New York Times related the history of attempts to slash emissions from power plants, which began with President Obama, “But his 2015 Clean Power Plan was put on hold by the Supreme Court and later rolled back by President Donald J. Trump. Then, in 2022, the “Supreme Court restrained the way E.P.A. could regulate emissions from power plants,” as we noted above, “ruling the government could not force a wholesale transition away from coal-fired electricity.”

The Biden Administration has tried to make its new pollution rules hew closely to the restrictions imposed by the High Court, but many in Congress and elsewhere disagreed.

Opposition has come from Democrats as well as Republicans. Like Yaw, Rep. Marcy Kaptur (D-Ohio) worries that utility rates would rise: “Depending on implementation, municipal electric utilities serving small, rural communities in my district may have no choice but to pass along the costs of compliance to their ratepayers.”

The New York Times also reported that “Senator Jon Tester [of Montana], one of the most vulnerable Democrats facing re-election in November who also opposed the power plant rule, said he wanted a methodical transition to cleaner energy. ‘I’m all about climate change, and we have to figure out ways to that,’ Mr. Tester said [on Feb. 28]. ‘In the meantime, we can’t shut off the spigot.’”

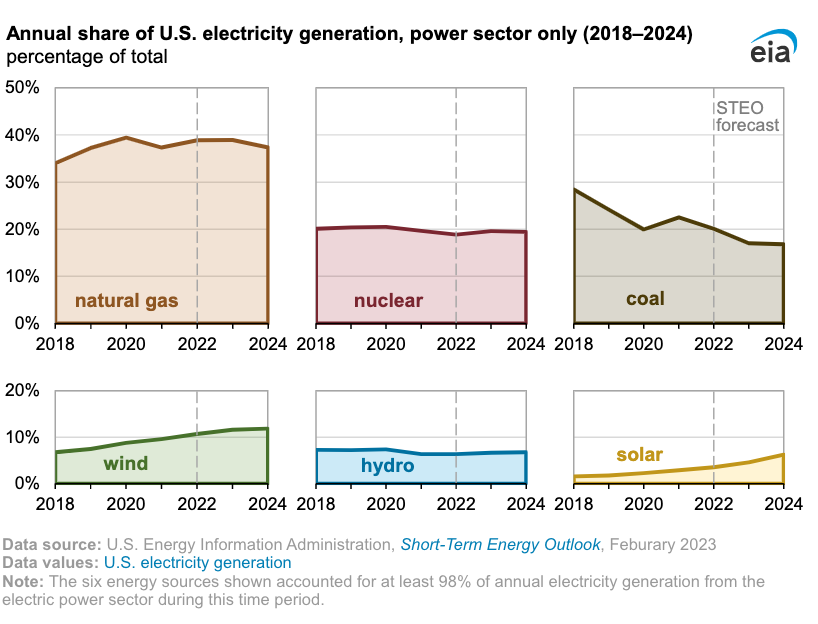

According to The Allegheny Front, which reports on Pennsylvania energy and climate issues, “Overall, the electricity sector is the second-largest source of greenhouse gases in the U.S., behind transportation, accounting for about 25 percent of greenhouse gases. It is now dominated by natural gas, which has overtaken coal as the nation’s largest source of electricity.”

“But coal, which emits about twice the carbon dioxide that gas does, is still the country’s largest source of electricity-related carbon emissions. Coal accounts for about 53 percent of the power sector’s CO2 emissions while only accounting for 16 percent of the country’s electricity. Gas, meanwhile, produces about 45 percent of the sector’s emissions and 43 percent of the nation’s electricity.”